Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,091

USD/JPY: macroeconomic statistics did not support JPY 23.08.2021

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on USD/JPY for a better understanding of the current market situation and more efficient trading.

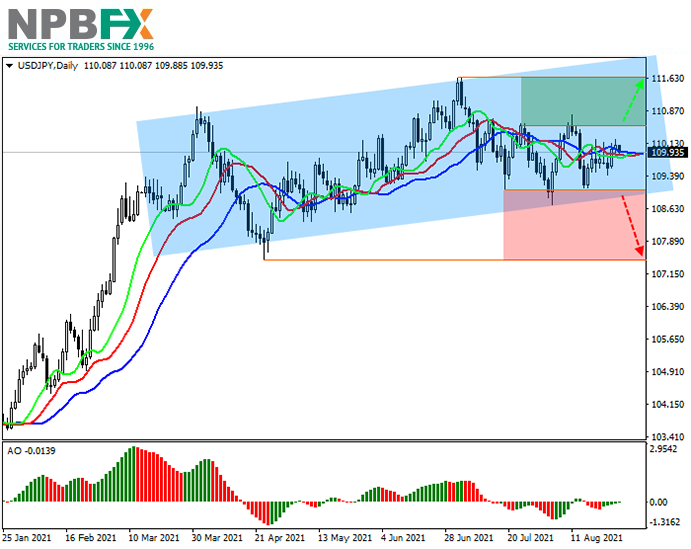

Current trend

USD has shown moderate gains against JPY during the Asian session, flat in the short term. As a safe-haven asset, investors are interested in USD much more than in JPY, but the growth of the instrument is still not so aggressive.

The statistics on consumer inflation in Japan released on Friday turned out to be ambiguous and did not contribute to an additional strengthening of JPY's position. The National Consumer Price Index fell 0.3% YoY in July after falling 0.5% YoY in June. Analysts had expected growth by 0.6% YoY.

At the beginning of the week, additional pressure on the position of JPY comes from the decline in the Manufacturing PMI from Jibun Bank. In August, the indicator fell from 53 to 52.4 points against the forecast of growth to 53.4 points.

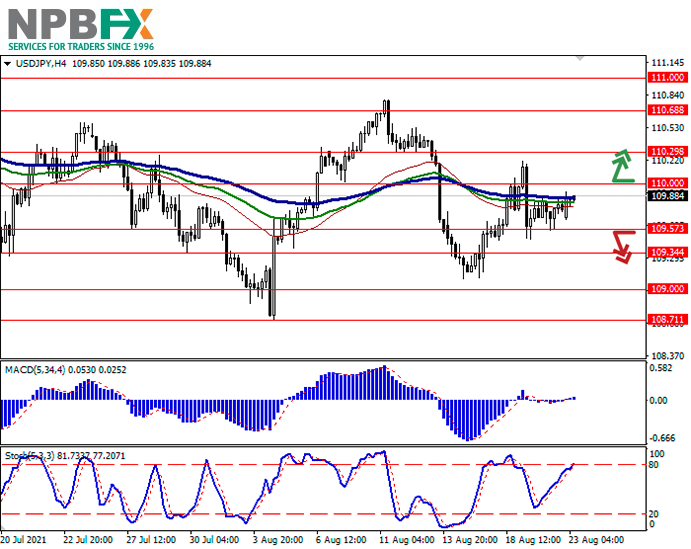

Support and resistance

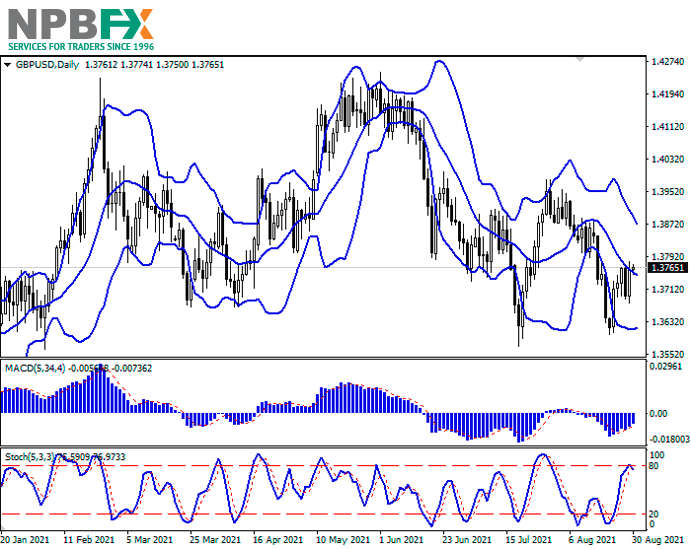

Bollinger Bands in D1 chart show weak growth. The price range is narrowing, pointing at the ambiguous nature of trading in the short term. MACD indicator is growing preserving a weak buy signal (located above the signal line). Stochastic is showing a more confident growth, signaling in favor of the development of the uptrend in the ultra-short term.

Existing long positions should be kept until technical indicators are clarified.

Resistance levels: 110.00, 110.29, 110.68, 111.00.

Support levels: 109.57, 109.34, 109.00, 108.71.

Trading tips

To open long positions, one can rely on the breakout of 110.00. Take-profit – 110.68. Stop-loss – 109.65. Implementation time: 2-3 days.

The breakdown of 109.57 may serve as a signal to new sales with the target at 109.00. Stop-loss – 109.80.

Use more opportunities of the NPBFX analytical portal: glossary

Beginning traders certainly face a lot of specialized concepts and lexicon on FOREX, which are often not fully been understood. Swap, tick, hedge, margin calls are often unfamiliar to beginning traders. But the lack of knowledge of these fundamentals make a competent market vision impossible. So glossary on the NPBFX analytical portal could be an excellent helper in this case, which contains all the main definitions with explanations in a compact and accessible form. All concepts are arranged in alphabetical order, so that you can easily and quickly find and explore a new concept for yourself.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/JPY and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on USD/JPY for a better understanding of the current market situation and more efficient trading.

Current trend

USD has shown moderate gains against JPY during the Asian session, flat in the short term. As a safe-haven asset, investors are interested in USD much more than in JPY, but the growth of the instrument is still not so aggressive.

The statistics on consumer inflation in Japan released on Friday turned out to be ambiguous and did not contribute to an additional strengthening of JPY's position. The National Consumer Price Index fell 0.3% YoY in July after falling 0.5% YoY in June. Analysts had expected growth by 0.6% YoY.

At the beginning of the week, additional pressure on the position of JPY comes from the decline in the Manufacturing PMI from Jibun Bank. In August, the indicator fell from 53 to 52.4 points against the forecast of growth to 53.4 points.

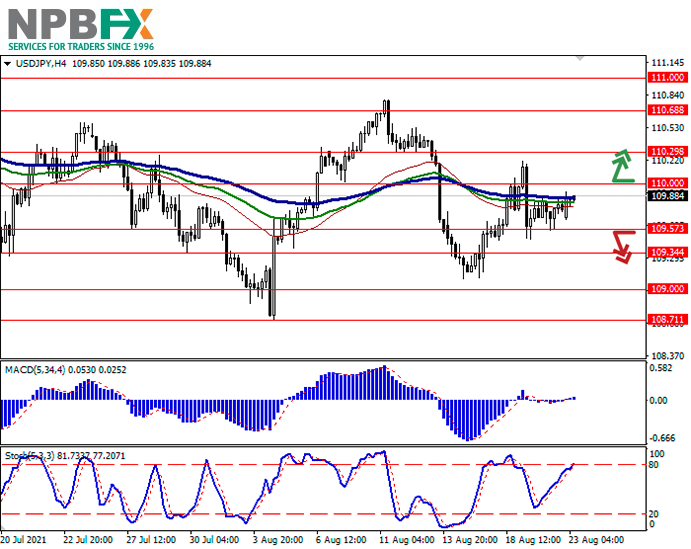

Support and resistance

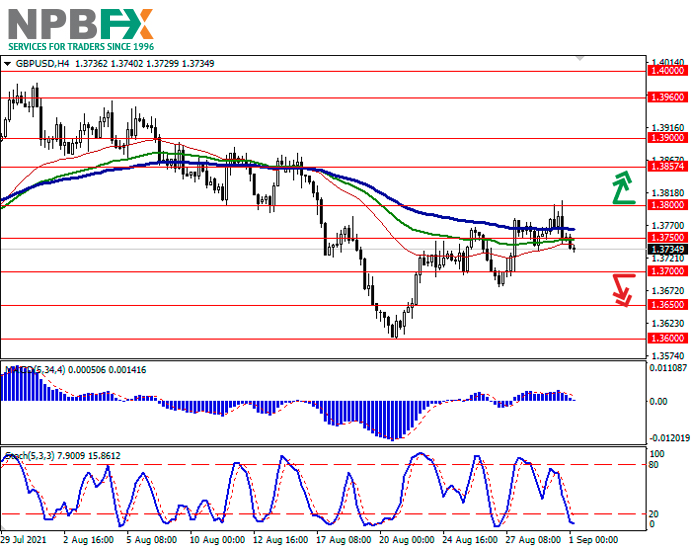

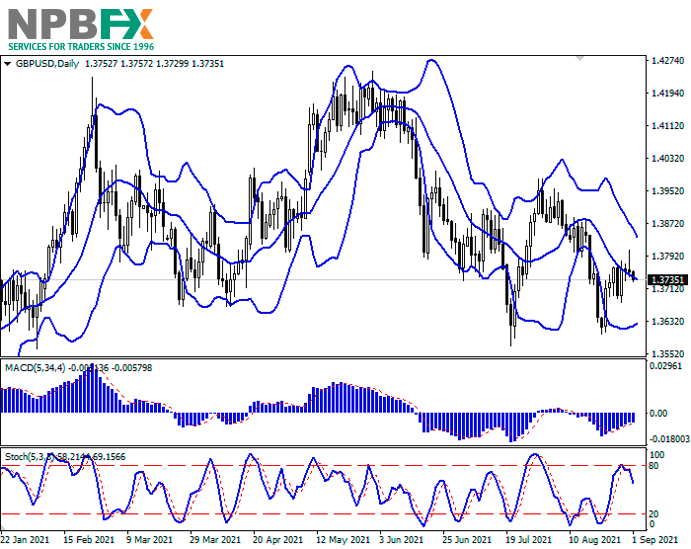

Bollinger Bands in D1 chart show weak growth. The price range is narrowing, pointing at the ambiguous nature of trading in the short term. MACD indicator is growing preserving a weak buy signal (located above the signal line). Stochastic is showing a more confident growth, signaling in favor of the development of the uptrend in the ultra-short term.

Existing long positions should be kept until technical indicators are clarified.

Resistance levels: 110.00, 110.29, 110.68, 111.00.

Support levels: 109.57, 109.34, 109.00, 108.71.

Trading tips

To open long positions, one can rely on the breakout of 110.00. Take-profit – 110.68. Stop-loss – 109.65. Implementation time: 2-3 days.

The breakdown of 109.57 may serve as a signal to new sales with the target at 109.00. Stop-loss – 109.80.

Use more opportunities of the NPBFX analytical portal: glossary

Beginning traders certainly face a lot of specialized concepts and lexicon on FOREX, which are often not fully been understood. Swap, tick, hedge, margin calls are often unfamiliar to beginning traders. But the lack of knowledge of these fundamentals make a competent market vision impossible. So glossary on the NPBFX analytical portal could be an excellent helper in this case, which contains all the main definitions with explanations in a compact and accessible form. All concepts are arranged in alphabetical order, so that you can easily and quickly find and explore a new concept for yourself.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/JPY and trade efficiently with NPBFX.