Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,094

EUR/USD: EUR consolidates in anticipation of new drivers 15.09.2021

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on EUR/USD for a better understanding of the current market situation and more efficient trading.

Current trend

EUR shows insignificant growth against USD during today's Asian session, consolidating near the level of 1.1800. The day before, EUR/USD failed to record positive dynamics, despite the fact that during the day the "bulls" clearly dominated the market.

EUR quotes failed to show growth even against the background of weak data from the US, which significantly reduced expectations of active actions from the US Fed aimed at tightening monetary policy until the end of this year. Consumer Price Index excluding Food and Energy, slowed down in August from +0.3% MoM to +0.1% MoM, which was worse than projected. In annual terms, the index slowed down from +4.3% YoY to +4.0% YoY against a forecast of +4.2% YoY. The inflation rate dropped to the lowest level in the last 6 months, which may signal that prices are going to a certain plateau as economic activity in the country recovers.

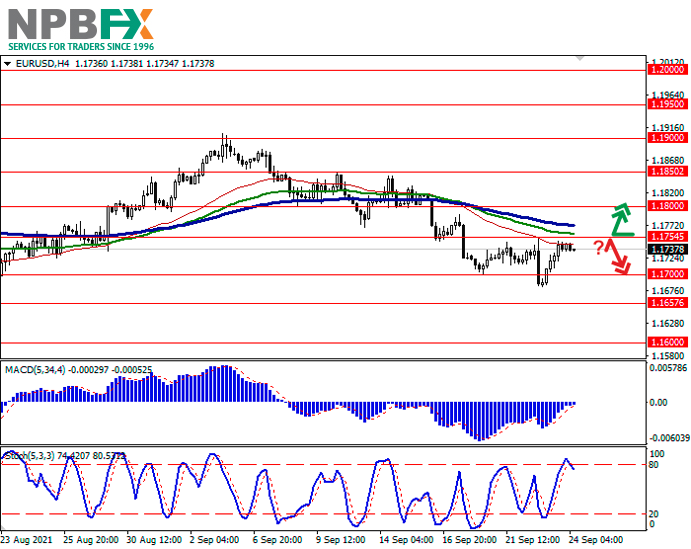

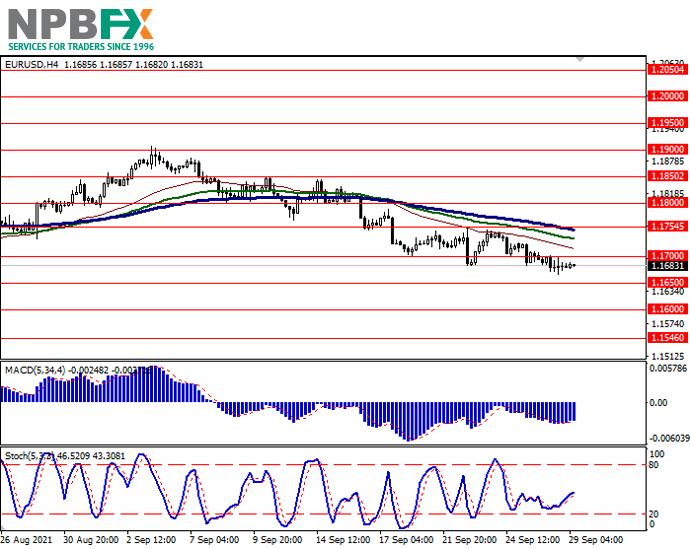

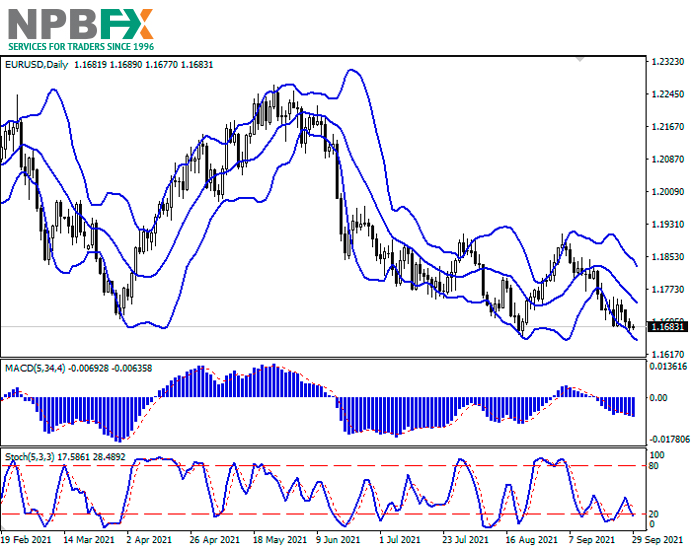

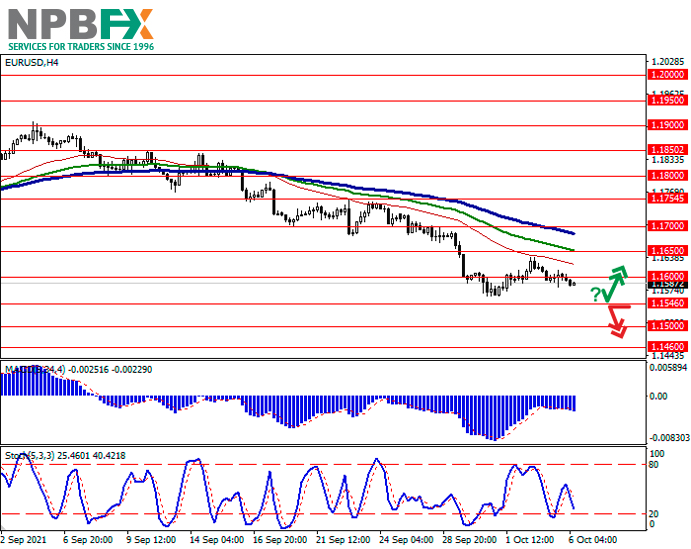

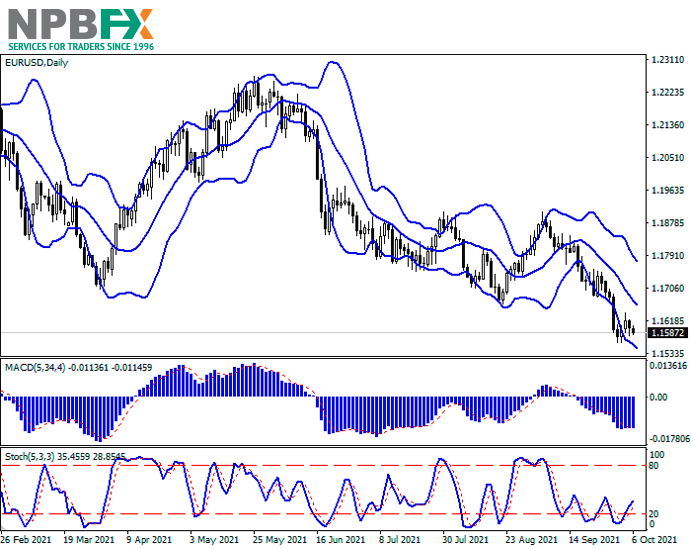

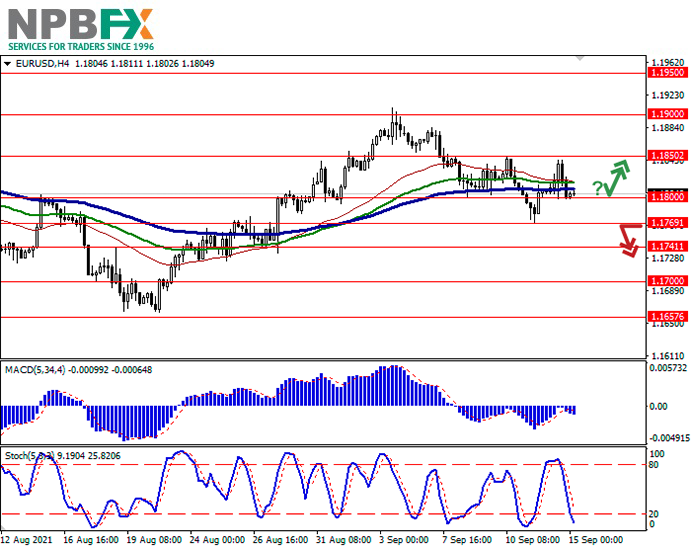

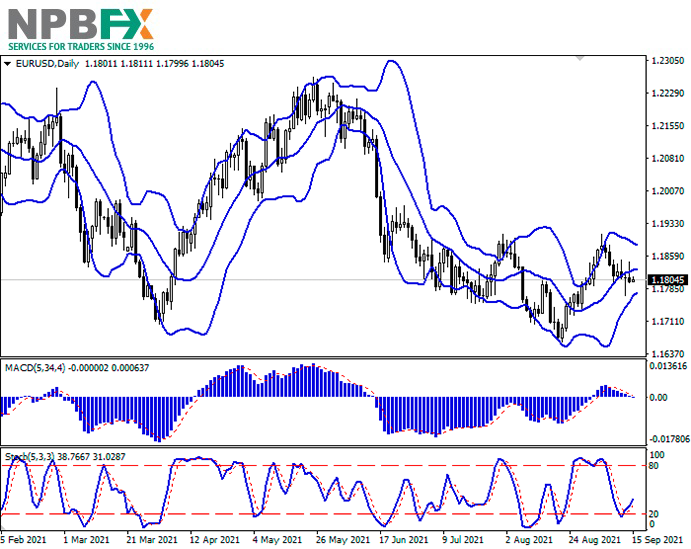

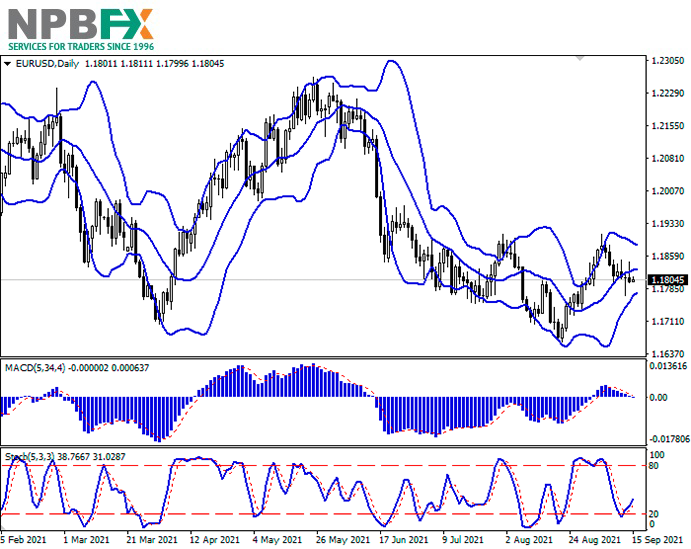

Support and resistance

On the D1 chart, Bollinger Bands are gradually reversing horizontally. The price range is narrowing, reflecting the emergence of ambiguous dynamics of trading in the short term. MACD is going down, keeping a fairly stable sell signal (located below the signal line). Stochastic, having rebounded from the level of "20", reversed towards growth, signaling in favor of the development of corrective dynamics in the ultra-short term.

Resistance levels: 1.1850, 1.1900, 1.1950, 1.2000.

Support levels: 1.1800, 1.1769, 1.1741, 1.1700.

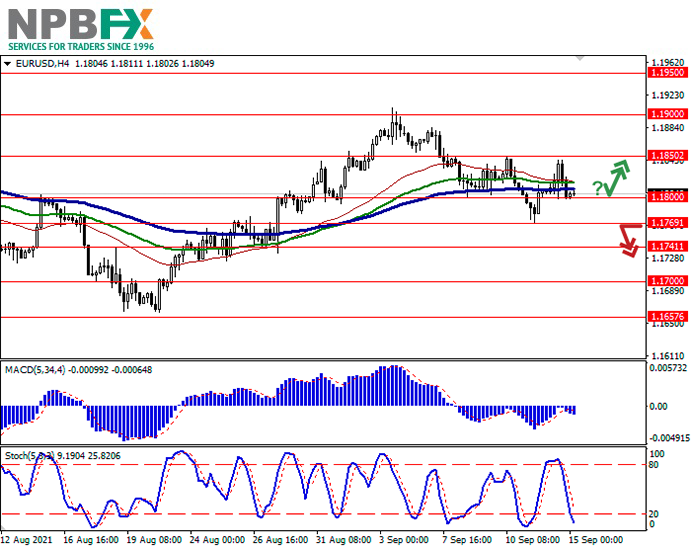

Trading tips

To open long positions, one can rely on the rebound from the support level of 1.1800 with the subsequent breakout of 1.1850. Take-profit – 1.1950. Stop-loss – 1.1800. Implementation time: 2-3 days.

The breakdown of 1.1769 may serve as a signal to new sales with the target at 1.1700. Stop-loss – 1.1800.

Use more opportunities of the NPBFX analytical portal: economic calendar

Be ready for any market changes through global events using the economic calendar on the NPBFX portal. The calendar contains all the most important events of the world economy and prognoses for them. In order to get free and unlimited access to the economic calendar and other useful instruments on the portal, you need to pass a one-time registration on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on EUR/USD and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on EUR/USD for a better understanding of the current market situation and more efficient trading.

Current trend

EUR shows insignificant growth against USD during today's Asian session, consolidating near the level of 1.1800. The day before, EUR/USD failed to record positive dynamics, despite the fact that during the day the "bulls" clearly dominated the market.

EUR quotes failed to show growth even against the background of weak data from the US, which significantly reduced expectations of active actions from the US Fed aimed at tightening monetary policy until the end of this year. Consumer Price Index excluding Food and Energy, slowed down in August from +0.3% MoM to +0.1% MoM, which was worse than projected. In annual terms, the index slowed down from +4.3% YoY to +4.0% YoY against a forecast of +4.2% YoY. The inflation rate dropped to the lowest level in the last 6 months, which may signal that prices are going to a certain plateau as economic activity in the country recovers.

Support and resistance

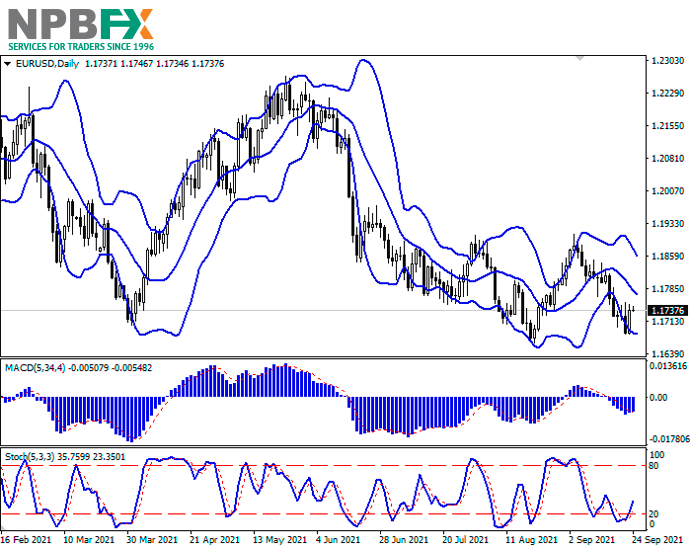

On the D1 chart, Bollinger Bands are gradually reversing horizontally. The price range is narrowing, reflecting the emergence of ambiguous dynamics of trading in the short term. MACD is going down, keeping a fairly stable sell signal (located below the signal line). Stochastic, having rebounded from the level of "20", reversed towards growth, signaling in favor of the development of corrective dynamics in the ultra-short term.

Resistance levels: 1.1850, 1.1900, 1.1950, 1.2000.

Support levels: 1.1800, 1.1769, 1.1741, 1.1700.

Trading tips

To open long positions, one can rely on the rebound from the support level of 1.1800 with the subsequent breakout of 1.1850. Take-profit – 1.1950. Stop-loss – 1.1800. Implementation time: 2-3 days.

The breakdown of 1.1769 may serve as a signal to new sales with the target at 1.1700. Stop-loss – 1.1800.

Use more opportunities of the NPBFX analytical portal: economic calendar

Be ready for any market changes through global events using the economic calendar on the NPBFX portal. The calendar contains all the most important events of the world economy and prognoses for them. In order to get free and unlimited access to the economic calendar and other useful instruments on the portal, you need to pass a one-time registration on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on EUR/USD and trade efficiently with NPBFX.