Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,092

Alcoa Corp.: technical analysis 29.08.2022

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on Alcoa Corp. for a better understanding of the current market situation and more efficient trading.

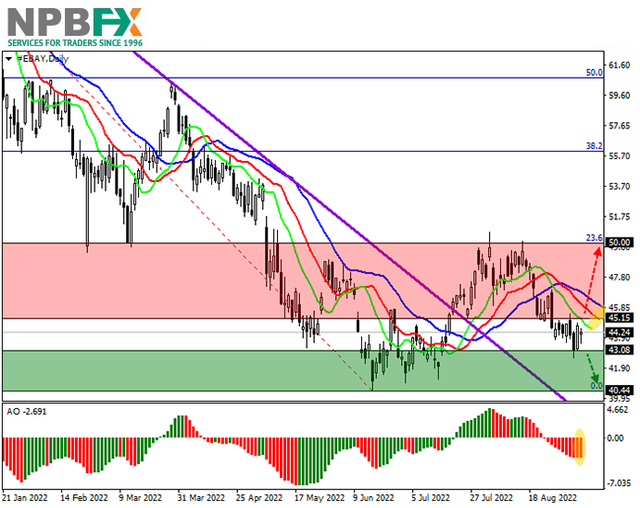

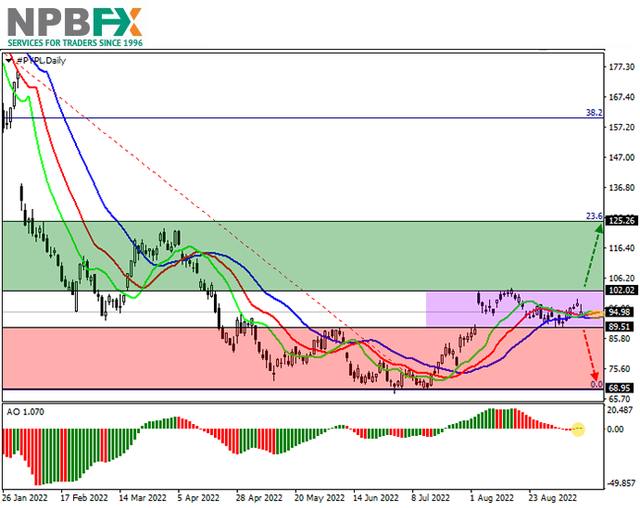

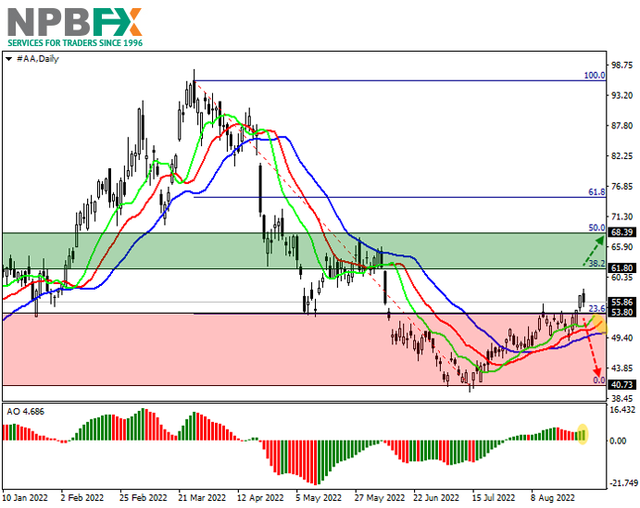

The shares of the American steel company Alcoa Corp. are trading at 56.00.

On the daily chart, the price is showing corrective dynamics after a prolonged downtrend, consolidated above the initial 23.6% Fibonacci retracement around 53.80.

On the four-hour chart, further movement of the quotes of the trading instrument will most likely continue in an uptrend since the key marker for the beginning of a full-fledged correction was received after consolidation above 23.6%. The next target is the basic correction of 38.2% Fibonacci around 61.80, the breakout of which will allow the issuer's shares to consolidate higher.

Technical indicators have reversed and keep a stable buy signal: indicator Alligator's EMA oscillation range expands upwards, and the AO oscillator histogram forms upward bars in the buying zone.

Trading tips

Long positions may be opened after the price rises and consolidates above 61.80 with the target at 68.40. Stop loss — 60.00. Implementation period: 7 days or more.

Short positions may be opened after a reversal, reduction, and consolidation of the price below 53.80 with the target at 40.70. Stop loss — 56.00.

Use more opportunities of the NPBFX analytical portal: analytics

You can find more actual analytical reviews on other popular currency pairs, metals and CFDs on the NPBFX online portal. Daily analytics with charts, current market prognoses and trading scenarios in the Feed section are available. Get free and unlimited access to the online portal after registering on the official website of NPBFX Company.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on Alcoa Corp. and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on Alcoa Corp. for a better understanding of the current market situation and more efficient trading.

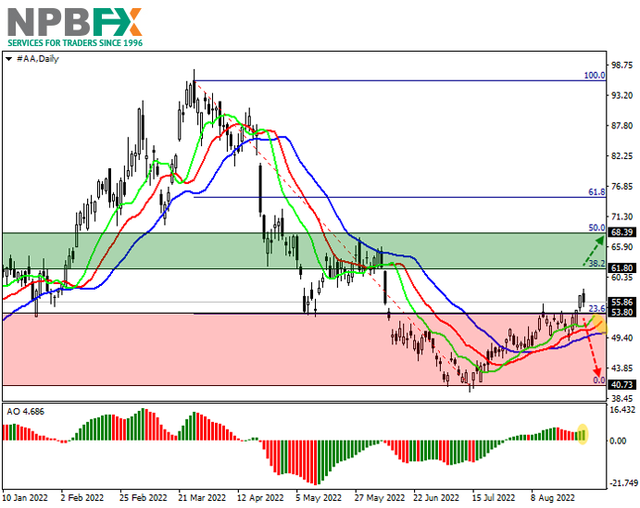

The shares of the American steel company Alcoa Corp. are trading at 56.00.

On the daily chart, the price is showing corrective dynamics after a prolonged downtrend, consolidated above the initial 23.6% Fibonacci retracement around 53.80.

On the four-hour chart, further movement of the quotes of the trading instrument will most likely continue in an uptrend since the key marker for the beginning of a full-fledged correction was received after consolidation above 23.6%. The next target is the basic correction of 38.2% Fibonacci around 61.80, the breakout of which will allow the issuer's shares to consolidate higher.

Technical indicators have reversed and keep a stable buy signal: indicator Alligator's EMA oscillation range expands upwards, and the AO oscillator histogram forms upward bars in the buying zone.

Trading tips

Long positions may be opened after the price rises and consolidates above 61.80 with the target at 68.40. Stop loss — 60.00. Implementation period: 7 days or more.

Short positions may be opened after a reversal, reduction, and consolidation of the price below 53.80 with the target at 40.70. Stop loss — 56.00.

Use more opportunities of the NPBFX analytical portal: analytics

You can find more actual analytical reviews on other popular currency pairs, metals and CFDs on the NPBFX online portal. Daily analytics with charts, current market prognoses and trading scenarios in the Feed section are available. Get free and unlimited access to the online portal after registering on the official website of NPBFX Company.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on Alcoa Corp. and trade efficiently with NPBFX.