Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,090

USD/CAD: the instrument is consolidating 19.06.2020

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on USD/CAD for a better understanding of the current market situation and more efficient trading.

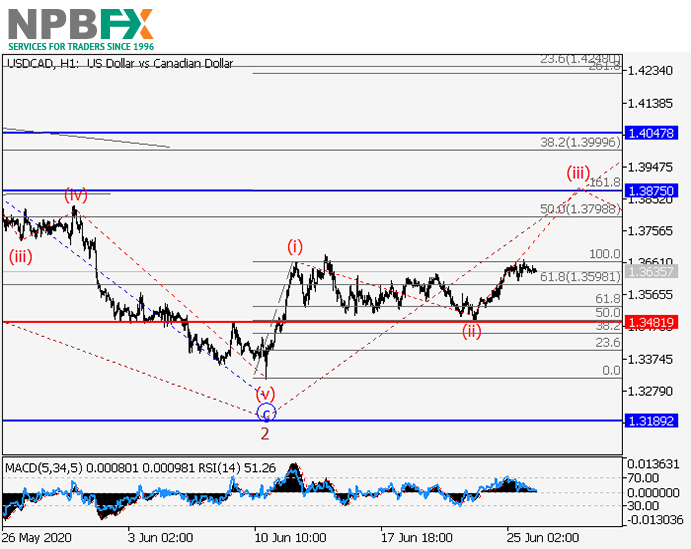

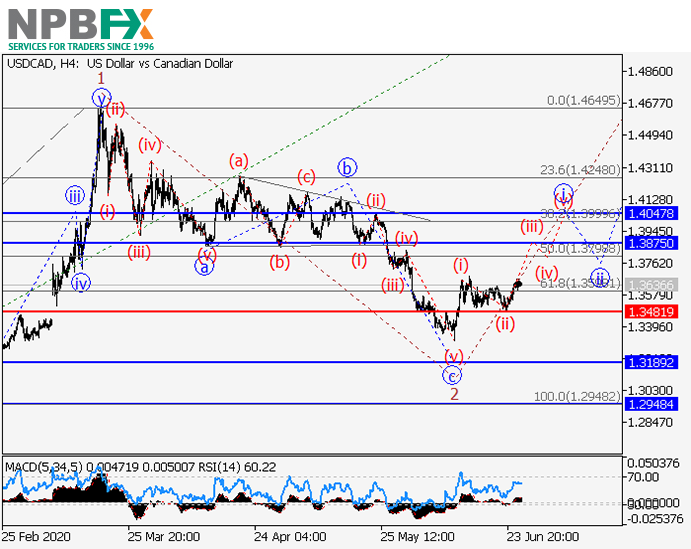

Current trend

USD shows ambiguous dynamics of trading against CAD during today’s Asian session, consolidating near the level of 1.3600. Yesterday, USD managed to strengthen across the entire spectrum of the market, receiving support from the concerns regarding the increase in the incidence of coronavirus in China and the US. Uncertain macroeconomic statistics on the US labor market almost did not prevent the strengthening of the instrument. Initial Jobless Claims for the week ending June 12 decreased from 1.566M to 1.508M, which was significantly worse than market expectations of 1.300M. Continuing Jobless Claims number fell from 20.606M to 20.544M with a forecast of 19.8M.

Canadian data has also been contradictory. Investors are optimistic about the release of the Canadian Employment Report from ADP. In May, the employment change increased by 208.4K jobs after a decrease of 2.361M jobs in the previous month. Experts expected the growth by 280.3K. At the same time, Wholesale Sales in April fell sharply by 21.6% MoM, which turned out to be almost twice worse than market expectations.

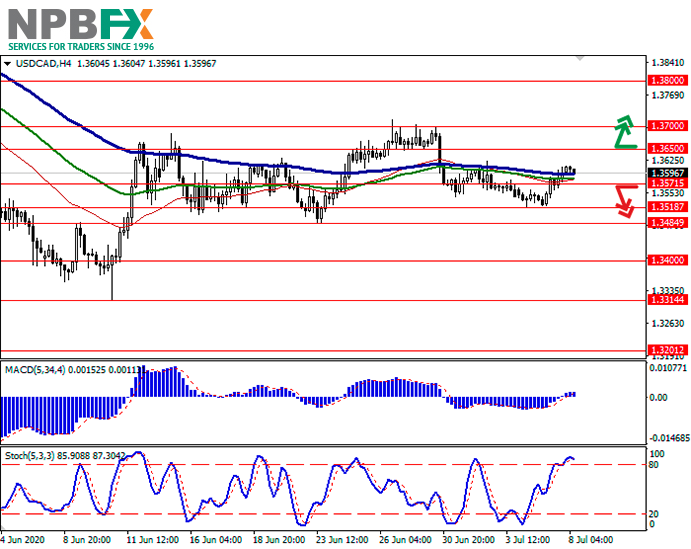

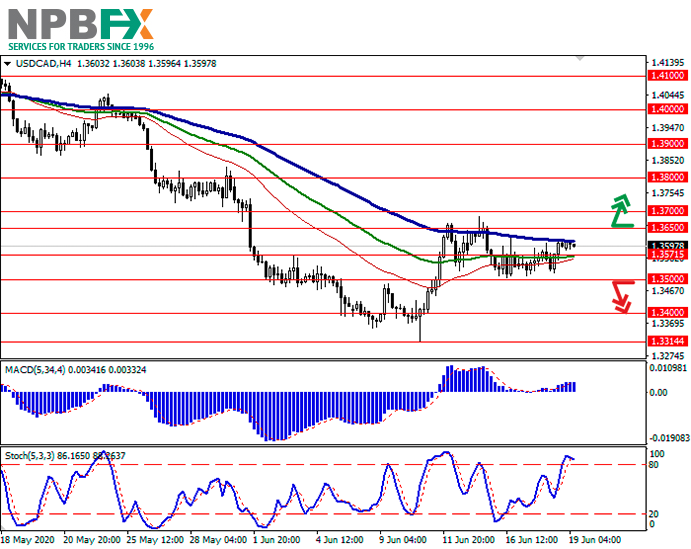

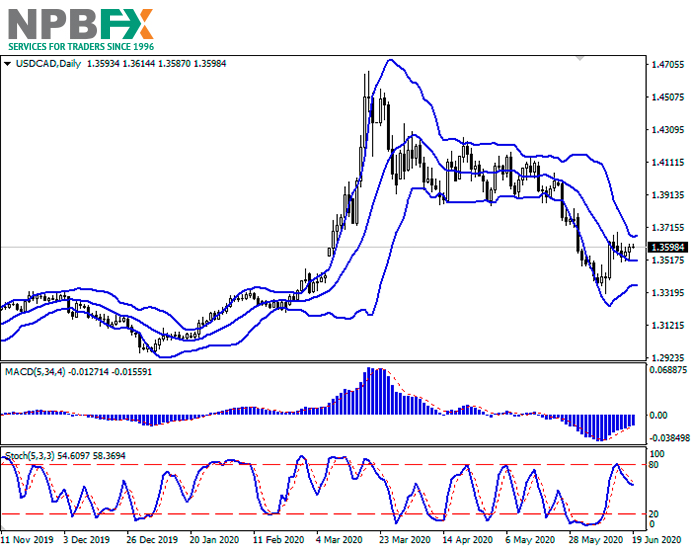

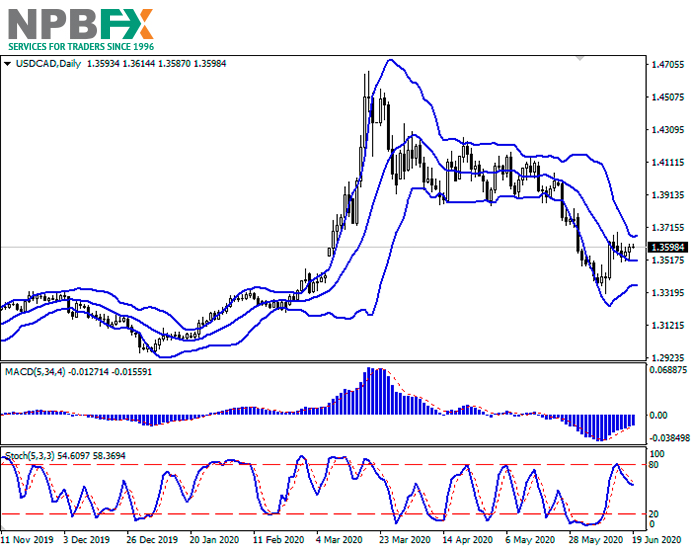

Support and resistance

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is trying to consolidate, reflecting the flat nature of trading in the short term. MACD indicator is growing preserving a weak buy signal (located above the signal line). Stochastic still maintains a downtrend and reacts weakly to recent growth.

Resistance levels: 1.3650, 1.3700, 1.3800, 1.3900.

Support levels: 1.3571, 1.3500, 1.3400, 1.3314.

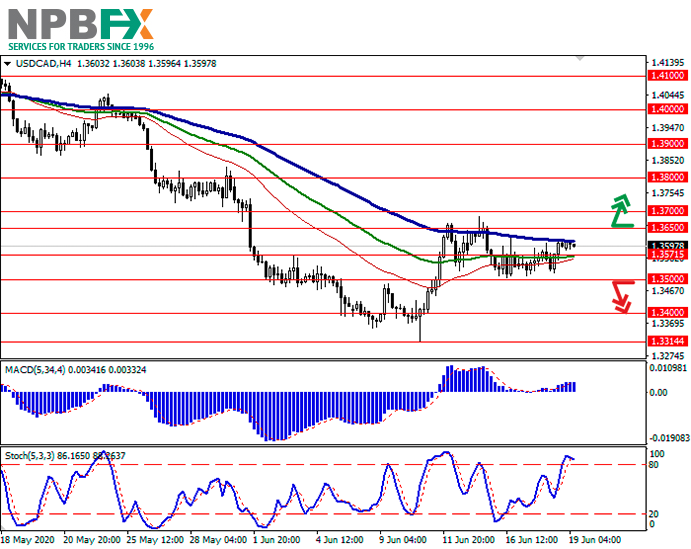

Trading tips

To open long positions, one can rely on the breakout of 1.3650. Take-profit – 1.3800. Stop-loss – 1.3571.

The breakdown of 1.3500 may serve as a signal to sales with the target at 1.3314. Stop-loss – 1.3600.

Implementation time: 2-3 days.

Use more opportunities of the NPBFX analytical portal: weekly FOREX forecast

You can learn more about the current situation on USD/CAD and get acquainted with the weekly analytical forecast in the "Video reviews" section on the NPBFX portal. Weekly video reviews contain trends, key levels, trading recommendations for such popular instruments as EUR/USD, GBP/USD, USD/JPY, AUD/USD. In order to get free and unlimited access to video forecast and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/CAD and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on USD/CAD for a better understanding of the current market situation and more efficient trading.

Current trend

USD shows ambiguous dynamics of trading against CAD during today’s Asian session, consolidating near the level of 1.3600. Yesterday, USD managed to strengthen across the entire spectrum of the market, receiving support from the concerns regarding the increase in the incidence of coronavirus in China and the US. Uncertain macroeconomic statistics on the US labor market almost did not prevent the strengthening of the instrument. Initial Jobless Claims for the week ending June 12 decreased from 1.566M to 1.508M, which was significantly worse than market expectations of 1.300M. Continuing Jobless Claims number fell from 20.606M to 20.544M with a forecast of 19.8M.

Canadian data has also been contradictory. Investors are optimistic about the release of the Canadian Employment Report from ADP. In May, the employment change increased by 208.4K jobs after a decrease of 2.361M jobs in the previous month. Experts expected the growth by 280.3K. At the same time, Wholesale Sales in April fell sharply by 21.6% MoM, which turned out to be almost twice worse than market expectations.

Support and resistance

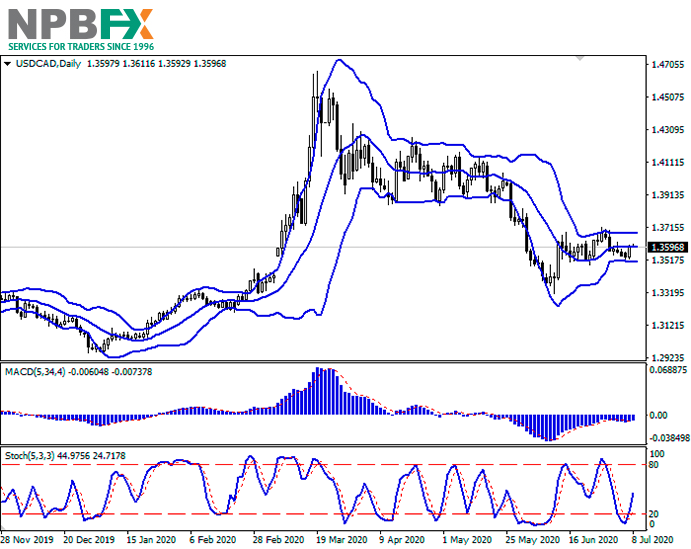

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is trying to consolidate, reflecting the flat nature of trading in the short term. MACD indicator is growing preserving a weak buy signal (located above the signal line). Stochastic still maintains a downtrend and reacts weakly to recent growth.

Resistance levels: 1.3650, 1.3700, 1.3800, 1.3900.

Support levels: 1.3571, 1.3500, 1.3400, 1.3314.

Trading tips

To open long positions, one can rely on the breakout of 1.3650. Take-profit – 1.3800. Stop-loss – 1.3571.

The breakdown of 1.3500 may serve as a signal to sales with the target at 1.3314. Stop-loss – 1.3600.

Implementation time: 2-3 days.

Use more opportunities of the NPBFX analytical portal: weekly FOREX forecast

You can learn more about the current situation on USD/CAD and get acquainted with the weekly analytical forecast in the "Video reviews" section on the NPBFX portal. Weekly video reviews contain trends, key levels, trading recommendations for such popular instruments as EUR/USD, GBP/USD, USD/JPY, AUD/USD. In order to get free and unlimited access to video forecast and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/CAD and trade efficiently with NPBFX.