Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,092

NZD/USD: return to the record highs 28.12.2020

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on NZD/USD for a better understanding of the current market situation and more efficient trading.

Current trend

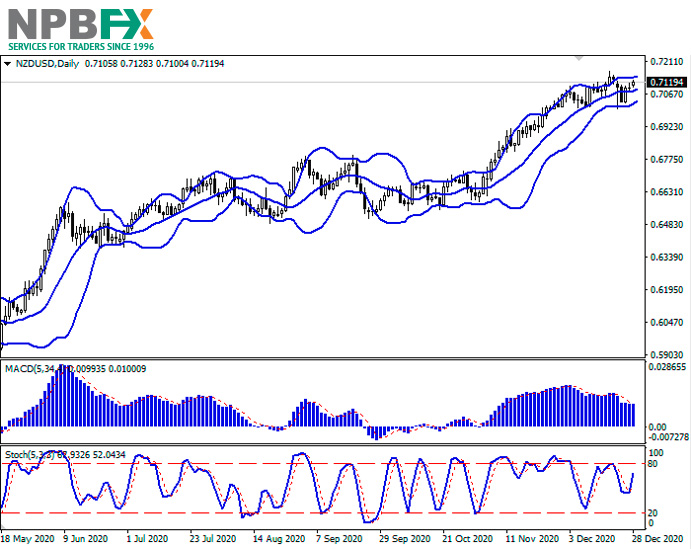

NZD has shown moderate gains against USD in trading this morning session, again testing 0.7120 for a breakout. Amid extremely low volatility in the market driven by the Christmas and New Year holidays, the instrument is moderately supported by the continued optimism about coronavirus vaccines and the conclusion of a trade agreement between the UK and the EU.

USD is declining again in response to difficulties in aligning the US budget for 2021 and delays in approving a new fiscal stimulus package. According to the media, Donald Trump signed both bills, although he had sharply criticized the proposed package of measures before, demanding an increase in the coronavirus payments from USD 600 to 2,000 per person. Last week, the US Congress approved a relief package that includes the allocation of USD 900B in direct aid to people and businesses.

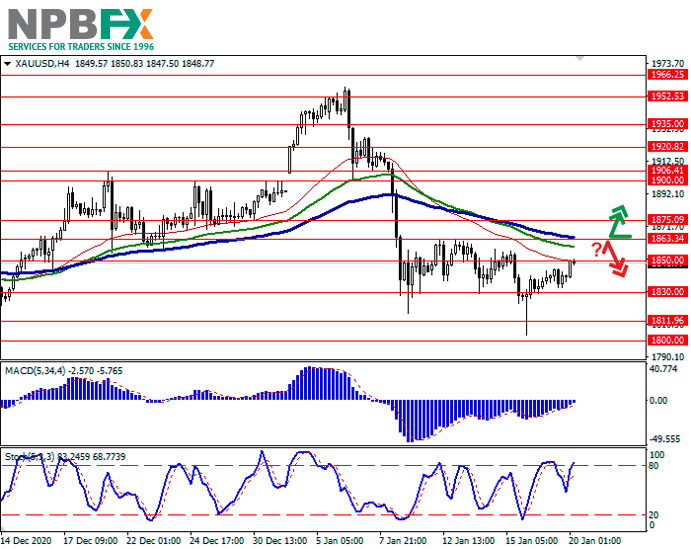

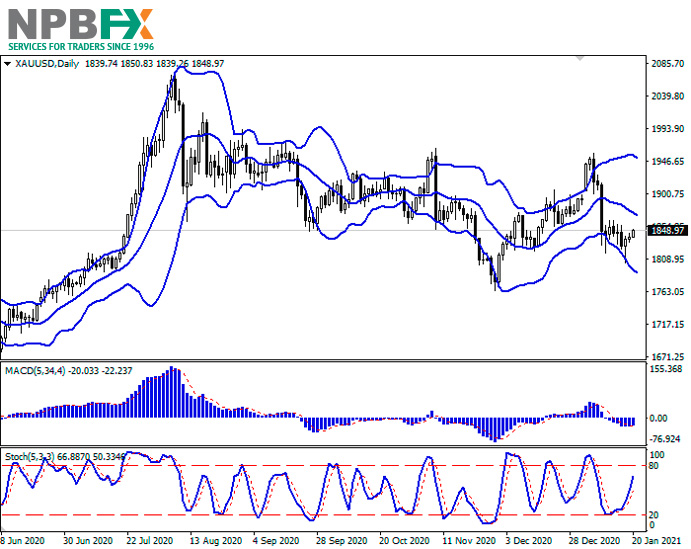

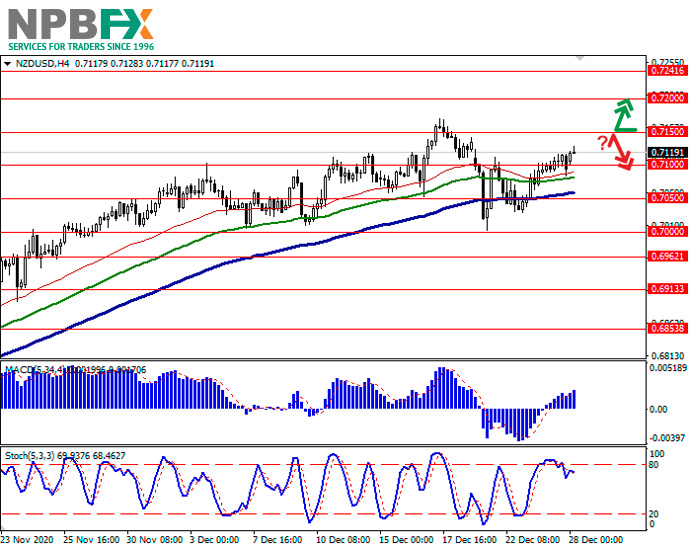

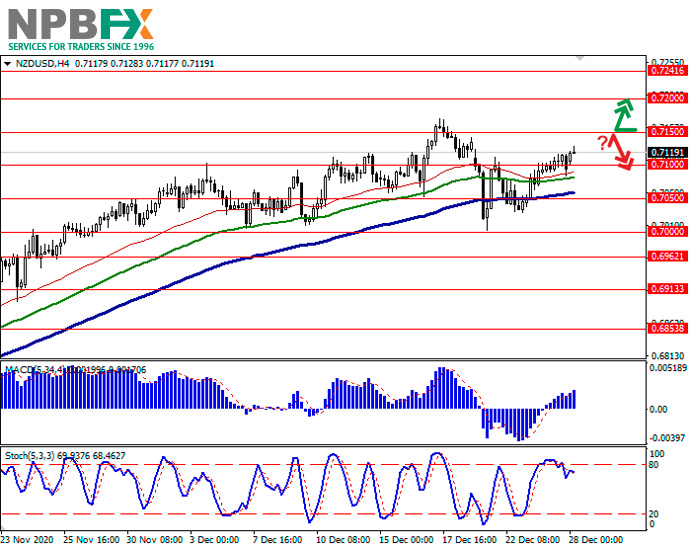

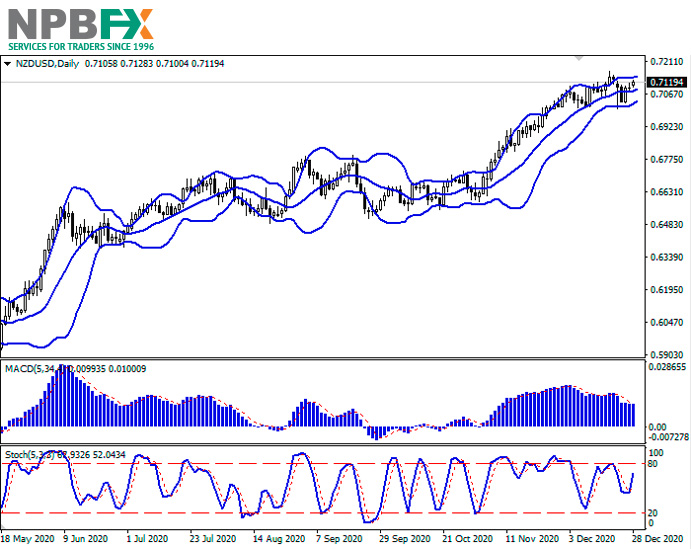

Support and resistance

Bollinger Bands in D1 chart show insignificant growth. The price range is narrowing from below, reflecting the ambiguous dynamics of trading in the short term. MACD is trying to resume growth keeping a previous sell signal (located below the signal line). Stochastic is showing similar dynamics; however, it is already approaching its highs, indicating the risks of overbought instrument in the ultra-short term.

It is worth looking into the possibility of the "bullish" trend development in the short and/or ultra-short term.

Resistance levels: 0.7150, 0.7200, 0.7241.

Support levels: 0.7100, 0.7050, 0.7000, 0.6962.

Trading tips

To open long positions, one can rely on the breakout of 0.7150. Take-profit – 0.7241. Stop-loss – 0.7100. Implementation time: 2-3 days.

A rebound from 0.7150 as from resistance, followed by a breakdown of 0.7100 may become a signal for new sales with the target at 0.7000. Stop-loss – 0.7150.

Use more opportunities of the NPBFX analytical portal: glossary

Beginning traders certainly face a lot of specialized concepts and lexicon on FOREX, which are often not fully been understood. Swap, tick, hedge, margin calls are often unfamiliar to beginning traders. But the lack of knowledge of these fundamentals make a competent market vision impossible. So glossary on the NPBFX analytical portal could be an excellent helper in this case, which contains all the main definitions with explanations in a compact and accessible form. All concepts are arranged in alphabetical order, so that you can easily and quickly find and explore a new concept for yourself.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on NZD/USD and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on NZD/USD for a better understanding of the current market situation and more efficient trading.

Current trend

NZD has shown moderate gains against USD in trading this morning session, again testing 0.7120 for a breakout. Amid extremely low volatility in the market driven by the Christmas and New Year holidays, the instrument is moderately supported by the continued optimism about coronavirus vaccines and the conclusion of a trade agreement between the UK and the EU.

USD is declining again in response to difficulties in aligning the US budget for 2021 and delays in approving a new fiscal stimulus package. According to the media, Donald Trump signed both bills, although he had sharply criticized the proposed package of measures before, demanding an increase in the coronavirus payments from USD 600 to 2,000 per person. Last week, the US Congress approved a relief package that includes the allocation of USD 900B in direct aid to people and businesses.

Support and resistance

Bollinger Bands in D1 chart show insignificant growth. The price range is narrowing from below, reflecting the ambiguous dynamics of trading in the short term. MACD is trying to resume growth keeping a previous sell signal (located below the signal line). Stochastic is showing similar dynamics; however, it is already approaching its highs, indicating the risks of overbought instrument in the ultra-short term.

It is worth looking into the possibility of the "bullish" trend development in the short and/or ultra-short term.

Resistance levels: 0.7150, 0.7200, 0.7241.

Support levels: 0.7100, 0.7050, 0.7000, 0.6962.

Trading tips

To open long positions, one can rely on the breakout of 0.7150. Take-profit – 0.7241. Stop-loss – 0.7100. Implementation time: 2-3 days.

A rebound from 0.7150 as from resistance, followed by a breakdown of 0.7100 may become a signal for new sales with the target at 0.7000. Stop-loss – 0.7150.

Use more opportunities of the NPBFX analytical portal: glossary

Beginning traders certainly face a lot of specialized concepts and lexicon on FOREX, which are often not fully been understood. Swap, tick, hedge, margin calls are often unfamiliar to beginning traders. But the lack of knowledge of these fundamentals make a competent market vision impossible. So glossary on the NPBFX analytical portal could be an excellent helper in this case, which contains all the main definitions with explanations in a compact and accessible form. All concepts are arranged in alphabetical order, so that you can easily and quickly find and explore a new concept for yourself.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on NZD/USD and trade efficiently with NPBFX.