Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,090

USD/CAD: the pair continues declining actively 17.05.2021

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on USD/CAD for a better understanding of the current market situation and more efficient trading.

Current trend

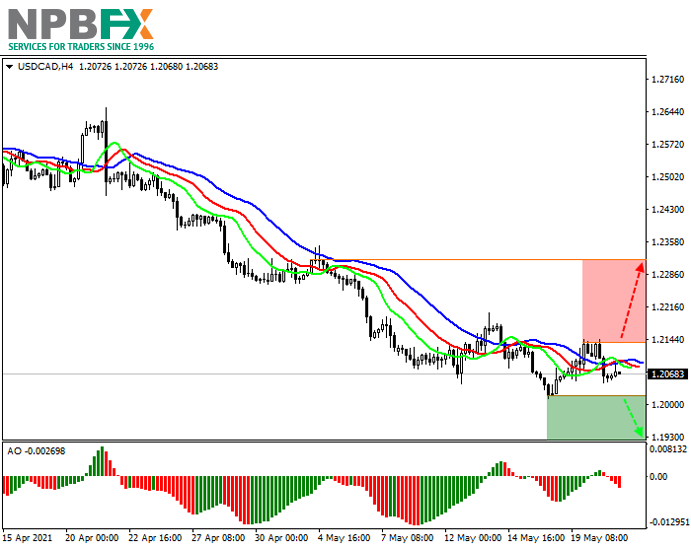

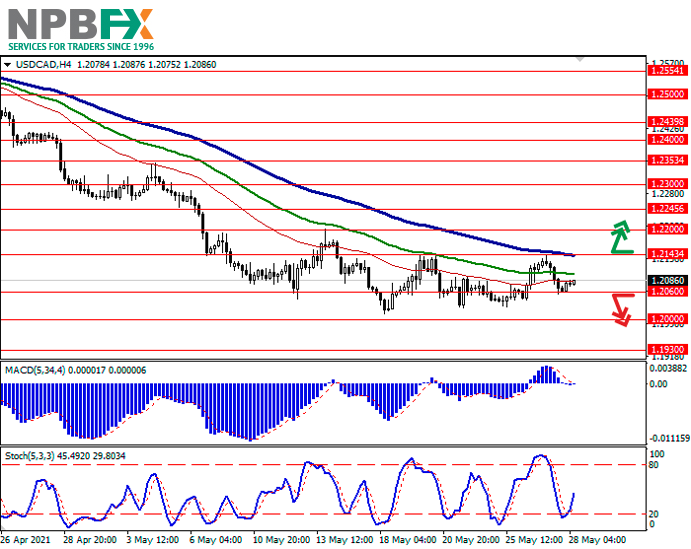

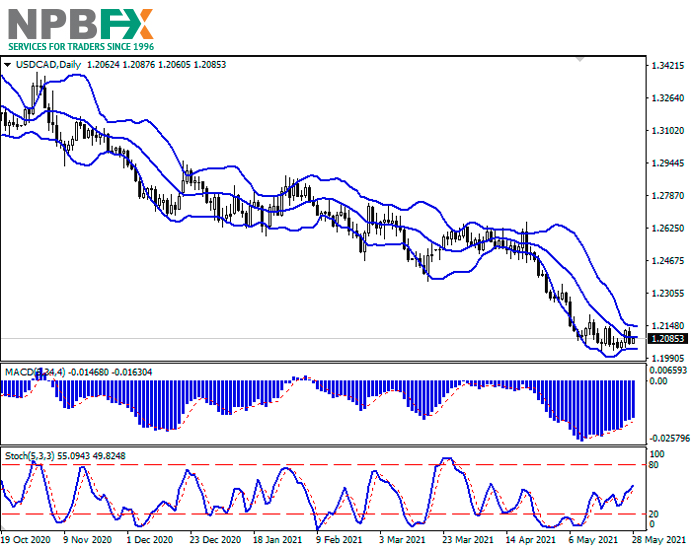

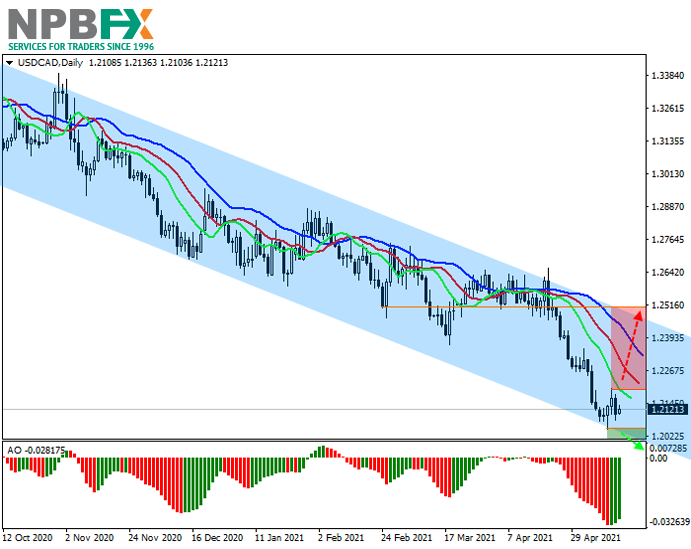

The USD/CAD pair is showing a downtrend, trading at 1.2121.

CAD continues to rise, hitting a record high since 2015 last Friday. The positive dynamics is facilitated by a sharp increase in global demand for manufactured goods and raw materials, the export leader of which is Canada. The price of lumber has increased by more than 49% since the beginning of the year, oil prices are in an uptrend, and demand for wheat and industrial metals such as copper has also increased significantly. In addition, a 173% increase in car sales in March and an increase in domestic wholesale sales of 2.8% should be noted.

USD began to decline again after the publication of disappointing macroeconomic statistics from the US. Retail sales excluding autos in April decreased by 0.8%, which was not expected by analysts, who predicted an increase of 0.7%. The volume of retail sales in April did not change, while analysts had expected the indicator to rise by 1.0%. Finally, industrial production grew by only 0.7%, which is worse than the 1.0% forecast.

Support and resistance

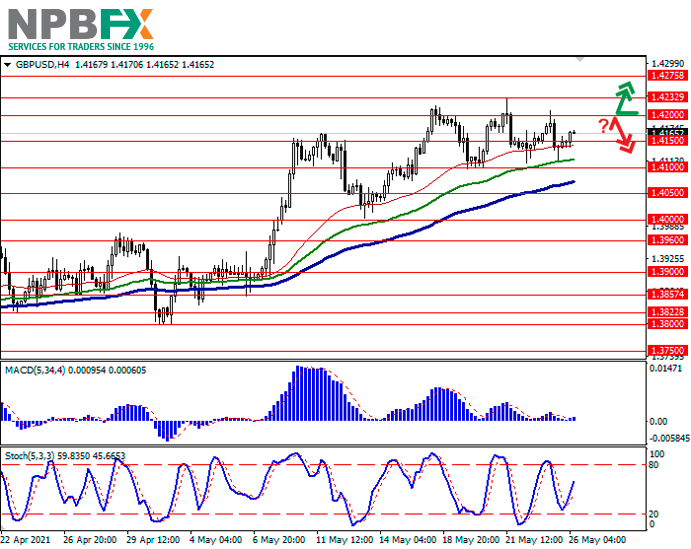

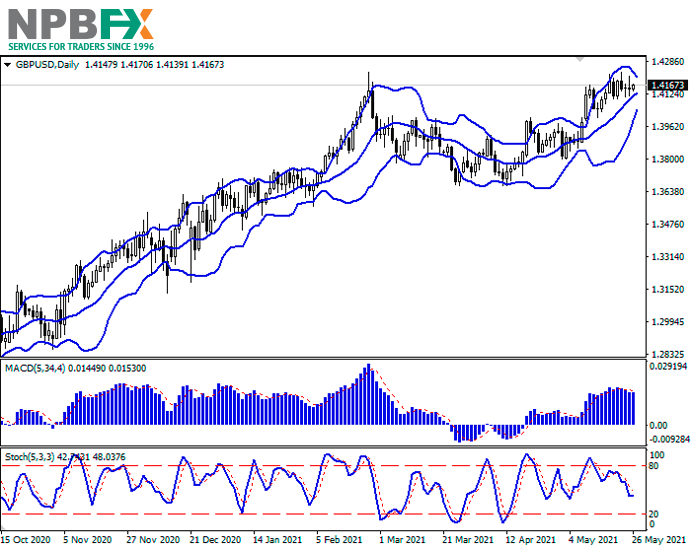

On the global chart, the price continues to form a descending channel. Technical indicators maintain the global sell signal. Fast EMAs on the Alligator indicator are below the signal line, and the AO oscillator histogram is trading in the sell zone.

Resistance levels: 1.2200, 1.2500.

Support levels: 1.2045, 1.1950.

Trading tips

If the asset continues declining and the price consolidates below the local support level at 1.2045, short positions can be opened with the target at 1.1950. Stop-loss – 1.2100. Implementation time: 7 days and more.

If the asset reverses and continues growing and the price consolidates above the local resistance level at 1.2200, long positions will be relevant with target at 1.2500. Stop-loss – 1.2100.

Use more opportunities of the NPBFX analytical portal: weekly FOREX forecast

You can learn more about the current situation on USD/CAD and get acquainted with the weekly analytical forecast in the "Video reviews" section on the NPBFX portal. Weekly video reviews contain trends, key levels, trading recommendations for such popular instruments as EUR/USD, GBP/USD, USD/JPY, AUD/USD. In order to get free and unlimited access to video forecast and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/CAD and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on USD/CAD for a better understanding of the current market situation and more efficient trading.

Current trend

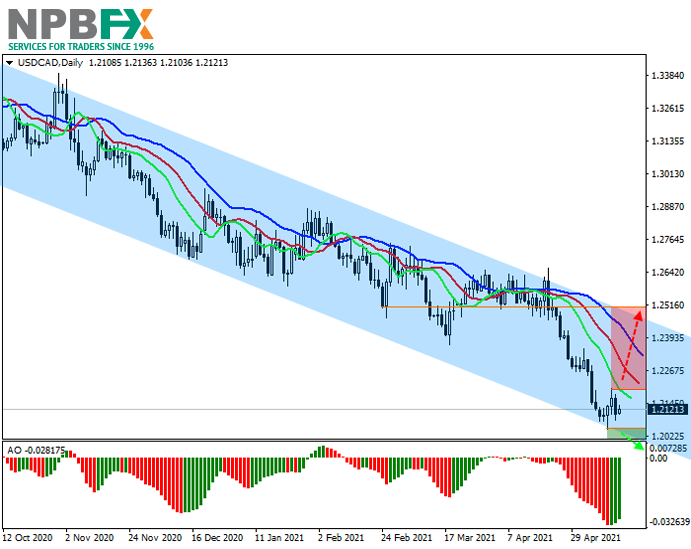

The USD/CAD pair is showing a downtrend, trading at 1.2121.

CAD continues to rise, hitting a record high since 2015 last Friday. The positive dynamics is facilitated by a sharp increase in global demand for manufactured goods and raw materials, the export leader of which is Canada. The price of lumber has increased by more than 49% since the beginning of the year, oil prices are in an uptrend, and demand for wheat and industrial metals such as copper has also increased significantly. In addition, a 173% increase in car sales in March and an increase in domestic wholesale sales of 2.8% should be noted.

USD began to decline again after the publication of disappointing macroeconomic statistics from the US. Retail sales excluding autos in April decreased by 0.8%, which was not expected by analysts, who predicted an increase of 0.7%. The volume of retail sales in April did not change, while analysts had expected the indicator to rise by 1.0%. Finally, industrial production grew by only 0.7%, which is worse than the 1.0% forecast.

Support and resistance

On the global chart, the price continues to form a descending channel. Technical indicators maintain the global sell signal. Fast EMAs on the Alligator indicator are below the signal line, and the AO oscillator histogram is trading in the sell zone.

Resistance levels: 1.2200, 1.2500.

Support levels: 1.2045, 1.1950.

Trading tips

If the asset continues declining and the price consolidates below the local support level at 1.2045, short positions can be opened with the target at 1.1950. Stop-loss – 1.2100. Implementation time: 7 days and more.

If the asset reverses and continues growing and the price consolidates above the local resistance level at 1.2200, long positions will be relevant with target at 1.2500. Stop-loss – 1.2100.

Use more opportunities of the NPBFX analytical portal: weekly FOREX forecast

You can learn more about the current situation on USD/CAD and get acquainted with the weekly analytical forecast in the "Video reviews" section on the NPBFX portal. Weekly video reviews contain trends, key levels, trading recommendations for such popular instruments as EUR/USD, GBP/USD, USD/JPY, AUD/USD. In order to get free and unlimited access to video forecast and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/CAD and trade efficiently with NPBFX.