“You can earn 5-7% a month on Forex, without constantly checking monitor”. Interview with the winner of the April’s Battle of Traders from Magnitogorsk

He is a successful businessman with clear goals, who is used to rely primarily on himself. He has a favorite job, family and he is really interested in trading, which adds adrenaline to his life and brings additional income. This is how we can briefly describe the winner of the April’s

Battle of Traders – Alexei Alexandrovich Bardakov from Magnitogorsk. He has been trading Forex since 2015. He admits that at first it was bumps and bruises, that’s why he wanted to quit trading, but overcame his doubts and came up with his own individual trading strategy. The winner’s trading portfolio includes currency pairs, indices, precious metals, cryptocurrencies. He emphasizes that the market is not limited with EUR/USD, one can earn money using any instruments. Alexey Alexandrovich does not trust analysts too much, relies on his own considerations about the market and predicts an active rise in cryptocurrency prices. Which principles of the winner’s trading strategy can be called fundamental, why monitoring the Battle can not only help the participants, but also prevent their success, as well as how one can earn 5-7% profit per month on Forex – all of these details we present in a big interview with Alexey Alexandrovich. We present you a script of an interesting conversation, from which you can borrow valuable ideas for yourself and achieve the same impressive results on your own trading account.

- Alexey Alexandrovich, please tell us how did you learn about the Battle of Traders and why did you decide to take part in it?

- I know the guys from My Everest project (myeverest.org) for a long time. Following their recommendation, roughly speaking, I found your company. And everything on your webpage is clear and understandable.

- As far as I know, you previously participated in the Battle, but were not among the winners. Did your experience help you to win in April?

- Actually, I took part three times, achieved different results. As you can understand, that this is not an ordinary trade, this is a demo account, therefore, I put all eggs in one basket and took the risk. The first two times I realized that there was a chance to win. The third time I devoted a little more time.

- What did you feel and what were your first words when you knew about your victory in the Battle of Traders? Did you share this news with someone?

- To be honest, the emotions were absolutely positive: I couldn’t say that I was so proud of my trade and myself, but I was very pleased. I took part in the Battle not for the prize, but to understand what niche I could occupy in this traders’ community.

There was no one to share the news with, because I have no friends involved in trading. Nobody would understand me. If a person is not a trader, how can I explain the essence of my victory?

- Alexey Alexandrovich, how long did it take you to register in the Battle of Traders? What’s your feedback about the conditions of the Battle held by NPBFX?

- Speaking about the terms of the Battle, I have nothing to complain about, everything is fair, everything is fine. It took about a minute, probably one and a half to subscribe for the Battle and open a demo account.

- How often did you monitor other participants’ accounts? Was it somehow useful to you?

- Sure, it is very useful. However sometimes monitoring makes everything worse. If, in general, one does not pay attention to the frantic jumps in people’s deposits, then, generally speaking, it can be helpful. If you chase after someone, then such monitoring interferes more than helps. It depends on the person. It helped me personally. Almost every day, I followed the participants and tracked their trading, how they trade, manually or using automated algorithms.

- You were able to increase your initial deposit of $5000 by 29 times (up to $147,872)! Please tell us more about your trading strategy: what is it based on?

- I probably won’t be able to explain it briefly. In principle, the market conditions are the same for everyone, everyone sees it the same way, but, at that, trades differently. I don't know, maybe my experience helped me, maybe it was my intuition. But intuition can hardly be the key tool, of course, because everything is tough there. Everything is the same as within any other trading strategy – stop loss, take profit. Everything is probably like in classical trading. When I trade on my demo account, I don’t treat thousands of dollars as money. I don’t count $100 as 7,500 rubles: I consider $100 like 100 score units on my deposit. It helps. Honestly, I would never trade like this on a real account. If, according to my strategy, it is clear that there is a 80-90% chance that a trade will be profitable, I can increase the risks, but on real account this risk cannot be more than 5% of the deposit. Well, I have 2% risk per trade. Although I will not say that I wasn’t nervous at all while trading on demo account, I still wanted to win and to not go into the red, this is a competition. Therefore, a certain adrenaline was present, even though it was a demo account.

- During the Battle you made 36 transactions. As can be seen from the statement, you had quite diverse trading portfolio: currency pairs, American and European indices, silver, oil. How do you choose assets for trading?

- It doesn’t matter to me which instrument to choose, if I see what gives me profit, I go into it and buy or sell. Therefore, I do not trade just on EUR/USD. Many traders use just one instrument and then try to catch their goldfish. I observe the whole market, because it is alive, it is dynamic. And it’s not just EUR/USD that can be used in trading. If an instrument allows me to enter the market, I enter. The only exception is that I don’t trade stocks, because I don’t really like gaps there, but any other instruments can be used. I can trade any instrument except stocks.

- You also had transactions with Litecoin and Ethereum. In your opinion, are there any peculiarities in trading crypto? How active are you as a crypto trader?

- I trade cryptocurrency like any asset, because it also functions according to market trends. I entered cryptocurrency market because its conditions were favorable. Still, I am not an active crypto trader, I rarely deal with cryptocurrency on charts, although it also gives me profit. I believe that cryptocurrency will grow, and the levels will be much higher than now, and the price will be even higher.

I have a “cold” wallet: I just buy and hold cryptocurrency. I invested $5000 in cryptocurrency. I started investing in it when cryptocurrency was worth around $6000- $8000. I sold a part for $20,000 and now I'm starting to buy little again. Even if it falls by 2 times from today’s price, then I will not lose much, $5000 max. I doubt that cryptocurrency will leave the market.

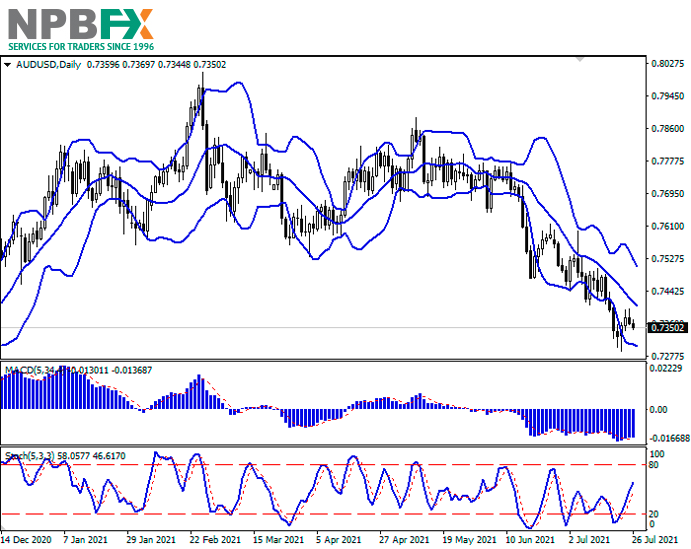

- The most profitable trade on your account was 20 lots of silver (XAG/USD) and brought more than $42,000 in profit. Do you use indicators, technical analysis, or ready-made trading indicators to determine the entry point?

- No, I trade only on technical analysis. I don’t have any indicators, I don’t even understand them and I don’t know how they work. I don't use them. There is a trend – I work on it.

- Do you use mobile version of MT4 or trade through the desktop version of the terminal?

- I use mobile version, but I do not trade from it: I track my transactions. If I am unable to approach PC, I track transactions on my mobile phone. After that I close or don’t close, depending on the market conditions.

- How much time per day did you usually spend on trading in the Battle?

- Specifically, I devoted a lot of time to the last Battle. You can see that the volumes of trades were huge there. Accordingly, you should be extremely precise to cope with such a volume. It was very hard to wait for a profit for transaction with silver, when I saw that the price was already so high. I don't usually enter into transitions like this. Usually the process consists of a trade entry, stop loss and take profit. Then, at most, I can track the progress of my transactions anywhere using my phone. And here I had to spend a lot of time and effort. It was not easy and simple.

- Perhaps you already managed to get acquainted with other popular services of our company, for example, with NPBFX Analytical portal?

- I am not guided by any analytics at all. I would not say that I completely ignore it, but I just do not use it directly in trading. I can pause trading, for instance, for six months, I do not have transactions for six months or a year, so I cannot apply fundamental analysis. That is, an analytical data may be helpful for someone, but not for me. All my trades are short, with a maximum duration of a week. I can take two trades, if it makes sense, and in this case analytics usually is not helpful, when you are told that the euro rate will rise, and you see from technical analysis that it will fall. Such contradictions challenge trading, so I haven’t taken analytics into account for more than two years. That’s it.

- The global economy situation, lockdowns due to the coronavirus pandemic, in your opinion, have somehow changed the structure of financial markets in the last year and a half?

- I do not see any significant changes. The only rumor is that volatility has increased, but it seems to me that it has not. My strategy has not changed. For trade – nothing has changed, for the global economy – maybe there are certain changes.

- $1000 has already been credited to your real NPBFX trading account. Do you plan to conduct the same trading on it as on a demo account in the Battle?

- I think I’ll be more careful. I don’t trade like that on a real account. The first time I participated in your Battle, I lost control and almost lost my real deposit. Of course, I managed to get out from this situation, but that was risky.

- Alexey Alexandrovich, how long have you been trading Forex? How did you study?

- I have been trading for a very long time, 5 years, since 2015. The first time I got more bumps and bruises. There was even a time when I wanted to give up and calm down. Somehow I managed to cope with this feeling. I have been trading on real account and earning real money for the last couple of years. I learned step by step by myself, sometimes I analyzed the experience of other traders. Trading is still an individual matter, everyone builds their own strategy and trades as best they can. There are traders who earn 5-7-10-20% a year, and they are satisfied with it, but for someone 20% a day is not enough.

- In your opinion, what qualities should a person possess to become a successful trader?

- At least – there should be no emotions, everything should be based on a careful thought. You have a strategy and rigid rules. You must obey them, even if you invented them for yourself. If you do not obey, it means that you don’t have a strategy, if there is no strategy, there is no trade. Generally speaking, you should be disciplined, that’s it.

- How would you answer the question: “Today Forex for me is ...?”

- This is not my main profession, but it is an opportunity to make money. But this is not my main occupation. If you want to make good money on Forex, you must dismiss all other activities. If you are satisfied with 2-3% per month, then you can not be distracted from your main work, and 5-7% can be earned without checking up your computer at all. I can do it, however, someone can’t afford that.

- Tell us a little about yourself: what do you do besides trading, what is your profession?

- I am a constructor. I am the CEO of a construction engineering organization. A businessman, in short.

- Please tell me, where are you from, what is the name of the city where you live? How old are you, are you a family man?

- Russia, Magnitogorsk. Yes, I am a family man, I have children. I am 40, I have been trading since 35.

- Do you have any hobbies, besides Forex market?

- My hobby is my job. I love my job, sometimes it doesn't like me very much. I am not the kind of a man who enjoys knitting or collecting stamps.

- Alexey Alexandrovich, would you advise your friends and acquaintances to join the Battle of Traders? Why?

- Probably, I would advise if I had friends who trade.

- What would you like to wish NPBFX and the participants of the next Battle of Traders?

- I would like to wish the participants a victory, because this is so satisfying. Of course everyone there cannot win. But it is possible to win. Really. Without any particular knowledge I took part and first place. I am an ordinary trader, and I will emphasize that trading is not my profession, not my main job. I had a month of vacation, and I subscribed and made certain effort to win. Victory be yours! Stay calm and proceed!

- Alexey Alexandrovich, thank you for participating in the Battle and answering the questions. May your trading on real account with NPBFX be as successful as it was in your contest account in April!