On the 6th September 15:00 (UK Time) I made over £10K profits at One Financial (UK) regarding USDCAD over the release of the Bank of Canada rate decision.

These trades were reversed and 'adjusted' without notice by One Financial.

I complained and was told their 'dealing desk witnessed stale prices in USDCAD over the release of the Bank of Canada rate decision'.

They refunded half of the profits after a further price comparison to Bloomberg's and then decided to close my account.I work with many other brokers and One Financial was the only one to reverse trades/ profits.

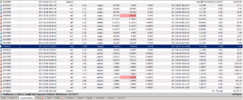

The attached image of my MT4 statement shows the trades.

This has also been reported to the FCA.

----Original Message----

From: compliance@ofmarkets.com

Date: 14/09/2017 11:15

To:

Cc: "Compliance"<compliance@ofmarkets.com>

Subj: RE: One Financial Markets - Account Closure

Dear ---,

I can confirm that the fund withdrawal you placed for £5,974.21 has been processed by our Payments department.

In response to the rest of your email below, please see the following:

In accordance to the terms and conditions that governs your trading account with us we state we reserve the right to refuse to accept any trades placed by you that we judge to be clearly outside the prevailing market price such that they may be deemed non-market price transactions, whether due to manifest human error or stale/incorrect/broken price feeds. Where we have opened or closed a trade before becoming aware of the price disparity, we may at our absolute discretion either treat that trade as void or accept that trade at the prevailing market price and will communicate this to you.

Therefore, in line with the this clause, the P&L for the following trades have been calculated taking using the prevailing market price at the time you were trading.

USDCAD Trades:

On 6th September at 15:00 (UK Time) our dealing desk witnessed stale prices in USDCAD over the release of the Bank of Canada rate decision.

As shown by the tick data below our prices froze from 15:00 to 15:00:02 (UK Time). During this time you were able to execute USDCAD trades at price 1.24060, whereas the actual price at the time of execution was 1.2318 (please see the Bloomberg data below).

One Financial Market Tick Data

Bloomberg Quote Recap

Having reviewed your trading account, you placed 7 orders at 15:00:01 (UK Time) for product USDCAD. These are order numbers 25727626, 25727836, 25727851, 25727872, 25728041, 25728103 and 25728633

When taking the correct open price of 1.2318 as shown in the Bloomberg data above, the P&L for the aforementioned trades are as follows:

The P&L for these trades are calculated using the following equation: P&L = [(lots x 100,000) x (open price – close price)] / close price

The P&L is stated in USD, and therefore has been converted into GBP. At the time of adjustment, the conversion rate was 1.3059.

Order 25727626 àP&L = {[(1.82 x 100,000) x (1.2318 – 1.22057)] / 1.22057}/ 1.3059 = £1,282.27

Order 25727836 àP&L = {[(1.46 x 100,000) x (1.2318 – 1.22087)] / 1.22087}/ 1.3059 = £1,000.91

Order 25727851 àP&L = {[(1.75 x 100,000) x (1.2318 – 1.22267)] / 1.22267}/ 1.3059 = £1,000.67

Order 25727872 àP&L = {[(1.22 x 100,000) x (1.2318 – 1.22242)] / 1.22242}/ 1.3059 = £716.86

Order 25728041 àP&L = {[(0.86 x 100,000) x (1.2318 – 1.22374)] / 1.22374}/ 1.3059 = £433.74

Order 25728103 àP&L ={[(0.60x 100,000) x (1.2318 – 1.22057)] / 1.22057}/ 1.3059 = £422.73

Order 25728633 àP&L = {[(1.39 x 100,000) x (1.2318 – 1.22147)] / 1.22147}/ 1.3059 = £900.17

Order Number

Volume

Market Price

Close

P&L

25727626

1.82

1.2318

1.22057

£ 1,282.27

25727836

1.46

1.2318

1.22087

£ 1,000.91

25727851

1.75

1.2318

1.22267

£ 1,000.67

25727872

1.22

1.2318

1.22242

£ 716.86

25728041

0.86

1.2318

1.22374

£ 433.74

25728103

0.6

1.2318

1.22057

£ 422.73

25728633

1.39

1.2318

1.22147

£ 900.17

Total

£ 5,757.33

USDNOK Trades

On Monday 11th September 2017 our dealing desk witnessed stale prices in USDNOK.

As shown by the tick data below our prices froze from 07:00:03 to 07:00:11 (UK Time). During this time you were able to execute USDNOK trades at price 7.75922, whereas the actual price at the time of execution was 7.7708 (please see the Bloomberg data below).

One Financial Market Tick Data

Bloomberg Quote Recap

Having reviewed your trading account I note that you placed 5 orders at 07:00:05 (UK Time). These are order numbers 25773560, 25773587, 25773602, 25773689 and 25773730

When taking the correct open price of 7.7708 as shown in the Bloomberg data above, the P&L for the aforementioned trades are as follows:

The P&L for these trades are calculated using the following equation: P&L = [(lots x 100,000) x (open price – close price)] / close price

The P&L is stated in USD, and therefore has been converted into EUR. At the time of adjustment, the conversion rate was 1.3175.

Order 25773560àP&L = {[(0.54 x 100,000) x (7.7708– 7.77449)]/ 7.77449}/1.3175 = £19.45

Order 25773587àP&L = {[(0.43 x 100,000) x (7.7708– 7.77459)]/ 7.77459}/1.3175 = £15.91

Order 25773602àP&L = {[(0.35 x 100,000) x (7.7708– 7.78097)]/ 7.78097}/1.3175 = £34.72

Order 25773689 àP&L ={[(0.41 x 100,000) x (7.7708– 7.78276)]/ 7.78276}/1.3175 = £47.82

Order 25773730àP&L = {[(0.97 x 100,000) x (7.7708– 7.78126)]/ 7.78126}/1.3175 = £98.97

Order Number

Volume

Market Price

Close

P&L

25773560

0.54

7.7708

7.77449

£ 19.45

25773587

0.43

7.7708

7.77459

£ 15.91

25773602

0.35

7.7708

7.78097

£ 34.72

25773689

0.41

7.7708

7.78276

£ 47.82

25773730

0.97

7.7708

7.78126

£ 98.97

Total

£ 216.88

Taking the P&L reimbursal made on all 12 orders above, the total P&L to be placed back on your landing account is £.

Product

P&L

USDNOK

£ 216.88

USDCAD

£ 5,757.33

Total

£ 5,974.21

Therefore, in accordance to my email below, please note the P&L related to all the above orders have been correctly adjusted at the underlying market price at the time you were trading, and your landing account reimbursed the correct amount.

Kind regards

Arti Jethwa

Senior Compliance Assistant

20 Savile Row

London

W1S 3PR

Tel: +44 207 534 0976 (Direct)

Tel: +44 207 534 0950 (Main)

Fax: +44 207 434 4367

Email:a.jethwa@ofmarkets.com

Web nefinancialmarkets.com

nefinancialmarkets.com

From

Sent: 14 September 2017 03:17

To: Compliance

Subject: Re: One Financial Markets - Account Closure

Dear Compliance,

I have submitted a withdrawal request for £5,974.21 to be withdrawn to my First Direct account. The outstanding profits that have been 'adjusted' on the account however total £4805.56 + £521.94 (profits also 'adjusted' on 11/9/2017, see attached). This leaves a total outstanding profit of £5327.50.

As per my previous email, I would like to remind you that these profits need to be reinstated by the end of this week or action will be taken against you at the FPA and the FCA. Whilst you have every right to close my account, you have absolutely no cause to withhold or 'adjust' profits made - it makes singularly bad press for any FX broker to behave like this!

Best wishes,

One Financial Markets is the trading name of C B Financial Services Ltd, a company registered in England with company number 6050593. C B Financial Services Ltd is authorised and regulated by the Financial Conduct Authority in the UK (under firm reference number 466201) and the Financial Services Board in South Africa (with FSP number 45784).

One Financial Markets (DIFC) Ltd is a company registered in the Dubai International Financial Centre at Index Tower, Level 10, Office 1008, PO Box 507147, Dubai, United Arab Emirates. One Financial Markets (DIFC) Ltd is regulated by the Dubai Financial Services Authority.

One Financial Markets (Asia) Ltd is an approved introducing agent of One Financial Markets, authorised and regulated by the Hong Kong Securities and Futures Commission (with SFC CE No BFZ621).

The risk of loss in leveraged foreign exchange trading can be substantial. You may not be suitable as you may sustain losses in excess of your initial margin funds. Leverage can work against you. Placing contingent orders, such as "stop-loss" or "stop-limit" orders, will not necessarily limit losses to the intended amounts. Market conditions may make it impossible to execute such orders. You may be called upon at short notice to deposit additional margin funds. If the required funds are not provided within the prescribed time, your position may be liquidated. You will remain liable for any resulting deficit in your account. You should therefore carefully consider whether such trading is suitable in light of your own financial position and investment objectives. Do not speculate with capital that you cannot afford to lose. If you decide to trade products offered by One Financial Markets Asia Limited, you must read and understand the terms and conditions provided by One Financial Markets Asia Limited.

----Original Message----

From: compliance@ofmarkets.com

Date: 13/09/2017 16:45

To: ---

Cc: "Compliance"<compliance@ofmarkets.com>

Subj: One Financial Markets - Account Closure

Dear Mr Bird,

RE: Trading Account number 1245171

Further to my email below, please note I have reviewed the situation surrounding your complaint.

Taking into account the underlying market prices at the time you were trading, we have now reimbursed your landing account with a total of £5,974.21, and will look to pay this outstanding balance back to the bank account details we hold for you.

At the same time I write to advise you that we are unable to continue to offer our services to you due to the trading strategy you have implemented on your trading account.

Under the Client Agreement which you have signed, we respectfully remind you that is in our absolute discretion to refuse to act upon any instruction and also to refuse any account.

Therefore in accordance with the Terms and Conditions that govern your trading account please accept this email as our formal written notice that your account will be closed with immediate effect.

Kind regards,

Arti Jethwa

Senior Compliance Assistant

20 Savile Row

London

W1S 3PR

Tel: +44 207 534 0976 (Direct)

Tel: +44 207 534 0950 (Main)

Fax: +44 207 434 4367

Email: a.jethwa@ofmarkets.com

Web: onefinancialmarkets.com

One Financial Markets is the trading name of C B Financial Services Ltd, a company registered in England with company number 6050593. C B Financial Services Ltd is authorised and regulated by the Financial Conduct Authority in the UK (under firm reference number 466201) and the Financial Services Board in South Africa (with FSP number 45784).

One Financial Markets (DIFC) Ltd is a company registered in the Dubai International Financial Centre at Index Tower, Level 10, Office 1008, PO Box 507147, Dubai, United Arab Emirates. One Financial Markets (DIFC) Ltd is regulated by the Dubai Financial Services Authority.

One Financial Markets (Asia) Ltd is an approved introducing agent of One Financial Markets, authorised and regulated by the Hong Kong Securities and Futures Commission (with SFC CE No BFZ621).

The risk of loss in leveraged foreign exchange trading can be substantial. You may not be suitable as you may sustain losses in excess of your initial margin funds. Leverage can work against you. Placing contingent orders, such as "stop-loss" or "stop-limit" orders, will not necessarily limit losses to the intended amounts. Market conditions may make it impossible to execute such orders. You may be called upon at short notice to deposit additional margin funds. If the required funds are not provided within the prescribed time, your position may be liquidated. You will remain liable for any resulting deficit in your account. You should therefore carefully consider whether such trading is suitable in light of your own financial position and investment objectives. Do not speculate with capital that you cannot afford to lose. If you decide to trade products offered by One Financial Markets Asia Limited, you must read and understand the terms and conditions provided by One Financial Markets Asia Limited.

From: Compliance

Sent: 12 September 2017 11:27

To:

Subject: FW: TRADE REVERSAL

Dear ---

Please note that your complaint is currently being reviewed and I revert back shortly.

Kind regards,

Arti Jethwa

Senior Compliance Assistant

20 Savile Row

London

W1S 3PR

Tel: +44 207 534 0976 (Direct)

Tel: +44 207 534 0950 (Main)

Fax: +44 207 434 4367

Email: a.jethwa@ofmarkets.com

Web: onefinancialmarkets.com

From:---

Sent: 11 September 2017 19:38

To: Middle Office

Cc: Mathew Pickles

Subject: TRADE REVERSAL

Dear One Financial,

I am writing with reference to the trade profits (GBP 10,779.77) that you have reversed on my account 1245171 on the 6/09/2017.

Not only did you reverse the trades illegally, you did not have the courtesy to advise me of this, either.

The trades listed from 6/09/2017, on the attached screenshot, were all well executed and indeed authenticate profits. You have absolutely no right to reverse them. Indeed my trades were executed at least 10 different brokerage accounts and One Financial has been the ONLY broker to 'adjust' profits.

I therefore respectfully suggest that you reconsider and honorably re-instate my profits ASAP (before week-end). If you don't I will be opening a thread (and court hearing) on Forex Peace Army (and any other online broker referral sites) and also reporting you to the FCA.

This is just not good enough!

Best wishes,

---

These trades were reversed and 'adjusted' without notice by One Financial.

I complained and was told their 'dealing desk witnessed stale prices in USDCAD over the release of the Bank of Canada rate decision'.

They refunded half of the profits after a further price comparison to Bloomberg's and then decided to close my account.I work with many other brokers and One Financial was the only one to reverse trades/ profits.

The attached image of my MT4 statement shows the trades.

This has also been reported to the FCA.

----Original Message----

From: compliance@ofmarkets.com

Date: 14/09/2017 11:15

To:

Cc: "Compliance"<compliance@ofmarkets.com>

Subj: RE: One Financial Markets - Account Closure

Dear ---,

I can confirm that the fund withdrawal you placed for £5,974.21 has been processed by our Payments department.

In response to the rest of your email below, please see the following:

In accordance to the terms and conditions that governs your trading account with us we state we reserve the right to refuse to accept any trades placed by you that we judge to be clearly outside the prevailing market price such that they may be deemed non-market price transactions, whether due to manifest human error or stale/incorrect/broken price feeds. Where we have opened or closed a trade before becoming aware of the price disparity, we may at our absolute discretion either treat that trade as void or accept that trade at the prevailing market price and will communicate this to you.

Therefore, in line with the this clause, the P&L for the following trades have been calculated taking using the prevailing market price at the time you were trading.

USDCAD Trades:

On 6th September at 15:00 (UK Time) our dealing desk witnessed stale prices in USDCAD over the release of the Bank of Canada rate decision.

As shown by the tick data below our prices froze from 15:00 to 15:00:02 (UK Time). During this time you were able to execute USDCAD trades at price 1.24060, whereas the actual price at the time of execution was 1.2318 (please see the Bloomberg data below).

One Financial Market Tick Data

Bloomberg Quote Recap

Having reviewed your trading account, you placed 7 orders at 15:00:01 (UK Time) for product USDCAD. These are order numbers 25727626, 25727836, 25727851, 25727872, 25728041, 25728103 and 25728633

When taking the correct open price of 1.2318 as shown in the Bloomberg data above, the P&L for the aforementioned trades are as follows:

The P&L for these trades are calculated using the following equation: P&L = [(lots x 100,000) x (open price – close price)] / close price

The P&L is stated in USD, and therefore has been converted into GBP. At the time of adjustment, the conversion rate was 1.3059.

Order 25727626 àP&L = {[(1.82 x 100,000) x (1.2318 – 1.22057)] / 1.22057}/ 1.3059 = £1,282.27

Order 25727836 àP&L = {[(1.46 x 100,000) x (1.2318 – 1.22087)] / 1.22087}/ 1.3059 = £1,000.91

Order 25727851 àP&L = {[(1.75 x 100,000) x (1.2318 – 1.22267)] / 1.22267}/ 1.3059 = £1,000.67

Order 25727872 àP&L = {[(1.22 x 100,000) x (1.2318 – 1.22242)] / 1.22242}/ 1.3059 = £716.86

Order 25728041 àP&L = {[(0.86 x 100,000) x (1.2318 – 1.22374)] / 1.22374}/ 1.3059 = £433.74

Order 25728103 àP&L ={[(0.60x 100,000) x (1.2318 – 1.22057)] / 1.22057}/ 1.3059 = £422.73

Order 25728633 àP&L = {[(1.39 x 100,000) x (1.2318 – 1.22147)] / 1.22147}/ 1.3059 = £900.17

Order Number

Volume

Market Price

Close

P&L

25727626

1.82

1.2318

1.22057

£ 1,282.27

25727836

1.46

1.2318

1.22087

£ 1,000.91

25727851

1.75

1.2318

1.22267

£ 1,000.67

25727872

1.22

1.2318

1.22242

£ 716.86

25728041

0.86

1.2318

1.22374

£ 433.74

25728103

0.6

1.2318

1.22057

£ 422.73

25728633

1.39

1.2318

1.22147

£ 900.17

Total

£ 5,757.33

USDNOK Trades

On Monday 11th September 2017 our dealing desk witnessed stale prices in USDNOK.

As shown by the tick data below our prices froze from 07:00:03 to 07:00:11 (UK Time). During this time you were able to execute USDNOK trades at price 7.75922, whereas the actual price at the time of execution was 7.7708 (please see the Bloomberg data below).

One Financial Market Tick Data

Bloomberg Quote Recap

Having reviewed your trading account I note that you placed 5 orders at 07:00:05 (UK Time). These are order numbers 25773560, 25773587, 25773602, 25773689 and 25773730

When taking the correct open price of 7.7708 as shown in the Bloomberg data above, the P&L for the aforementioned trades are as follows:

The P&L for these trades are calculated using the following equation: P&L = [(lots x 100,000) x (open price – close price)] / close price

The P&L is stated in USD, and therefore has been converted into EUR. At the time of adjustment, the conversion rate was 1.3175.

Order 25773560àP&L = {[(0.54 x 100,000) x (7.7708– 7.77449)]/ 7.77449}/1.3175 = £19.45

Order 25773587àP&L = {[(0.43 x 100,000) x (7.7708– 7.77459)]/ 7.77459}/1.3175 = £15.91

Order 25773602àP&L = {[(0.35 x 100,000) x (7.7708– 7.78097)]/ 7.78097}/1.3175 = £34.72

Order 25773689 àP&L ={[(0.41 x 100,000) x (7.7708– 7.78276)]/ 7.78276}/1.3175 = £47.82

Order 25773730àP&L = {[(0.97 x 100,000) x (7.7708– 7.78126)]/ 7.78126}/1.3175 = £98.97

Order Number

Volume

Market Price

Close

P&L

25773560

0.54

7.7708

7.77449

£ 19.45

25773587

0.43

7.7708

7.77459

£ 15.91

25773602

0.35

7.7708

7.78097

£ 34.72

25773689

0.41

7.7708

7.78276

£ 47.82

25773730

0.97

7.7708

7.78126

£ 98.97

Total

£ 216.88

Taking the P&L reimbursal made on all 12 orders above, the total P&L to be placed back on your landing account is £.

Product

P&L

USDNOK

£ 216.88

USDCAD

£ 5,757.33

Total

£ 5,974.21

Therefore, in accordance to my email below, please note the P&L related to all the above orders have been correctly adjusted at the underlying market price at the time you were trading, and your landing account reimbursed the correct amount.

Kind regards

Arti Jethwa

Senior Compliance Assistant

20 Savile Row

London

W1S 3PR

Tel: +44 207 534 0976 (Direct)

Tel: +44 207 534 0950 (Main)

Fax: +44 207 434 4367

Email:a.jethwa@ofmarkets.com

Web

From

Sent: 14 September 2017 03:17

To: Compliance

Subject: Re: One Financial Markets - Account Closure

Dear Compliance,

I have submitted a withdrawal request for £5,974.21 to be withdrawn to my First Direct account. The outstanding profits that have been 'adjusted' on the account however total £4805.56 + £521.94 (profits also 'adjusted' on 11/9/2017, see attached). This leaves a total outstanding profit of £5327.50.

As per my previous email, I would like to remind you that these profits need to be reinstated by the end of this week or action will be taken against you at the FPA and the FCA. Whilst you have every right to close my account, you have absolutely no cause to withhold or 'adjust' profits made - it makes singularly bad press for any FX broker to behave like this!

Best wishes,

One Financial Markets is the trading name of C B Financial Services Ltd, a company registered in England with company number 6050593. C B Financial Services Ltd is authorised and regulated by the Financial Conduct Authority in the UK (under firm reference number 466201) and the Financial Services Board in South Africa (with FSP number 45784).

One Financial Markets (DIFC) Ltd is a company registered in the Dubai International Financial Centre at Index Tower, Level 10, Office 1008, PO Box 507147, Dubai, United Arab Emirates. One Financial Markets (DIFC) Ltd is regulated by the Dubai Financial Services Authority.

One Financial Markets (Asia) Ltd is an approved introducing agent of One Financial Markets, authorised and regulated by the Hong Kong Securities and Futures Commission (with SFC CE No BFZ621).

The risk of loss in leveraged foreign exchange trading can be substantial. You may not be suitable as you may sustain losses in excess of your initial margin funds. Leverage can work against you. Placing contingent orders, such as "stop-loss" or "stop-limit" orders, will not necessarily limit losses to the intended amounts. Market conditions may make it impossible to execute such orders. You may be called upon at short notice to deposit additional margin funds. If the required funds are not provided within the prescribed time, your position may be liquidated. You will remain liable for any resulting deficit in your account. You should therefore carefully consider whether such trading is suitable in light of your own financial position and investment objectives. Do not speculate with capital that you cannot afford to lose. If you decide to trade products offered by One Financial Markets Asia Limited, you must read and understand the terms and conditions provided by One Financial Markets Asia Limited.

----Original Message----

From: compliance@ofmarkets.com

Date: 13/09/2017 16:45

To: ---

Cc: "Compliance"<compliance@ofmarkets.com>

Subj: One Financial Markets - Account Closure

Dear Mr Bird,

RE: Trading Account number 1245171

Further to my email below, please note I have reviewed the situation surrounding your complaint.

Taking into account the underlying market prices at the time you were trading, we have now reimbursed your landing account with a total of £5,974.21, and will look to pay this outstanding balance back to the bank account details we hold for you.

At the same time I write to advise you that we are unable to continue to offer our services to you due to the trading strategy you have implemented on your trading account.

Under the Client Agreement which you have signed, we respectfully remind you that is in our absolute discretion to refuse to act upon any instruction and also to refuse any account.

Therefore in accordance with the Terms and Conditions that govern your trading account please accept this email as our formal written notice that your account will be closed with immediate effect.

Kind regards,

Arti Jethwa

Senior Compliance Assistant

20 Savile Row

London

W1S 3PR

Tel: +44 207 534 0976 (Direct)

Tel: +44 207 534 0950 (Main)

Fax: +44 207 434 4367

Email: a.jethwa@ofmarkets.com

Web: onefinancialmarkets.com

One Financial Markets is the trading name of C B Financial Services Ltd, a company registered in England with company number 6050593. C B Financial Services Ltd is authorised and regulated by the Financial Conduct Authority in the UK (under firm reference number 466201) and the Financial Services Board in South Africa (with FSP number 45784).

One Financial Markets (DIFC) Ltd is a company registered in the Dubai International Financial Centre at Index Tower, Level 10, Office 1008, PO Box 507147, Dubai, United Arab Emirates. One Financial Markets (DIFC) Ltd is regulated by the Dubai Financial Services Authority.

One Financial Markets (Asia) Ltd is an approved introducing agent of One Financial Markets, authorised and regulated by the Hong Kong Securities and Futures Commission (with SFC CE No BFZ621).

The risk of loss in leveraged foreign exchange trading can be substantial. You may not be suitable as you may sustain losses in excess of your initial margin funds. Leverage can work against you. Placing contingent orders, such as "stop-loss" or "stop-limit" orders, will not necessarily limit losses to the intended amounts. Market conditions may make it impossible to execute such orders. You may be called upon at short notice to deposit additional margin funds. If the required funds are not provided within the prescribed time, your position may be liquidated. You will remain liable for any resulting deficit in your account. You should therefore carefully consider whether such trading is suitable in light of your own financial position and investment objectives. Do not speculate with capital that you cannot afford to lose. If you decide to trade products offered by One Financial Markets Asia Limited, you must read and understand the terms and conditions provided by One Financial Markets Asia Limited.

From: Compliance

Sent: 12 September 2017 11:27

To:

Subject: FW: TRADE REVERSAL

Dear ---

Please note that your complaint is currently being reviewed and I revert back shortly.

Kind regards,

Arti Jethwa

Senior Compliance Assistant

20 Savile Row

London

W1S 3PR

Tel: +44 207 534 0976 (Direct)

Tel: +44 207 534 0950 (Main)

Fax: +44 207 434 4367

Email: a.jethwa@ofmarkets.com

Web: onefinancialmarkets.com

From:---

Sent: 11 September 2017 19:38

To: Middle Office

Cc: Mathew Pickles

Subject: TRADE REVERSAL

Dear One Financial,

I am writing with reference to the trade profits (GBP 10,779.77) that you have reversed on my account 1245171 on the 6/09/2017.

Not only did you reverse the trades illegally, you did not have the courtesy to advise me of this, either.

The trades listed from 6/09/2017, on the attached screenshot, were all well executed and indeed authenticate profits. You have absolutely no right to reverse them. Indeed my trades were executed at least 10 different brokerage accounts and One Financial has been the ONLY broker to 'adjust' profits.

I therefore respectfully suggest that you reconsider and honorably re-instate my profits ASAP (before week-end). If you don't I will be opening a thread (and court hearing) on Forex Peace Army (and any other online broker referral sites) and also reporting you to the FCA.

This is just not good enough!

Best wishes,

---