SOLID ECN LLC

Solid ECN Representative

- Messages

- 511

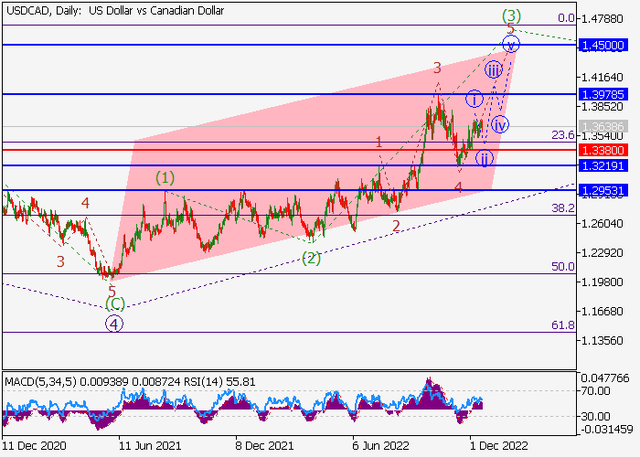

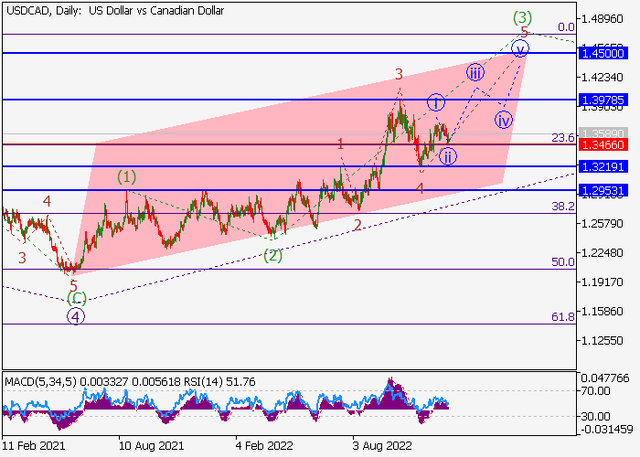

USDCAD - The price is in a correction and may grow.

On the daily chart, the fifth upward wave of the higher level 5 develops, within which the wave (3) of 5 forms. Now, the third wave of the lower level 3 of (3) has formed, a downward correction has ended as the fourth wave 4 of (3), and the wave 5 of (5) is developing, within which the wave i of 5 has ended, and the local correction ii of 5 is forming.

If the assumption is correct, USDCAD pair will grow to the area of 1.3978 – 1.45. In this scenario, critical stop loss level is 1.3380.

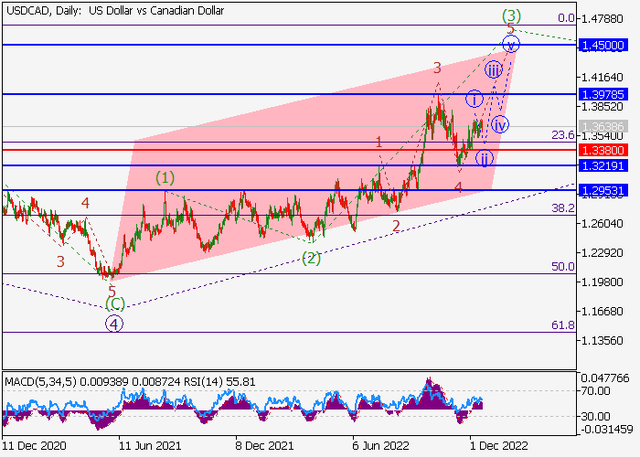

On the daily chart, the fifth upward wave of the higher level 5 develops, within which the wave (3) of 5 forms. Now, the third wave of the lower level 3 of (3) has formed, a downward correction has ended as the fourth wave 4 of (3), and the wave 5 of (5) is developing, within which the wave i of 5 has ended, and the local correction ii of 5 is forming.

If the assumption is correct, USDCAD pair will grow to the area of 1.3978 – 1.45. In this scenario, critical stop loss level is 1.3380.