SOLID ECN LLC

Solid ECN Representative

- Messages

- 511

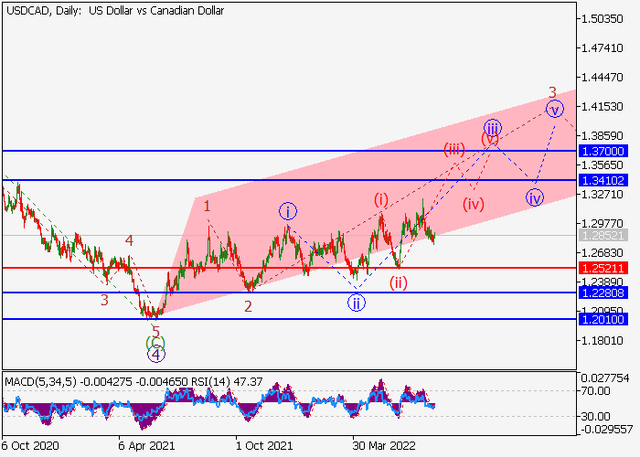

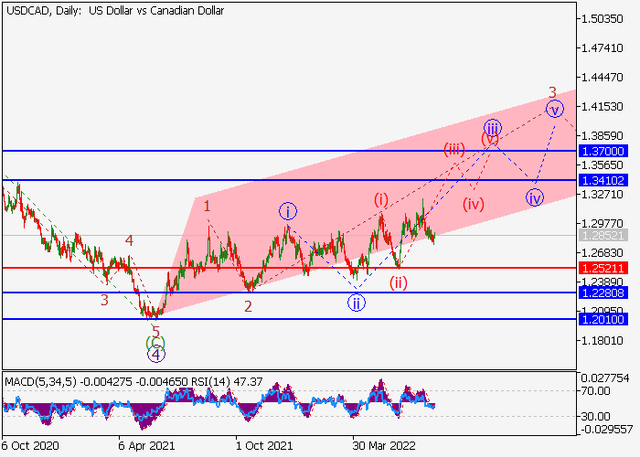

USDCAD - Growth in possible.

On the daily chart, the first wave of the higher level (1) of 5 forms, within which the wave 3 of (1) develops. Now, the third wave of the lower level iii of 3 is developing, within which the wave (iii) of iii is forming.

If the assumption is correct, the USDCAD pair will grow to the levels of 1.341 – 1.37. In this scenario, critical stop loss level is 1.2521.

On the daily chart, the first wave of the higher level (1) of 5 forms, within which the wave 3 of (1) develops. Now, the third wave of the lower level iii of 3 is developing, within which the wave (iii) of iii is forming.

If the assumption is correct, the USDCAD pair will grow to the levels of 1.341 – 1.37. In this scenario, critical stop loss level is 1.2521.