Last week, after I bought the spreadsheet I realized it has the potential to be used for trading binary options. In that short time, I have made at least 20 times the purchase price of the spreadsheet using them in this way. Now, I don't think I'll be using any other method to trade binaries. I'd like to start a discussion on how to use the OptionLevels for binary trading.

First of all what is a binary option contract? A binary option contract is a derivative which states a condition that has only two possible outcomes. It includes an underlying asset on which the condition is based, the condition, a strike price and an expiry time. Here's an example of a binary option contract: EUR/USD will be trading above 1.3000 at 2PM US Eastern time on April 26th, 2013.

The parts of this binary option are:

Underlying Asset:

EURUSD

Strike Level:

1.3000

Expiry Time:

2PM US Eeastern

Condition:

EURUSD must be higher than the strike price at expiry time

Expiry Date:

April 26, 2013

There are only two possible outcomes. The condition will be satisfied at expiry time or it will not. We traders can either

BUY the contract if we think EUR/USD will be trading ABOVE 1.3000 at 2PM US Eastern time on April 26, 2013 or we can

SELL the contract if we think EUR/USD will be trading at 1.3000 or less. Note that even if EUR/USD is exactly 1.3000 at expiry time, then the condition is viewed as false because it states that the EUR/USD will be ABOVE 1.3000 at expiry time.

Now if we choose to take one of those two positions, what price are we going to pay? The contracts fluctuate in value based on the amount of time left until expiry and the current level of the underlying asset. Let's say some good news for the EUR/USD comes out. Before the news, EUR/USD is trading at 1.3000, but after the news EUR/USD soars in value and now it is trading at 1.3100 (100 pips higher). Before the news comes out, the EUR/USD 1.3000 contract might cost $50 to buy. However, after EUR/USD jumps up by 100 pips after the news, the contract might cost $99.50. This reflects the fact that now it is virtually 100 percent guaranteed that the condition of the binary option will be proved true.

Similarly, let's say some bad news comes out. Now, EUR/USD plummets to 1.2900 (100 pips lower). That contract that was trading at $50 is now selling at $1. This reflects that there is essentially 0 percent probability that the condition of the binary contract will be proved true.

Of course, there isn't always news, so EUR/USD might stay in a small range. Still, the value of the binary option contract will rise and fall in value based on where EUR/USD trades and how much time is left until expiry. For example, if there is just 5 mins left until expiry and EUR/USD is at 1.3005, then the contract price might well be $90, since it is very likely that condition will be satisfied. On the other hand, maybe it falls to 1.2995 before expiry. So, a buyer of the contract might be able to buy it for $45. You get the idea. Time value and underlying price are the two prime factors of

ANY type of option (binary or otherwise) that affect the price.

I am in the United States. The only governmentally-approved platform on which to trade binary options is NADEX, the North American Derivatives Exchange. It is regulated by the Commodities Futures Trading Commission which is the government agency responsible for making sure commodities and futures dealers play by the rules which CFTC has established for the futures markets. This regulation means that you can trade on NADEX with confidence that the transactions are transparent and that you will receive your money via prompt withdrawals, etc. NADEX only accepts people with a United States address and a US taxpayer ID number. At the end of the year, you will receive a tax form in the mail showing how much you made or lost and you will have to report your income to the IRS.

Binary option contracts on NADEX have a payout of $0 or $100 at expiry. If you

BUY a contract that whose condition is satisfied at expiry time, you will get a payout of $100. If the condition is not satisfied you will get $0 (yes, you lose 100 percent of your investment).

If you

SELL a contract whose condition is satisfied at expiry time you will get a payout of $0 (yes, you lose 100 percent of the investment). If the condition is

NOT satisfied you as the seller of the contract get back a payout of $100.

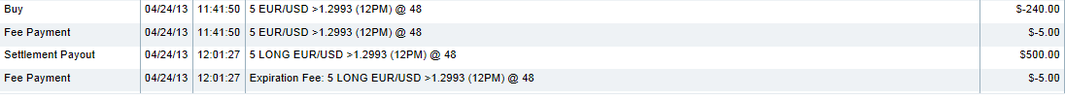

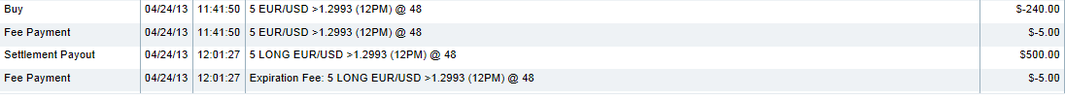

Now, how do we use OptionLevels to make money? Take a look at the following screenshot of a completed trade I did on NADEX a few days ago after buying OptionLevels:

The spreadsheet indicated that 1.2994 was an important level of support. On NADEX there was a binary option contract with a strike price of 1.2993 set to expire at 12PM US Eastern time. At 11:41AM US Eastern time with 19 minutes until expiry, EUR/USD dropped below 1.2993. That pushed down the price of the 1.2993 contract to $48. When I saw that, I immediately bought 5 contracts. My risk on the position was 5 x $48 = $240. If EUR/USD was trading at 1.2993 or lower at expiry time 19 minutes later, I would lose 100 percent of my investment. However, if EUR/USD rose back above 1.2993 at expiry, I would get a payout of $100 per contract. So, the potential reward was $100(payout) - $48 (risk) = $52. That is a little more than 100 percent return on investment. NADEX does charge fees to open and close positions. I am not taking those into account here. But, you get the point. As shown in the screenshot of my transaction, EUR/USD did finish above 1.2993 and so I received $100 per contract at expiry. So, I risked a total of $240 and I received back $500 for a total profit of $260 not counting fees.

It isn't shown in the transaction record, however, NADEX publishes the final expiration values of all contracts on their website. For this particular contract, EUR/USD expired at 1.29955 which was above the 1.2993 strike price of the contract.

It's a slightly more advanced concept, but just as you can

BUY these contracts if you think the price will finish ABOVE the strike price, you can also

SELL the contracts if you think the price will finish below the strike price. This is how I played another trade on Friday.

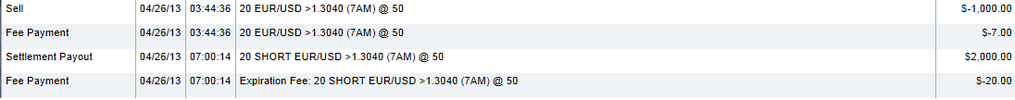

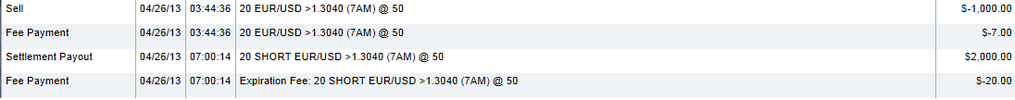

The spreadsheet for use last Friday showed that 1.3041 was a resistance level for EUR/USD. I found a contract on NADEX set to expire at 7AM US Eastern time with a strike level of 1.3040. Well in advance, I determined that if EUR/USD rose to that level, I would SELL that contract on the belief that it would fall back below that level due to the resistance there. Here's the screenshot of my complete trade:

This screenshot shows that I

SOLD (went short) 20 EUR/USD 1.3040 contracts at 3:44AM US Eastern time. I sold at $50. This means my risk on the trade in total was $50 x 20 = $1000. If EUR/USD finished above 1.3040 I would lose my entire $1000 investment. If EUR/USD finished less than (or equal to) 1.3040 at 7AM US Eastern, I would receive a payout of $100 per contract x 20 contracts = $2000. Since I invested $1000, that would yield return on investment of $2000 - $1000 = $1000 profit (100 percent return).

In the end EUR/USD finished below 1.3040 and I received the full payout and a $1000 profit. The final expiration value of 1.30044.

On NADEX binary options have various expiries. Some options open for trading two hours before they expire, others are daily options which are available for trading for 8 hours or more. You can also, place limit orders. For example, as I mentioned in the case of the 1.3040 option, I determined well in advance that if EUR/USD rose above that level I would sell at $50. At the time I made that decision, EUR/USD was well below 1.3040 and so the option was priced around $19. If you sell at that level, you are assuming far too much risk. A sell at $19, means you are assuming $81 of risk. In this case, even if you did that you would have come out with a profit. However, it is not worth the risk. So, I placed my order to sell at $50 and walked away from the computer. Later, when I checked my account, I saw that in the hours after I placed my order, the EUR/USD had risen above 1.3040 and the price of the option therefore rose above $50. When the price hit the Bid price of $50 my order was automatically triggered while I was away from the computer and a position was open for me at $50.

There was still 3 hours 15 minutes remaining until expiry. As EUR/USD started falling before expiry, I had the option of closing the position early for a profit. But, I was confident that the resistance level of 1.3040 was going to hold and that EUR/USD would not finish above it. So, I held the position all the way to expiry and got a good outcome. Just keep in mind that a key benefit of trading the binary contracts on NADEX is that if you want to get out early to take a smaller gain or to limit a loss you can certainly do that.

I hope you can see the potential power of trading binaries on NADEX using the calculations in the spreadsheet.

Someone said over in the OptionLevels 50 percent discount thread that this information is available for free on the CME website. Well, the data that goes into the spreadsheet may be free there, but, being able to use the spreadsheet and have it calculate the levels for me is definitely worth the $49 I paid. Also, as you can see, I have made many multiples of $49 back in profit just in the few days since I bought it.

I'd like to hear from anyone else who may be using the OptionLevels for trading binaries. If you trade on one of the offshore platforms, that is fine. But, I am particularly interested in hearing from any fellow NADEX traders. That platform is awesome and the potential returns available when trading there are simply not available on any offshore platform.