MDunleavy

iticsoftware.com Representative

- Messages

- 185

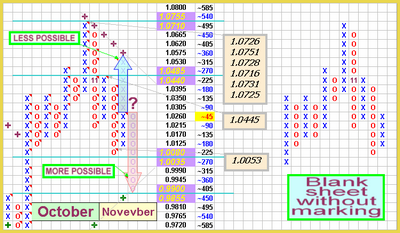

Market Commentary Dollar Index is just nearing resistance zone of 78.75-79.30 ranges though double dip depression in the US is still glooming resulting in most of the asset classes trading softer especially the equities, the dollar index may go sideways.

CLICK HERE for detail information...

~~~>mdunleavy.byethost7.com/11Sep20.html

^^^ OR vvv

~~~>img842.imageshack.us/img842/5364/11sep27.pdf

^^^ OR vvv

~~~>iticsoftware.com/postimages2//201009/11Sep20.html

^^^ OR vvv

A t t a c h m e n t

CLICK HERE for detail information...

~~~>mdunleavy.byethost7.com/11Sep20.html

^^^ OR vvv

~~~>img842.imageshack.us/img842/5364/11sep27.pdf

^^^ OR vvv

~~~>iticsoftware.com/postimages2//201009/11Sep20.html

^^^ OR vvv

A t t a c h m e n t