MDunleavy

iticsoftware.com Representative

- Messages

- 185

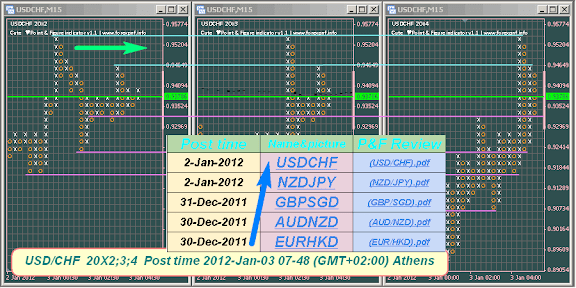

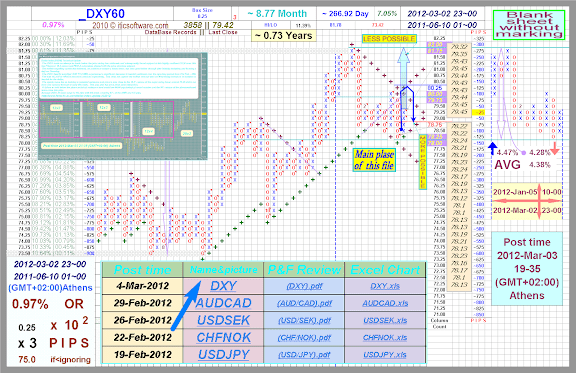

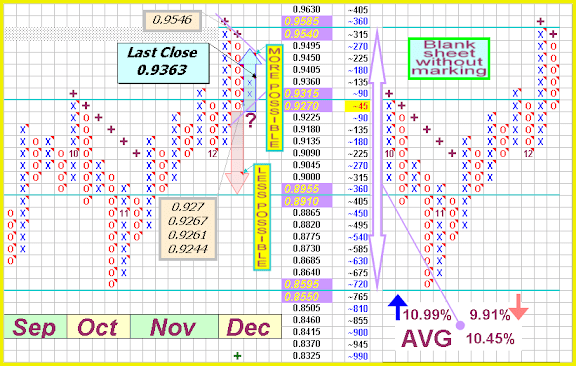

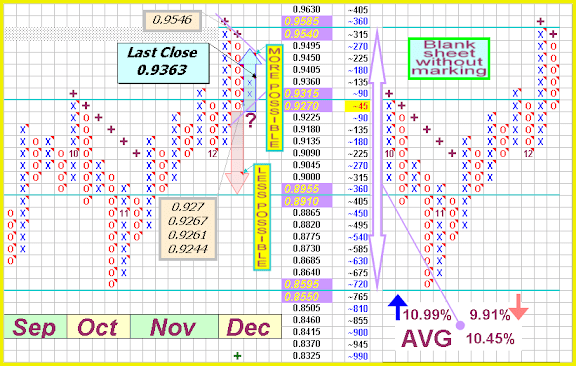

USD/CHF: The recent break above the critical October highs at 0.9315 is significant and now opens the door for the next major upside extension over the coming weeks back towards parity. A confirmed higher low is now in place by 0.9065 following the recent break over 0.9330, and next key resistance comes in by 0.9785. Ultimately, only back under 0.9065 would delay constructive outlook.[by dailyfx]

Learn more :

~~~>iticsoftware.com/postimages2//201009/11Dec25.html

^^^ORvvv

~~~>img521.imageshack.us/img521/929/11dec25.pdf

^^^ORvvv

A t t a c h m e n t

Learn more :

~~~>iticsoftware.com/postimages2//201009/11Dec25.html

^^^ORvvv

~~~>img521.imageshack.us/img521/929/11dec25.pdf

^^^ORvvv

A t t a c h m e n t

Code:

https://docs.google.com/leaf?id=0BxxKzvQ2GlM8YjZlZjI0NDktNmYyZS00Yjk2LWJhOTMtY2Y4ZWIwYzgzMjEz&sort=name&layout=list&num=50