SOLID ECN LLC

Solid ECN Representative

- Messages

- 511

XAUUSD, flat dynamics in the short term

Gold prices are consolidating during the Asian session, holding near 1920. The day before, the instrument showed a rather active decline, which was caused by another increase in the attractiveness of the US currency for investors. The US dollar is strengthening amid expectations of further tightening of monetary policy by the US Federal Reserve, which may raise the rate by 50 basis points at once during the May meeting. In addition, the demand for the US currency is growing due to an increase in the yield of treasury bonds: for 10-year securities it rose above 2.55% for the first time since May 2019. Return of asset quotes above 1950 will provide stronger support for gold, which may then rush to last week's highs around 1966.

In turn, the demand for gold as a safe-haven asset remains quite high amid the escalation of the conflict in Ukraine. Traders are disappointed in the negotiation process and no longer expect that the parties will be able to reach a peace agreement in the near future.

It is also worth noting that the London Bullion Market Association (LBMA) and the World Gold Council (WGC) intend to create a blockchain-based database that will allow tracking the origin and movement of gold bars around the world. The initiative is aimed at preventing trading in illegally mined metal. At the moment, the market is recording an increase in the number of bars with counterfeit stamps with logos of large manufacturing enterprises.

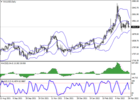

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is narrowing, reflecting the emergence of ambiguous dynamics of trading in the short/ultra-short term. MACD is going down, keeping a fairly stable sell signal. Stochastic, having retreated from its highs, shows an active downtrend, signaling in favor of the further development of "bearish" trend in the ultra-short term.

Resistance levels: 1930, 1952, 1974.2, 2000.

Support levels: 1900, 1877, 1860, 1840.

Gold prices are consolidating during the Asian session, holding near 1920. The day before, the instrument showed a rather active decline, which was caused by another increase in the attractiveness of the US currency for investors. The US dollar is strengthening amid expectations of further tightening of monetary policy by the US Federal Reserve, which may raise the rate by 50 basis points at once during the May meeting. In addition, the demand for the US currency is growing due to an increase in the yield of treasury bonds: for 10-year securities it rose above 2.55% for the first time since May 2019. Return of asset quotes above 1950 will provide stronger support for gold, which may then rush to last week's highs around 1966.

In turn, the demand for gold as a safe-haven asset remains quite high amid the escalation of the conflict in Ukraine. Traders are disappointed in the negotiation process and no longer expect that the parties will be able to reach a peace agreement in the near future.

It is also worth noting that the London Bullion Market Association (LBMA) and the World Gold Council (WGC) intend to create a blockchain-based database that will allow tracking the origin and movement of gold bars around the world. The initiative is aimed at preventing trading in illegally mined metal. At the moment, the market is recording an increase in the number of bars with counterfeit stamps with logos of large manufacturing enterprises.

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is narrowing, reflecting the emergence of ambiguous dynamics of trading in the short/ultra-short term. MACD is going down, keeping a fairly stable sell signal. Stochastic, having retreated from its highs, shows an active downtrend, signaling in favor of the further development of "bearish" trend in the ultra-short term.

Resistance levels: 1930, 1952, 1974.2, 2000.

Support levels: 1900, 1877, 1860, 1840.