Gold prices show a slight increase during the morning session, developing a fairly strong "bullish" momentum formed in the middle of last week and trading at 1855.9. The main driver of the instrument's recovery was the weakening USD Index, which sharply corrected from multi-year highs around 105, losing more than 2.5%, to a low of 102, despite the "hawkish" rhetoric of the US Fed members.

Demand for XAUUSD is holding up as global tensions escalate as fundamentals change little. Many economies are facing record inflation amid soaring prices for energy and other resources, forcing investors to look for safer alternatives to risky assets. In turn, rising inflation prompts the world's central banks to sharply tighten monetary policy, making gold ownership less attractive, since it does not generate interest income. Meanwhile, a special military operation in Ukraine continues, and the negotiation process is actually stopped, so the conflict is becoming more and more protracted.

Today, investors are waiting for the publication in the US of May statistics on business activity, as well as April data on the dynamics of New Home Sales. During the day, the Chair of the US Federal Reserve, Jerome Powell, is also scheduled to speak.

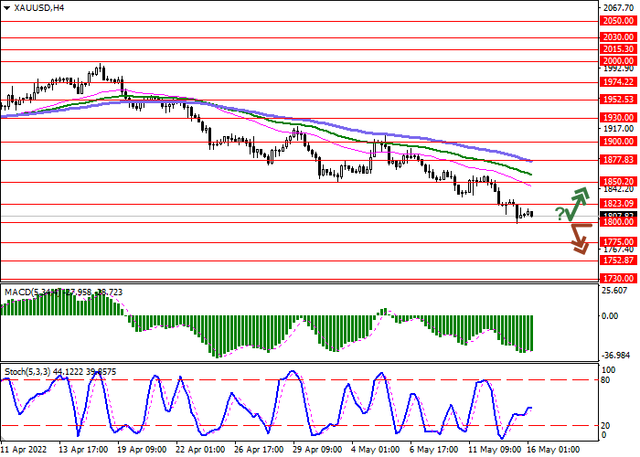

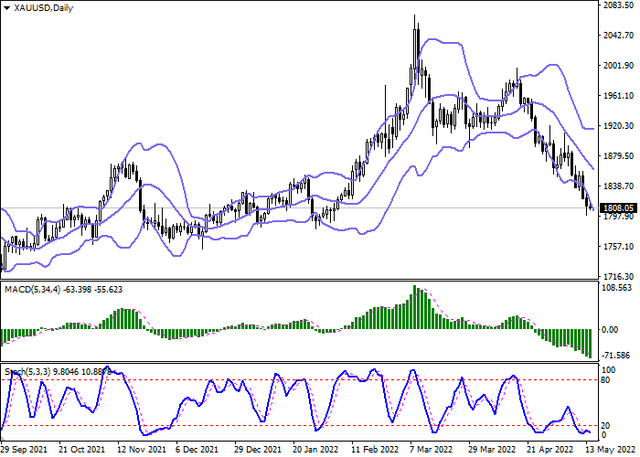

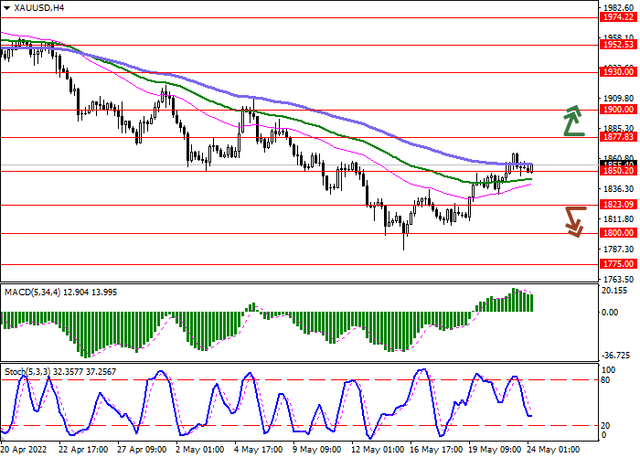

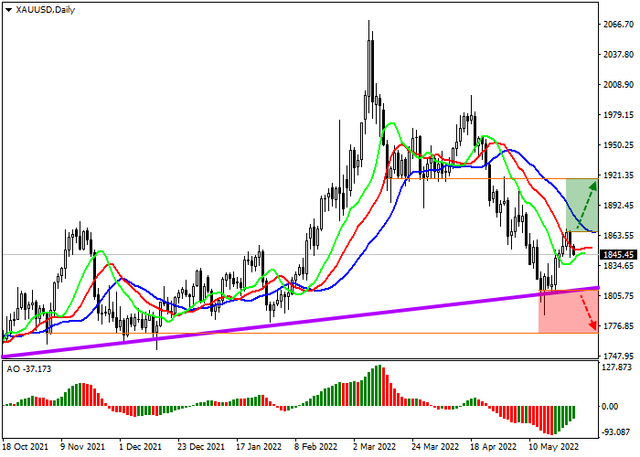

Bollinger Bands in D1 chart demonstrate active decrease. The price range is narrowing, reflecting the emergence of ambiguous dynamics of trading in the short term. MACD indicator is growing, while preserving a rather stable buy signal (located above the signal line). Stochastic approached the level of "100" and reversed into a horizontal plane, indicating a strongly overbought instrument in the ultra-short term and signaling in favor of the development of a corrective decline.

Resistance levels: 1877.83, 1900, 1930, 1952.53 | Support levels: 1850.2, 1823.09, 1800, 1775