FXP_2020

Fxprimus Representative

- Messages

- 0

The first week of 2021 has been anything but boring. The 2 undecided U.S Senate seats went to Democrats in Georgia Run-offs and the sitting U.S. Senate certified Joe Biden’s win. This was followed by historical pro-Trump protests in the U.S. which culminated with protesters breaching the U.S. Capitol security on Wednesday. President Trump was subsequently blocked from Twitter and Facebook and eventually had to concede – almost a month after the initial election results were published.

Joe Biden is now confirmed to be the 46th President of the U.S. and Kamala Harris to be his Vice-President. The duo can expect to have a rather smooth sailing for the first two years, until the mid-terms, as Democrats are in control of both the Senate as well as the House. Joe Biden suggested that further stimulus will be pushed into the economy and the current US$ 900 billion is just a ‘down payment’. The aggregate stimulus may reach US$ 2 trillion which could be spent on infrastructure, green energy but also on COVID-19 related stimulus to individuals and businesses. The fiscal stimulus combined with monetary stimulus from the Federal Reserve Bank might give the U.S. economy an inflationary push from the demand side which could put even further downwards pressure on the Greenback. US dollar, measured by DXY, is currently trading near 90.0 which is the lowest since April 2018. The Fed has committed to continue the current stimulus of US$ 120 billion every month, in the form of purchasing treasury securities, as well as mortgage-backed securities. On the flipside, should the U.S. economy bounce back fast, the dollar might get a boost and recover to 91.2 – 92.3 levels. Rosenberg Research estimates that the U.S. might see 3.3% of economic growth in 2021 with the currently approved stimulus. Assuming that additional funds are poured into the economy, the growth rate might reach even 7% which is another historical high.

Amid the record high coronavirus hospitalizations, deaths and daily new cases, jobs recovery has come a halt in the U.S. Non-farm payroll data was negative for the first time since April – we saw 140,000 jobs cut in December, versus the consensus of 71,000 jobs added. This trend was also confirmed in ADP jobs data on Wednesday – 123,000 jobs were lost, versus the consensus of 75,000 jobs to be added. Leisure and hospitality had the largest cuts of negative 498,000 according to NFP data, while retail added 121,000 new jobs. WSJ reports that 2020 was the worst year in terms of job loss with 9.4 million American jobs cut, exceeding the previous record in 2009 when 5 million jobs were cut. Unemployment rate of 6.7% is unchanged from November. In terms of the number of unemployed people, we are back at 2015 levels, meaning that COVID-19 crisis erased 5 and a half years of job gains in the U.S. economy, according to Rosenberg Research. Assuming that December pace of recovery continues, it would take at least 4 years to reach the level of employment we saw in February 2020.

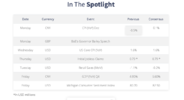

The markets have been in a risk-on mode with S&P500 and Nasdaq100 respectively gaining 1.83% and 1.68%. Russell2000 also posted strong gains of 5.9%. Gold was down 2.6%, while US dollar, measured as DXY, gained 19 bps. Oil broke some key resistance levels, gaining 9.2% and traded near US$ 52.0 – levels last seen in February 2020. A couple of other noteworthy moves were Bitcoin reaching all-time-high of 41,000, and UST 10-year yield broke to 1.11% – last seen in March 2020. Re-inflationary trade seems have taken off.

Impact

• China Consumer Price Index

Inflation measures the rise in consumer prices in an economy over a certain period of time. Higher inflation means that consumer

prices have grown compared to the previous period. Higher than expected rate may be both positive or negative for CNY as the

market does not like inflation expectations too far off from consensus. Generally, both high and negative inflation are bearish for currency, while positive and low inflation, in line with expectations, is bullish.

• Chinese GDP

GDP data shows the monetary value of all the goods and services produced in China. China is the only large economy that is expected to have a positive growth in 2020. A negative number indicates a contraction of economic activity while a positive number shows an expansion. A better than expected growth is generally positive for CNY, whilst a print below expectations tends to be negative.

EURUSD

EURUSD seems to have established a new trading range of 1.2121 to 1.2266. Stacked Moving Averages (8 > 21 > 34 > 50 > 100 > 200) support bullish trend short-term and long-term. The price has found support near 8-day Moving Average level of 1.2187. RSI of 65.9 and Slow Stochastic of 61.1 are both neutral but rising. DMI+ is currently near 20.4 while DMI- is 12.8, giving a weak signal about prevalent bullish trend. ADX is currently 28.9 signaling a moderate strength of the momentum.

Support: 1.21615

Resistance: 1.2241

GBPUSD

The pair has been steadily climbing higher but has broken 8-day Moving Average support, testing currently 21-day Moving Average support. Moving Averages are stacked, supporting bullish momentum (8 > 21 > 34 > 50 > 100 > 200) but 8-day MA is declining. RSI of 51.9 and Stochastic of 74.3 are both neutral. DMI+ and DMI- are both 19, while ADX of 11.7 gives no signal value.

Support: 1.34875

Resistance: 1.35640

USDJPY

USDJPY has shown mighty gains and recovered to 50-day Moving Average resistance levels. The price has benefitted from risk off sentiment as capital flows are flowing into safe haven currencies. Short-term and long-term Moving Averages are still bearish but 8-day Moving Average is about to converge with 21-day Moving Average, potentially diverting the short-term trend. RSI of 56.3 and Stochastic of 66.8 are both neutral. ADX is 14.5, giving no signal. DMI+ and DMI- are respectively 19.8 and 16.5 offering a weak signal quality.

Support: 103.76

Resistance: 104.27

XAUUSD

The pair has intraday fallen below 200-day Moving Average support near 1,838.00. The price has recovered since with short- and long-term bullish theme still in place. RSI of 43.9 is neutral while Stochastic of 50.2 is neutral but declining rapidly. ADX of 19.0 gives a weak signal value. DMI- of 32.3 dominates DMI+ of 20.2, indicating a bearish momentum.

Support: 1,838.00

Resistance: 1,860.00

Joe Biden is now confirmed to be the 46th President of the U.S. and Kamala Harris to be his Vice-President. The duo can expect to have a rather smooth sailing for the first two years, until the mid-terms, as Democrats are in control of both the Senate as well as the House. Joe Biden suggested that further stimulus will be pushed into the economy and the current US$ 900 billion is just a ‘down payment’. The aggregate stimulus may reach US$ 2 trillion which could be spent on infrastructure, green energy but also on COVID-19 related stimulus to individuals and businesses. The fiscal stimulus combined with monetary stimulus from the Federal Reserve Bank might give the U.S. economy an inflationary push from the demand side which could put even further downwards pressure on the Greenback. US dollar, measured by DXY, is currently trading near 90.0 which is the lowest since April 2018. The Fed has committed to continue the current stimulus of US$ 120 billion every month, in the form of purchasing treasury securities, as well as mortgage-backed securities. On the flipside, should the U.S. economy bounce back fast, the dollar might get a boost and recover to 91.2 – 92.3 levels. Rosenberg Research estimates that the U.S. might see 3.3% of economic growth in 2021 with the currently approved stimulus. Assuming that additional funds are poured into the economy, the growth rate might reach even 7% which is another historical high.

Amid the record high coronavirus hospitalizations, deaths and daily new cases, jobs recovery has come a halt in the U.S. Non-farm payroll data was negative for the first time since April – we saw 140,000 jobs cut in December, versus the consensus of 71,000 jobs added. This trend was also confirmed in ADP jobs data on Wednesday – 123,000 jobs were lost, versus the consensus of 75,000 jobs to be added. Leisure and hospitality had the largest cuts of negative 498,000 according to NFP data, while retail added 121,000 new jobs. WSJ reports that 2020 was the worst year in terms of job loss with 9.4 million American jobs cut, exceeding the previous record in 2009 when 5 million jobs were cut. Unemployment rate of 6.7% is unchanged from November. In terms of the number of unemployed people, we are back at 2015 levels, meaning that COVID-19 crisis erased 5 and a half years of job gains in the U.S. economy, according to Rosenberg Research. Assuming that December pace of recovery continues, it would take at least 4 years to reach the level of employment we saw in February 2020.

The markets have been in a risk-on mode with S&P500 and Nasdaq100 respectively gaining 1.83% and 1.68%. Russell2000 also posted strong gains of 5.9%. Gold was down 2.6%, while US dollar, measured as DXY, gained 19 bps. Oil broke some key resistance levels, gaining 9.2% and traded near US$ 52.0 – levels last seen in February 2020. A couple of other noteworthy moves were Bitcoin reaching all-time-high of 41,000, and UST 10-year yield broke to 1.11% – last seen in March 2020. Re-inflationary trade seems have taken off.

Impact

• China Consumer Price Index

Inflation measures the rise in consumer prices in an economy over a certain period of time. Higher inflation means that consumer

prices have grown compared to the previous period. Higher than expected rate may be both positive or negative for CNY as the

market does not like inflation expectations too far off from consensus. Generally, both high and negative inflation are bearish for currency, while positive and low inflation, in line with expectations, is bullish.

• Chinese GDP

GDP data shows the monetary value of all the goods and services produced in China. China is the only large economy that is expected to have a positive growth in 2020. A negative number indicates a contraction of economic activity while a positive number shows an expansion. A better than expected growth is generally positive for CNY, whilst a print below expectations tends to be negative.

Market Sentiment

EURUSD

EURUSD seems to have established a new trading range of 1.2121 to 1.2266. Stacked Moving Averages (8 > 21 > 34 > 50 > 100 > 200) support bullish trend short-term and long-term. The price has found support near 8-day Moving Average level of 1.2187. RSI of 65.9 and Slow Stochastic of 61.1 are both neutral but rising. DMI+ is currently near 20.4 while DMI- is 12.8, giving a weak signal about prevalent bullish trend. ADX is currently 28.9 signaling a moderate strength of the momentum.

Support: 1.21615

Resistance: 1.2241

GBPUSD

The pair has been steadily climbing higher but has broken 8-day Moving Average support, testing currently 21-day Moving Average support. Moving Averages are stacked, supporting bullish momentum (8 > 21 > 34 > 50 > 100 > 200) but 8-day MA is declining. RSI of 51.9 and Stochastic of 74.3 are both neutral. DMI+ and DMI- are both 19, while ADX of 11.7 gives no signal value.

Support: 1.34875

Resistance: 1.35640

USDJPY

USDJPY has shown mighty gains and recovered to 50-day Moving Average resistance levels. The price has benefitted from risk off sentiment as capital flows are flowing into safe haven currencies. Short-term and long-term Moving Averages are still bearish but 8-day Moving Average is about to converge with 21-day Moving Average, potentially diverting the short-term trend. RSI of 56.3 and Stochastic of 66.8 are both neutral. ADX is 14.5, giving no signal. DMI+ and DMI- are respectively 19.8 and 16.5 offering a weak signal quality.

Support: 103.76

Resistance: 104.27

XAUUSD

The pair has intraday fallen below 200-day Moving Average support near 1,838.00. The price has recovered since with short- and long-term bullish theme still in place. RSI of 43.9 is neutral while Stochastic of 50.2 is neutral but declining rapidly. ADX of 19.0 gives a weak signal value. DMI- of 32.3 dominates DMI+ of 20.2, indicating a bearish momentum.

Support: 1,838.00

Resistance: 1,860.00