Francis Aneke

Recruit

- Messages

- 10

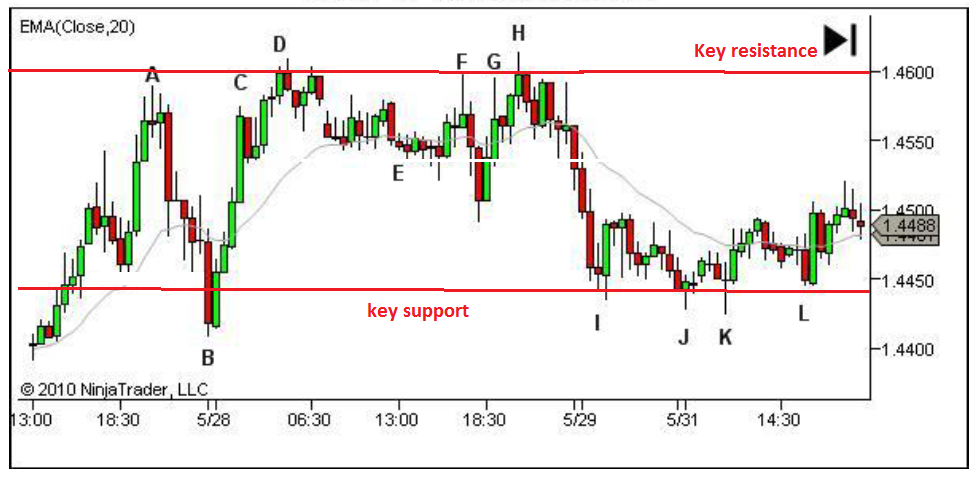

I really want to understand the market and what happens inside it using chart, because without understanding your chart you have not begun.....I have read some books that have given me insights but I feel like traders in this forum can equally be of good help...so I have these questions here (though it may look some how, but that's how serious I want to understand the market though charts, just like many gurus out there).

.>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

Letters on the charts are point of long entry and short.

Which point on the chart (Point A B C D E F G H I J K L) are suitable for smart traders to take long or short position.

{The remainder of the questions are down}

1. Which point would the longs exit to maximize profit (closer to their entry point?).

2. Which point would one take a long and be trapped in the market (and made loss)

3. Which points are best to take shorts hoping to cover at the next point of swing H/L?

4. Which points are best to take Longs hoping to cover at the next point of swing H/L?

5. Which Points can a short trader at point "I" break-even having made a wrong entry?

6. Which point can a losing long trader exit to regain profit; at what point is that long trader started losing initially.

7. Traders in a long position that didn’t take profit at point A, if opportunity calls again, which other point they can take profit (via a sell order)

8. A trader who took long or short at point A; how would he profit

9. A trader who took long or short at point C; how would he profit

10. Finally, what does it mean to cover a position (long or short)?

----------------------------------------------------------------------------------------

All questions should be backed up by explanations, please (It's not an order but I am begging with high respect...)

.>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

Letters on the charts are point of long entry and short.

Which point on the chart (Point A B C D E F G H I J K L) are suitable for smart traders to take long or short position.

{The remainder of the questions are down}

1. Which point would the longs exit to maximize profit (closer to their entry point?).

2. Which point would one take a long and be trapped in the market (and made loss)

3. Which points are best to take shorts hoping to cover at the next point of swing H/L?

4. Which points are best to take Longs hoping to cover at the next point of swing H/L?

5. Which Points can a short trader at point "I" break-even having made a wrong entry?

6. Which point can a losing long trader exit to regain profit; at what point is that long trader started losing initially.

7. Traders in a long position that didn’t take profit at point A, if opportunity calls again, which other point they can take profit (via a sell order)

8. A trader who took long or short at point A; how would he profit

9. A trader who took long or short at point C; how would he profit

10. Finally, what does it mean to cover a position (long or short)?

----------------------------------------------------------------------------------------

All questions should be backed up by explanations, please (It's not an order but I am begging with high respect...)