fxjennifer

Recruit

- Messages

- 2

FX110 website, as an influential and comprehensive forex portal website, is obliged to give all forex investors, especially Chinese ones, prudential and professional suggestions about what to do in the wave of CHF exposure.

Chinese Clients of FXCM are Reminded to Withdraw Funds Before Those from Other Countries do, to Avoid Being the Only Group of losers.

To ensure the safety of Chinese investors’ funds, We have invited a certified public accountant with favorable qualification to check the financial statements of FXCM. The accountant concluded that the assets of FXCM indicated on the financial statements are deficient to pay off the loan of $300 million with additional interests. And it is hard to understand the conduct of Leucadia to have financed $300 million to FXCM, based on the net profits and net assets as well as the growth curves of years of 2013 and 2014 of FXCM, and relevant trade experience.

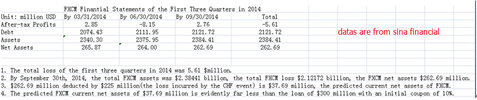

By September 30th , 2014, FXCM owned the net assets of about $263 million, with negative after-tax profits of $-5.61 million. After the CHF event, which led to a loss of $225 million, the current net assets is predicted to be about $38 million. Though the FXCM fourth quarterly financial statement of 2014 has not been found on the website of sina finance. it is predicted that FXCM operated with losses in the fourth quarter. Thus the net assets of FXCM after the CHF event was probably less than $20 million, more than which the minimum regulatory capital requirement for FXCM by NFA is. FXCM also announced that it may not meet the regulatory capital requirement after the CHF event.

The after-tax profits of 2013 for FXCM was only $34.84 million despite of a favorable operating status. In 2014, FXCM was at a loss as a whole. So we conclude that the FXCM net capital of less than $20 million is deficient to repay the loan of $300 million with an initial coupon of 10%.

Detailed information about the financial statements of FXCM can be found on the website of sina financial.See picture below.

As one of the most authoritative and neutral forex portal website in China, fx110.com thinks that it has the duty to tell people how to deal with financial crisis. According to FXCM's $225 million losses, we have studied $300 million financing channels of Leucadia to FXCM, maybe which is just an empty talk.

First, FXCM lost $225 million, whose stocks price fall down 85.59%, and market capitalization just keep to $74.5 million. However, FXCM admitted in the announcements that it cannot meet the capital requirements of the regulatory agencies, which can be inferred that FXCM cannot meet NFA’s $20 million minimum requirement. Thus you can image FXCM current capital strength.

Second, why does Leucadia is willing to loan $300 million to FXCM on the conditions that FXCM only has $7.45 million market value. Is it a charity? Any banks and investment institutions require the borrowers having the ability to repay the loan.

Third, According to the loan terms between FXCM and Leucadia, FXCM and its subsidiaries guaranteed that Leucadia can obtain certain percentage of its sale proceeds and, in the event FXCM makes other distributions on account of its equity, a corresponding payment for its own account. if so, FXCM's future trading environment will be worse and worse. If FXCM is in debt and still need to pay the loan, can it not infringe on the interests of investors?

Forth, FXCM is only a retail forex exchange dealer, whose trading volume can be said to be tiny, compared with big investment Banks. However, the world biggest banks like Citigroup and Deutsche bank only lost $100 million. Moreover, I think it is impossible that the trading loss from the clients of FXCM reached $225 million under the condition of EUR/CHF not being popular currency pair. So we speculated that FXCM made use of client funds to bet with other banks.

Most of Chinese Clients are trade with FXCM UK not FXCM American. According to FCA regulation rules, the swiss franc movements should not have affected client’s money because of segregated account. But it is the fact that clients money was suffered a loss. Maybe FXCM embezzled client capital, which hasn’t been confirmed so far by FXCM.

FXCM comes to a global crisis owing to clients from all over the world. Timely $300 million loans to FXCM is a good chance to remit the capital pressure. As a result, all the clients will split the loans.

As Chinese clients are not good at English, and foreign exchange trading are not allowed in China, which mean Chinese clients will not be protected by law. It is no doubt that Chinese clients will suffer a loss if clients from other countries withdraw firstly.Moreover,it takes time,money and high lawer expenses to take the case to court. Most of them will quit since all these expenses may exceed his capital in FXCM.

There is no 100% safe company in the world, We can still remember Refco event in 2005.Refco’s market value was $3.6 billion, but it went bankruptcy overnight. Many Chinese clients only to accept it but can do nothing. Newbies haven't realized the serious situation so far.

It is also our best wish that FXCM could get through this crisis. Given that protecting the interests of Chinese investors,FX110 website suggest withdraw should come first.