Vlad RF

RoboForex Representative

- Messages

- 487

Providec Trading System: Simple Strategy for Beginners

Author: Timofey Zuev

Dear Traders,

The Providec trading strategy is one of the simplest Forex strategies that I have ever seen: just two indicators than never close the price chart. The trading strategy suits any currency pair or any other instrument featured by the MetaTrader 4 or MetaTrader 5 terminal, be it futures, stocks, of CFDs. The timeframe may vary from M1 to MN.

If the timeframe is shorter than H1, open orders in the European or American sessions only. As soon as the American session is over, close all trades regardless of their results. Conversely, if you trade on H1 or higher, you may leave trades in the market for as long as you wish.

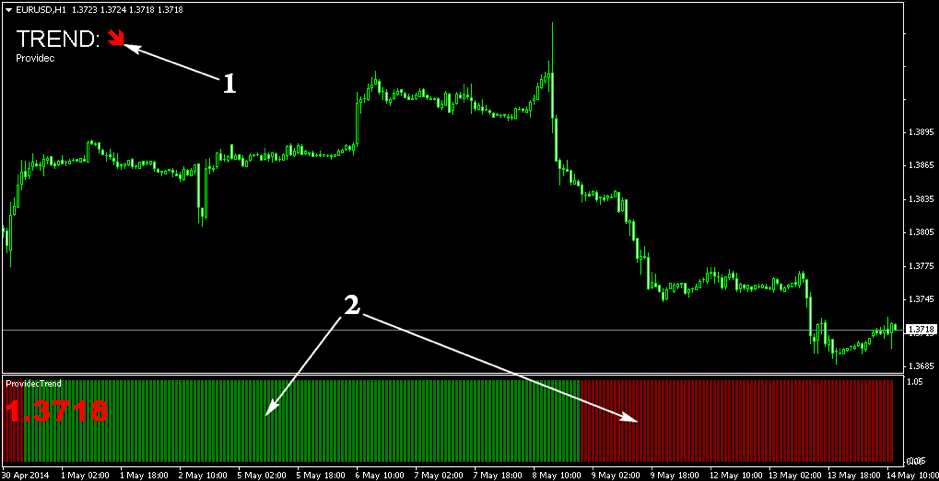

The Providec strategy desktop

Providec strategy

Description of the desktop:

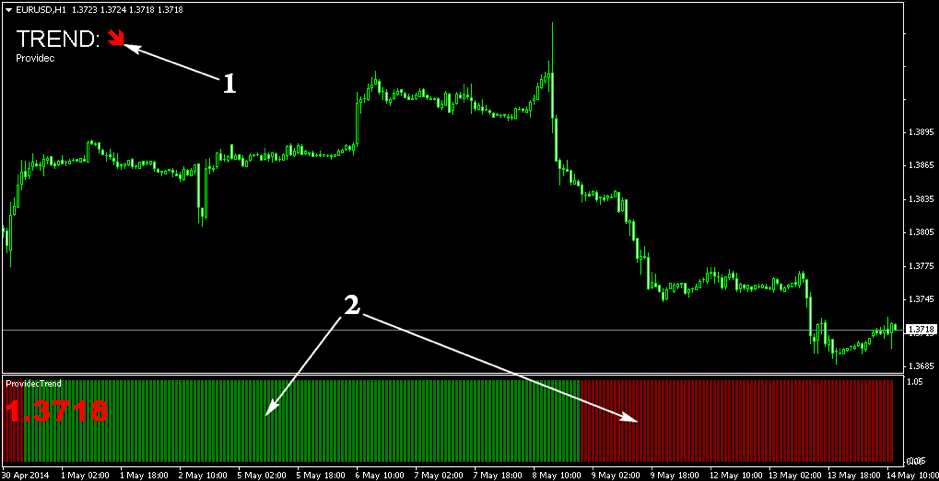

A signal to buy by the Providec system

A signal to buy needs several conditions to be met:

An example of a signal to buy by the Providec system

Read more at R Blog - RoboForex

Sincerely,

RoboForex team

Author: Timofey Zuev

Dear Traders,

The Providec trading strategy is one of the simplest Forex strategies that I have ever seen: just two indicators than never close the price chart. The trading strategy suits any currency pair or any other instrument featured by the MetaTrader 4 or MetaTrader 5 terminal, be it futures, stocks, of CFDs. The timeframe may vary from M1 to MN.

If the timeframe is shorter than H1, open orders in the European or American sessions only. As soon as the American session is over, close all trades regardless of their results. Conversely, if you trade on H1 or higher, you may leave trades in the market for as long as you wish.

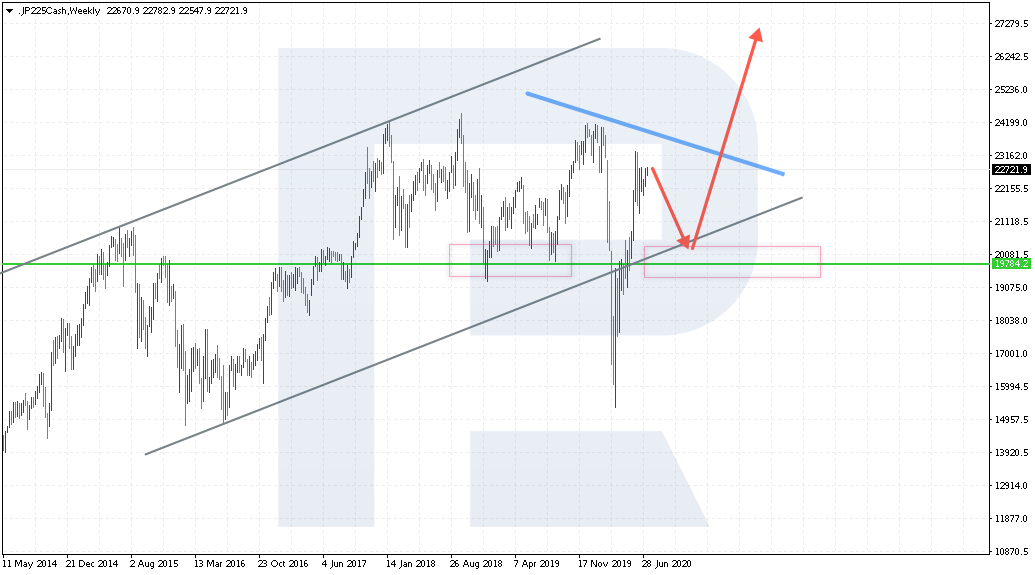

The Providec strategy desktop

Providec strategy

Description of the desktop:

- The Providec indicator that gives direct signals to buy or to sell by the strategy.

- The ProvidecTrend indicator that filters the signals of Providec.

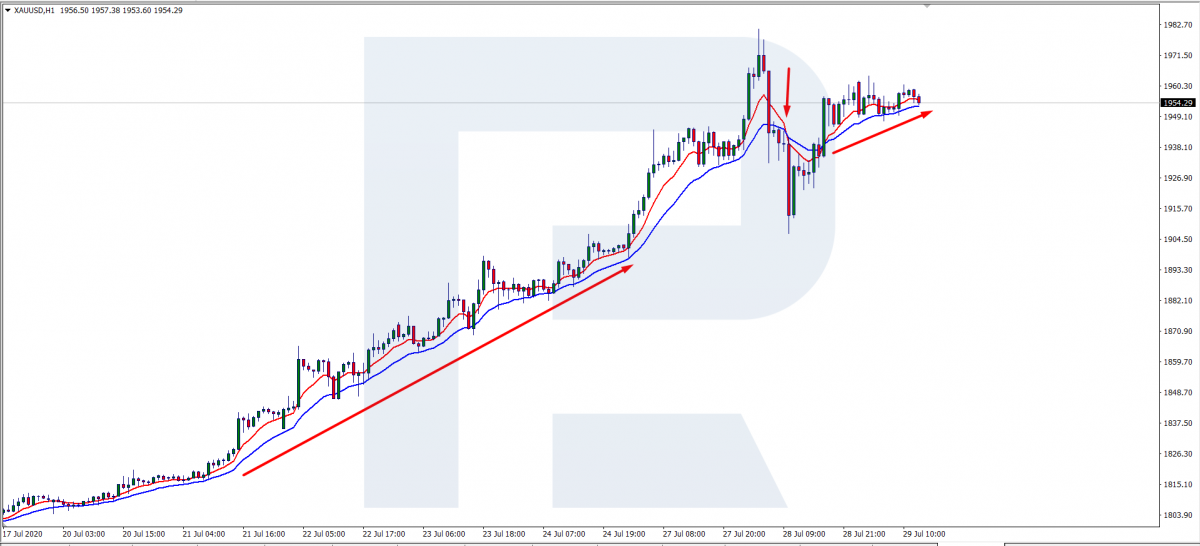

A signal to buy by the Providec system

A signal to buy needs several conditions to be met:

- The Providec indicator must show a green arrow aimed upwards.

- The ProvidecTrend indicator must be green.

- The green arrow of Providec must be the first green line to emerge after ProvidecTrend changed from red to green.

An example of a signal to buy by the Providec system

Read more at R Blog - RoboForex

Sincerely,

RoboForex team