Vlad RF

RoboForex Representative

- Messages

- 487

How to Trade EUR/GBP?

Author: Igor Sayadov

Dear Clients and Partners,

There are eight currencies in the world, recommended by the International Monetary Fund (IMF) for storing gold reserves. They would be:

1. USD – US dollar

2. EUR – euro

3. GBP – Great Britain pound

4. AUD – Australian dollar

5. NZD – New Zealand dollar

6. CAD – Canadian dollar

7. CHF – Swiss franc

8. JPY – Japanese yen.

The pairs constituted by 7 main currencies against the US dollar are called majors: EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/CAD, USD/JPY, USD/CHF.

All other pairs traded in Forex that do not include the USD are called cross-rates.

Majors make up for 70% of all daily turnover in Forex; cross-rates make up for the remaining 30%. While among majors, the most widely used is EUR/USD, among cross-rates, EUR/GBP is the most popular one.

This article is devoted to this currency pair, its history and peculiarities, and trading strategies that suit it.

Short history of EUR/GBP

The EUR/GBP pair appeared right after the European Union was formed because it was necessary to establish trade relations between the two largest economies in Europe. Britain entered the EU in 1998, keeping its own currency and credit and monetary policy.

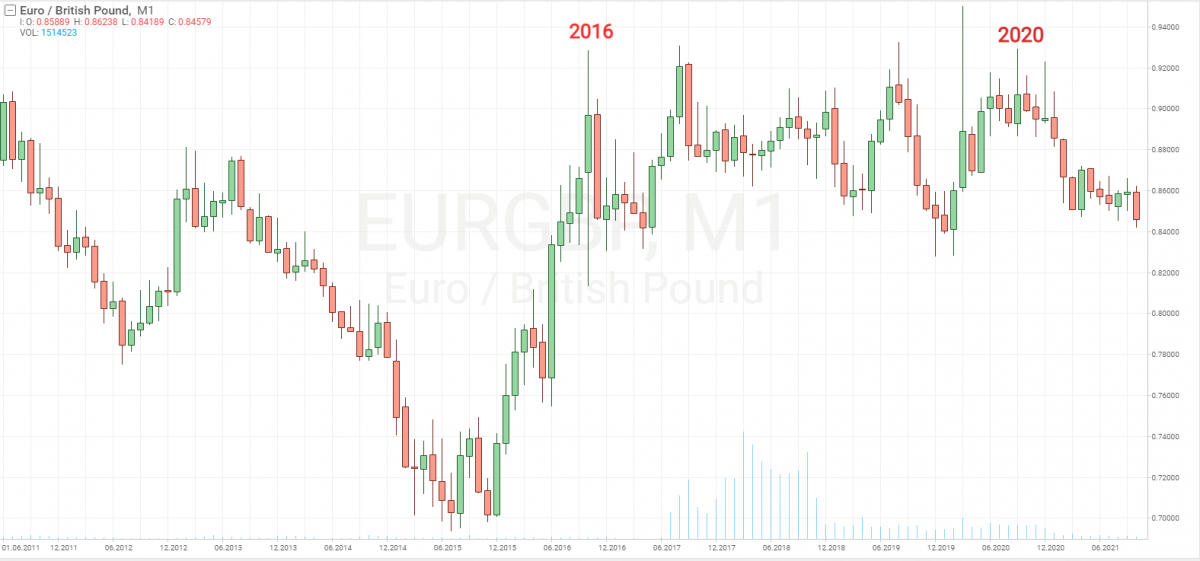

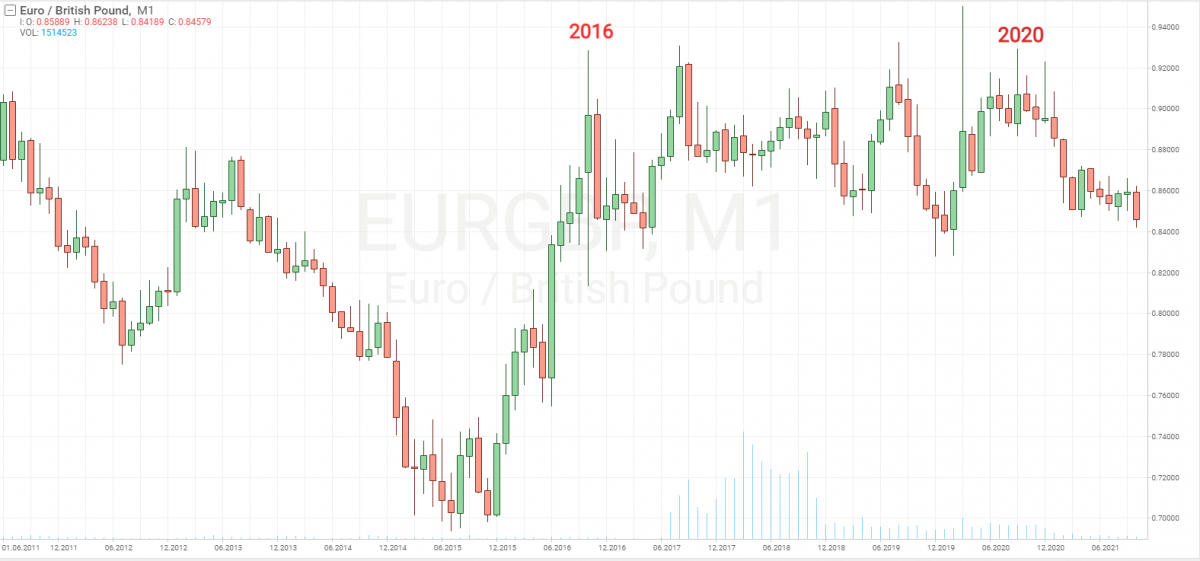

In 2016, the country decided to exit the EU. Brexit, which used to be the main source of talks before the coronavirus, came into force in 2020. Naturally, such dramatic changes affected the cross-rate of EUR/GBP.

On MN, we can see an uptrend coming to an end in 2016 and a consolidation range form at this high until 2020. After Britain signed an agreement about its final exit from the EU, the quotations started a new wave of decline.

What influences EUR/GBP quotations

EUR/GBP is neutral to the US economy and performs no stunts characteristic of other pairs when some important news in the USA emerge.

This pair mostly reacts to inflation data in the EU and Britain. Also, check the pair when the ECB and Bank of England change interest rates.

As a rule, cross-rates react to such events by long-term trends. So, before such news emerge, single out a consolidation area and wait for exiting these areas by the trend.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team

Author: Igor Sayadov

Dear Clients and Partners,

There are eight currencies in the world, recommended by the International Monetary Fund (IMF) for storing gold reserves. They would be:

1. USD – US dollar

2. EUR – euro

3. GBP – Great Britain pound

4. AUD – Australian dollar

5. NZD – New Zealand dollar

6. CAD – Canadian dollar

7. CHF – Swiss franc

8. JPY – Japanese yen.

The pairs constituted by 7 main currencies against the US dollar are called majors: EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/CAD, USD/JPY, USD/CHF.

All other pairs traded in Forex that do not include the USD are called cross-rates.

Majors make up for 70% of all daily turnover in Forex; cross-rates make up for the remaining 30%. While among majors, the most widely used is EUR/USD, among cross-rates, EUR/GBP is the most popular one.

This article is devoted to this currency pair, its history and peculiarities, and trading strategies that suit it.

Short history of EUR/GBP

The EUR/GBP pair appeared right after the European Union was formed because it was necessary to establish trade relations between the two largest economies in Europe. Britain entered the EU in 1998, keeping its own currency and credit and monetary policy.

In 2016, the country decided to exit the EU. Brexit, which used to be the main source of talks before the coronavirus, came into force in 2020. Naturally, such dramatic changes affected the cross-rate of EUR/GBP.

On MN, we can see an uptrend coming to an end in 2016 and a consolidation range form at this high until 2020. After Britain signed an agreement about its final exit from the EU, the quotations started a new wave of decline.

What influences EUR/GBP quotations

EUR/GBP is neutral to the US economy and performs no stunts characteristic of other pairs when some important news in the USA emerge.

This pair mostly reacts to inflation data in the EU and Britain. Also, check the pair when the ECB and Bank of England change interest rates.

As a rule, cross-rates react to such events by long-term trends. So, before such news emerge, single out a consolidation area and wait for exiting these areas by the trend.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team