Vlad RF

RoboForex Representative

- Messages

- 487

Top-7 Trading Strategies on Forex in 2020

Author: Andrey Goilov

Dear Traders,

In RoboForex blog, we have discussed a whole range of forex strategies — from the simplest to the most intricate ones, from those suitable for beginners to those meant for experts, those with and without indicators. Today, I will try to enumerate top-7 trading strategies of 2020, which will be especially useful for you if you have not tried some of them yet.

Always keep in mind that however beautiful a strategy may seem, never rush at using it on real money. Start with a demo account where you can painlessly master the strategy, detecting its strong and weak sides. Only after you reach good results try trading on a real account.

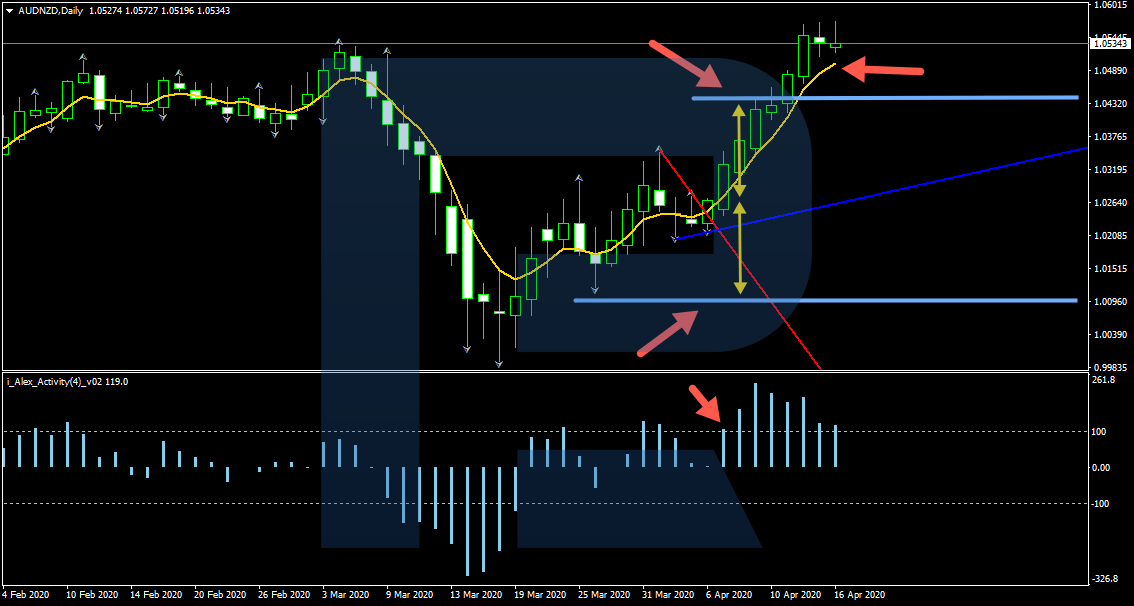

1. The Fishing trading strategy

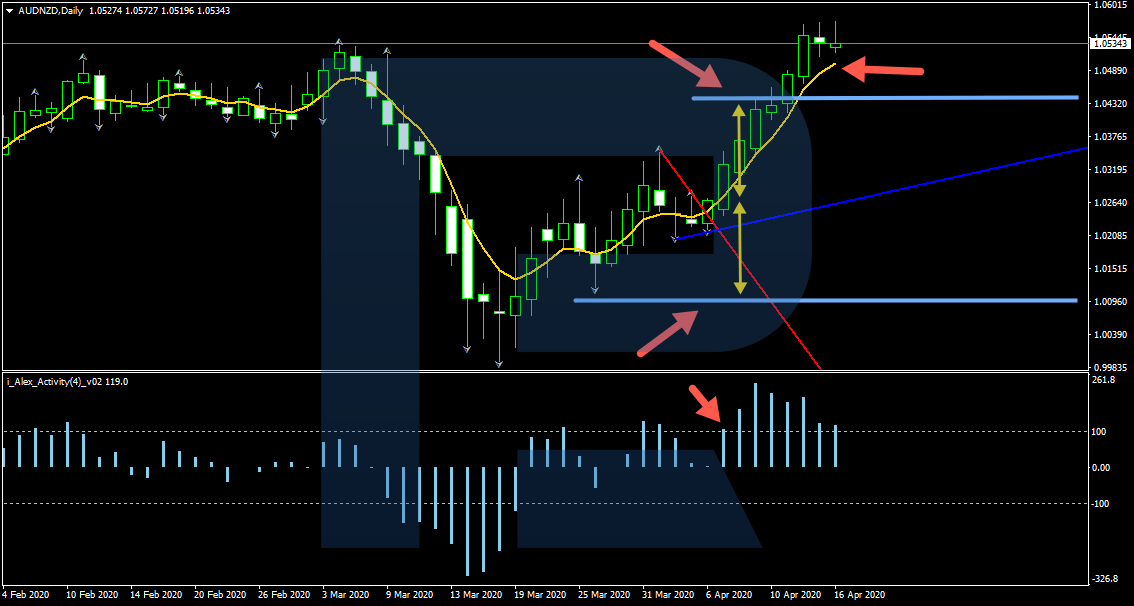

The Fishing strategy is meant for D1, however, you may try it on timeframes no smaller than H1. The trading strategy uses special indicators that you may download from the detailed description of Fishing.

The Fishing trading strategy

The trading strategy gives two main signals for opening a position: a breakaway of the trendline drawn by the indicators and breakaways of the special sales and buy levels. In short, the whole work of Fishing is based on the indicators built in the strategy.

An obvious advantage f the method is trading on D1: you do not need to spend all of your time at the trading terminal; another advantage is that you trade the trend. The drawbacks are the lack of back-testing because the indicator draws the lines for the current moment only.

2. Woodies CCI trading strategy

The Woodies CCI trading strategy is based on an indicator with the same name — Woodies CCI. It will suit those who prefer analyzing the price chart themselves. The author offers various ways of trading by the indicator: using breakaways of trendlines, graphic levels, bounces off the zero line.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team

Author: Andrey Goilov

Dear Traders,

In RoboForex blog, we have discussed a whole range of forex strategies — from the simplest to the most intricate ones, from those suitable for beginners to those meant for experts, those with and without indicators. Today, I will try to enumerate top-7 trading strategies of 2020, which will be especially useful for you if you have not tried some of them yet.

Always keep in mind that however beautiful a strategy may seem, never rush at using it on real money. Start with a demo account where you can painlessly master the strategy, detecting its strong and weak sides. Only after you reach good results try trading on a real account.

1. The Fishing trading strategy

The Fishing strategy is meant for D1, however, you may try it on timeframes no smaller than H1. The trading strategy uses special indicators that you may download from the detailed description of Fishing.

The Fishing trading strategy

The trading strategy gives two main signals for opening a position: a breakaway of the trendline drawn by the indicators and breakaways of the special sales and buy levels. In short, the whole work of Fishing is based on the indicators built in the strategy.

An obvious advantage f the method is trading on D1: you do not need to spend all of your time at the trading terminal; another advantage is that you trade the trend. The drawbacks are the lack of back-testing because the indicator draws the lines for the current moment only.

2. Woodies CCI trading strategy

The Woodies CCI trading strategy is based on an indicator with the same name — Woodies CCI. It will suit those who prefer analyzing the price chart themselves. The author offers various ways of trading by the indicator: using breakaways of trendlines, graphic levels, bounces off the zero line.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team