How to invest 10,000 USD?

Author: Andrey Goilov

Dear Clients and Partners,

A not long time ago, we discussed the possibilities of investing $1,000. And if it was a rather small amount, then $10,000 is looking much more fascinating for investments.

To find the correct answer to this question, we should take several things into account. First of all, goals and periods of investments. If the period is rather short, then one may risk and consider aggressive methods of investing. If you need to use the money, which you want to invest, in a couple of weeks or months, then you can choose an option of investing it in stocks that may bring profit in years, that’s why investment horizons are a very important parameter.

Another factor is your attitude to risks, which can be assessed by answering some questions, for example, how much will your life change if you lose this money? If your appetite for risks is okay, then you can try the currency market and trade with the leverage according to a chosen strategy.

Emotions have a very significant influence on investments: a lot of beginner investors tend to close positions when the market starts falling, at the time of a slight drawdown, which may sometimes be considered as a good time for buying. If emotions can’t deal with such drawdowns, it might be better to switch to conservative ways of investing.

What is the best way to invest $10,000?

The modern world offers plenty of ways to invest your money and some of them don’t even require you to leave home. However, you should remember that many of the offered investment methods are of speculative nature, while more aggressive ways imply significant risks. Moreover, unfortunately, but the previous results shouldn’t be considered as a prediction of receiving profit in the future because financial markets are quickly changing, as well as global affairs and events. Let’s discuss the most popular investment methods.

Stock market

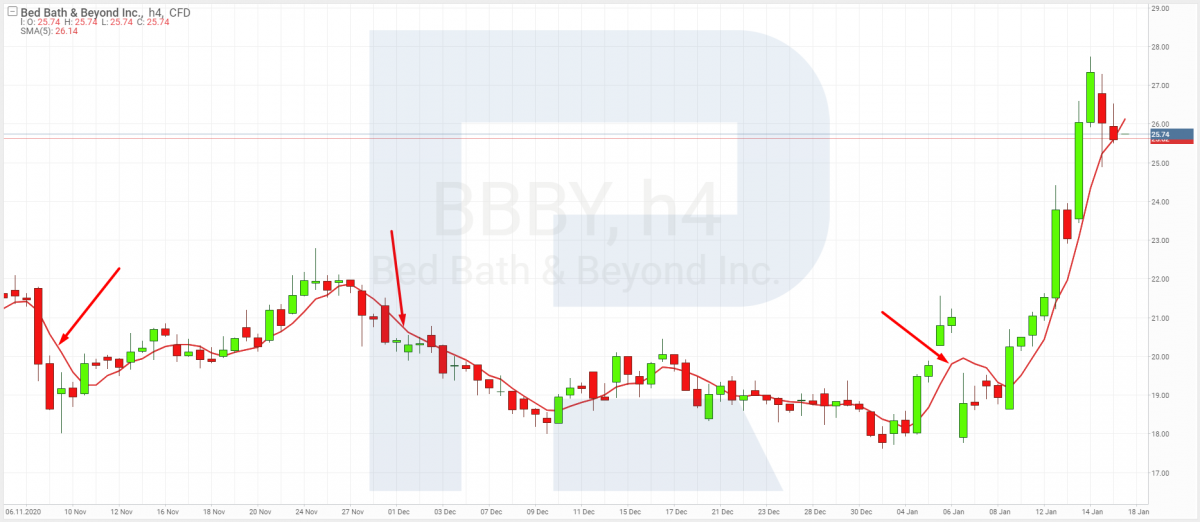

There is an opinion that if there is $10,000, one can trade on the stock market with comfort. Still, this trading implies not only buying stocks: an investor must follow the news and behavior of stocks. The most part on investors seeks to buy during the market meltdown because later it will recover and the price will go up. However, the anticipation of a rebound may take much time.

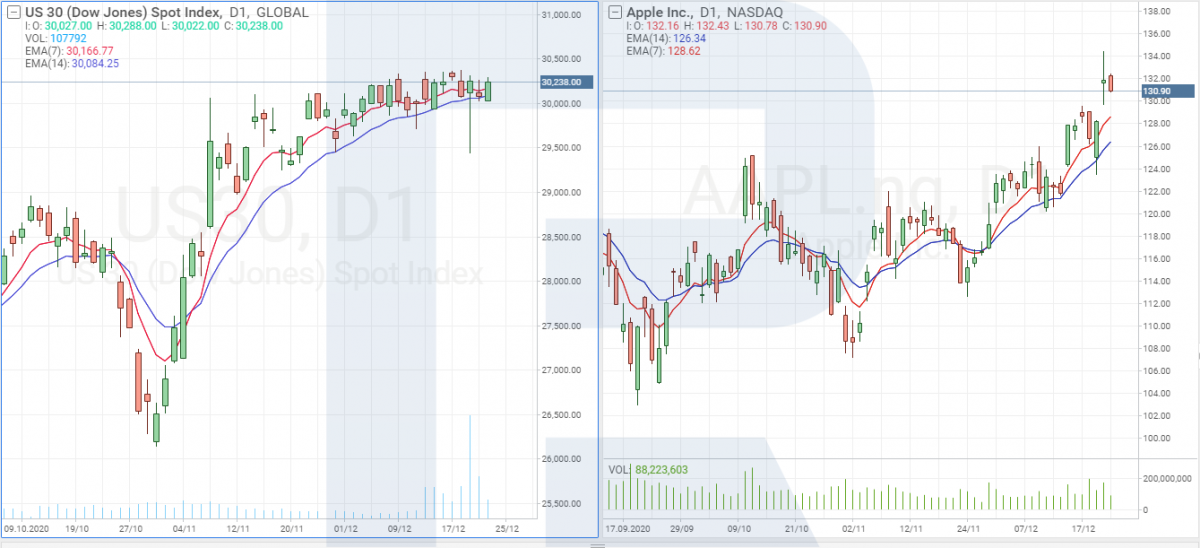

For example, Warren Buffett dissuades from choosing any particular stocks but offers to invest money in some unexpensive companies. If you take a closer look at Buffett’s portfolio, you will find shares of such companies as Apple, Bank of America, Coca-Cola, American Express, JP Morgan Chase, Moody’s, Goldman Sachs.

These companies’ shares plunged early in the year but they are growing again and, probably, may reach their peaks in the nearest future. Such market movements confirm that the best possible moment for buying stocks might be the time when they fall to lower prices because such investments are not considered to be short-term.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team