How to Trade without Leverage

Author:Victor Gryazin

Dear Clients and Partners,

In this overview, I will speak about trading without leverage so that you could decide whether this type of trading suits you.

What is leverage?

Trading with leverage means that you open a position for a lager sum than you have on your deposit via marginal crediting. In essence, leverage is the ratio of your capital and borrowed money. In financial markets, leverage is provided by your broker; normally it starts from 1:10.

Using leverage, traders with small deposits can open rather large positions in financial markets. For example, owning a deposit of 1,000 USD, a trader can use leverage of 1:100 (provided by their broker) and open positions for 100,000 USD total (1,000 USD * 100).

On the one hand, trading with leverage lets the trader increase their potential profit; n the other hand, it also increases possible risks. Conversely, trading without leverage means lower risks but requires a larger deposit.

Trading in Forex without leverage

As a rule, trading in Forex means quite high leverage (starting 1:100). This is explained by currency pairs being instruments with low volatility, and traders compensate for this by increased trade volumes. However, using leverage is not obligatory; you can make a profit without it. This will require more investments, though.

Naturally, potential profitability will be lower when you trade without leverage than with it. If a currency has grown by 1%, and the trader bought it for the whole deposit with leverage of 1:100, their profit will be 100%, while without leverage, it would be just 1%. However, the use of leverage means maximum risk: if you get mistaken with your forecasts, you can lose the whole of your deposit in one trade.

Imagine a trader who has a deposit of 100 EUR and opens a maximally possible trader with leverage of 1:100, buying 0.1 lot of EUR/USD. If their forecast turns out to be wrong, and the price goes against their position, an average daily movement of 100 points in this pair (1 point = 1 euro) will destroy the whole of their deposit; they will have nothing to trade anymore.

To open the same position of 0.1 lot in EUR/USD without leverage, one needs to have 10,000 EUR. However, the same opposite movement of 100 points against the position will only mean a loss of 1% of the deposit (100 EUR). The trader will have 9,900 EUR left to trade, while in the first case, they will be left with nothing. If you trade without leverage, you risk losing your whole deposit only if your currency nears zero.

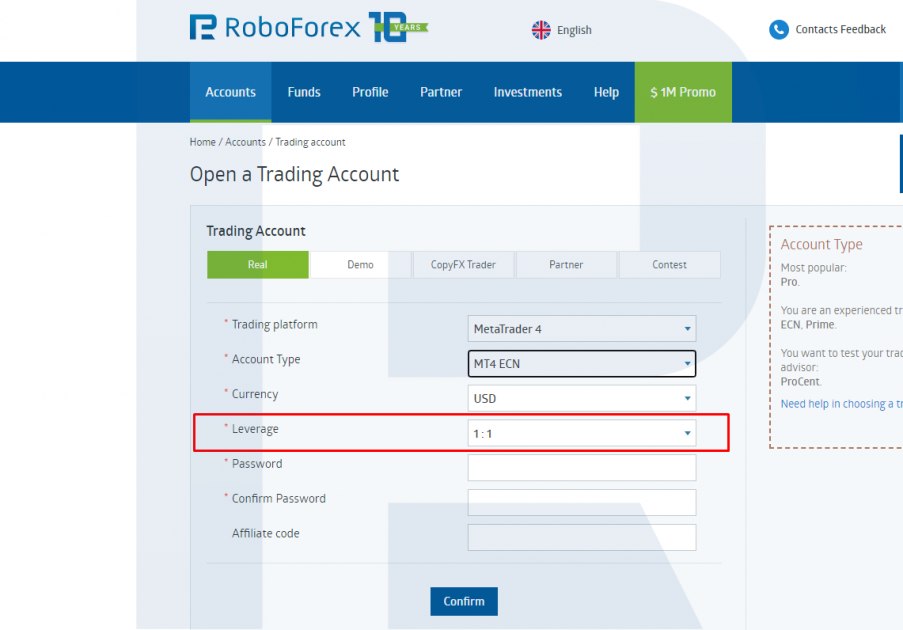

To trade in Forex without leverage, you need a reliable broker that provides leverage of 1:1. Choose your broker with all your diligence because your deposit will have to be substantial (starting 10,000 USD). Opening a trading account, alongside other parameters (trading terminal, type of account, currency), choose leverage of 1:1.

Advantages and drawbacks of no-leverage trading

The pluses and minuses of trading without leverage are as follows:

Advantages:

- Smaller trading risks – the size of the deposit lets you trade with a good safety margin and withstand drawdowns waiting for your asset (stocks) to grow.

- Psychological comfort – trading with a good safety margin, you take most price movements calmly and pay less attention to trading.

- Less expenses as you pay no fees for overnight transferring of your positions.

Drawbacks:

- A large deposit – no less than 10,000 USD is recommended.

- Moderate profitability – significantly smaller than when trading with leverage.

Closing thoughts

It is up to each trader to decide whether to use leverage in trading or not. If you have enough money and prefer long-term trading with moderate risks, you will be comfortable trading without leverage. Choose your broker wisely and open a trading account with leverage of 1:1.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team