Vlad RF

RoboForex Representative

- Messages

- 487

What Is Russell 2000 and How Does It Differ from S&P 500?

Author: Victor Gryazin

Dear Clients and Partners,

This overview is devoted to a popular stock index Russell 2000: its contents, its differences from the S&P 500, and ways of trading it.

What is Russell 2000?

The Russell 2000 index (US Small Cap 2000) is one of the leading global indices based on the stock prices of 2,000 companies with small capitalization traded in the USA. The index was created in 1984 by the Frank Russell Company, a part of the London Stock Exchange. Russell 2000 is called a wide market index among small companies as it represents stock price dynamics of tier 2 and 3 companies.

The Russell family consists of several indices, the most famous of them being:

Leading companies of Russell 2000 include startups in the spheres of healthcare, food, and consumer goods. Russell 2000 is calculated based on capitalization-weighed stock price of all the companies in it. The index gets revised every year, some companies being removed from and some added to it.

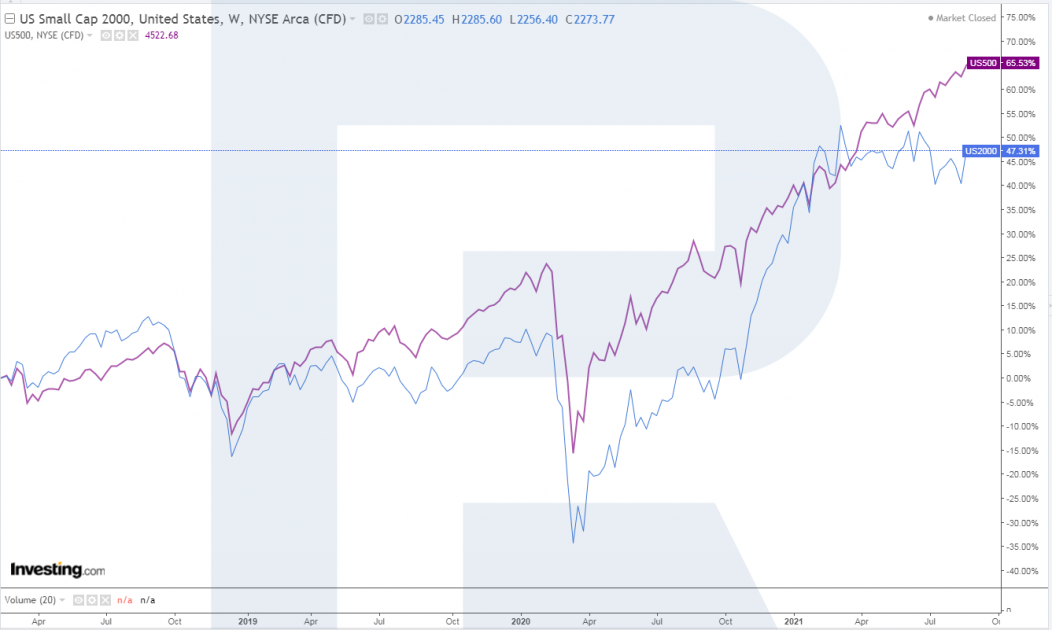

How does Russell 2000 differ from S&P 500?

How to trade Russell 2000

First of all, Russell 2000 is a most popular investment instrument but it can be used for short-term trading as well. Thanks to a wide range of instruments (ETFs, futures, options, CFDs) for trading Russell 2000, different strategies may be used.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team

Author: Victor Gryazin

Dear Clients and Partners,

This overview is devoted to a popular stock index Russell 2000: its contents, its differences from the S&P 500, and ways of trading it.

What is Russell 2000?

The Russell 2000 index (US Small Cap 2000) is one of the leading global indices based on the stock prices of 2,000 companies with small capitalization traded in the USA. The index was created in 1984 by the Frank Russell Company, a part of the London Stock Exchange. Russell 2000 is called a wide market index among small companies as it represents stock price dynamics of tier 2 and 3 companies.

The Russell family consists of several indices, the most famous of them being:

- Russell 3000 is an index based on the stock prices of 3,000 largest public companies registered in the USA. Their overall capitalization makes up for 97% of the American stock market.

- Russell 2000 is an index consisting of 2,000 smallest companies of the Russell 3000 index.

- Russell 1000 is an index that tracks 1,000 stocks with the highest rating from Russell 3000.

Leading companies of Russell 2000 include startups in the spheres of healthcare, food, and consumer goods. Russell 2000 is calculated based on capitalization-weighed stock price of all the companies in it. The index gets revised every year, some companies being removed from and some added to it.

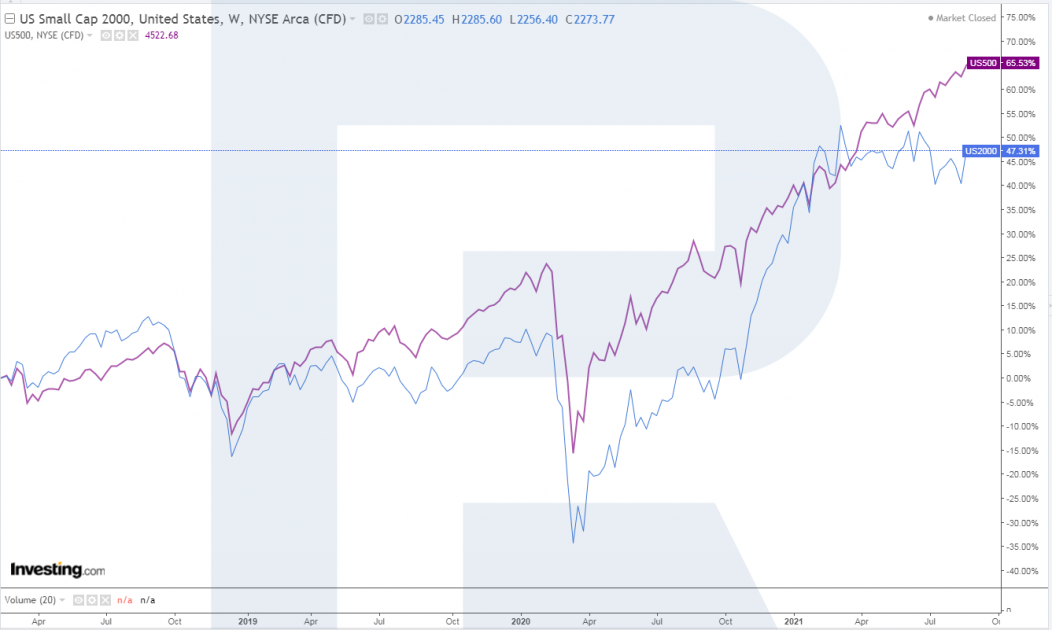

How does Russell 2000 differ from S&P 500?

- The number of companies: S&P 500 uses the shares of 500 largest companies, and Russell 2000 – the shares of 2000 smaller ones.

- Capitalization of companies: S&P 500 tracks the leading companies; it is meant for investors who hold the shares of large enterprises. Russell 2000 demonstrates the state of affairs in small companies; it is meant for investors who hold small but promising shares in their portfolios.

- Volatility: depending on the current market conditions, the volatility of S&P 500 and Russell 2000 may differ. At certain times, one index demonstrates better volatility, while the other comes to the scene as soon as the situation changes.

- These two indices have both differences and common features. S&P 500 is a wide market index that includes companies with the highest capitalization, while Russell 2000 is a wide market index with a low capitalization. The main differences are as follows:

How to trade Russell 2000

First of all, Russell 2000 is a most popular investment instrument but it can be used for short-term trading as well. Thanks to a wide range of instruments (ETFs, futures, options, CFDs) for trading Russell 2000, different strategies may be used.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team