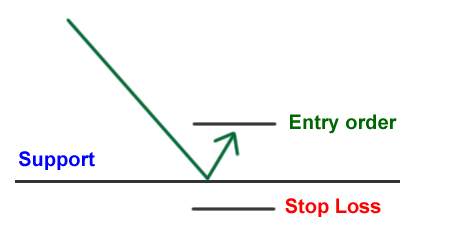

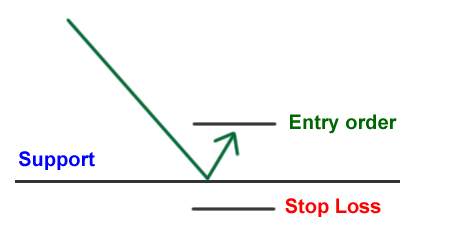

Hello traders. I was reading about reasonably simple price action trading strategy and I was wondering if there are traders out here who are using it successfully. The strategy is as simple as placing sell/buy stop orders when anticipating a level rejection; as shown in the picture:

How powerful is the strategy, how wide are your stops, what you look at when drawing S/R, what time frames do you prefer to use with this strategy, what are your entry criteria and what other opinions are you able to share to contribute to the discussion?

How powerful is the strategy, how wide are your stops, what you look at when drawing S/R, what time frames do you prefer to use with this strategy, what are your entry criteria and what other opinions are you able to share to contribute to the discussion?