Andrew Marshall

Recruit

- Messages

- 4

Damocles, since you still have that conversation on FB, why not scroll down a little further to where you suggest to raise the Max DD to 40%? Or even more, when I contact you about losses and you give the confirmation that everything is fine and to continue trading? The drawdown showing on that statement is inaccurate, not sure why the inaccuracy, but the real DD is 19.7%.

You are also a citizen of China and have no status in the U.S., correct? We spoke of the issues that I was having trying to find the best method for opening an account for management by a U.S. Citizen, but funded by a citizen of China. We even had to switch brokers (from ATCbrokers to forex.com) because of this.

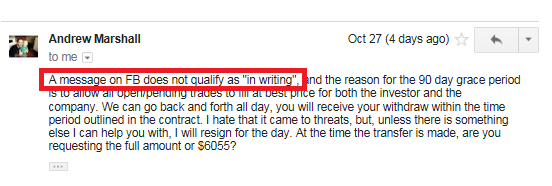

I may have unintentionally violated the terms of service with FOREX.com (gain capital Corp), but there were no violations pertaining to U.S. Regulations with the NFA or CFTC. You were not scammed by any stretch of the imagination, sir. You would have received your funds back as soon as the open trades were closed within the time limit granted in the LPOA. No new trades were opened using your funds once the written confirmation was received.

I also think you're having a hard time understanding how increasing exposure at random can cause a swing in performance. Trading my with my normal exposure on my strategy shows a different return than increasing risk at random because 20 and 40% are 2X and 4X my normal exposure (same TP, SL, just larger lot sizes) which means if the increase took place just prior to a losing trade, that losing trade is going to be greater (proportionally) than the previous wins. In theory, however, if trading continues to play out at the same exposure, then the reward would have increased as well. I will take the blame for that, because I've been trading with the same exposure and risk for years, and should have known better than to succumb to the wishes for an increase.

You are also a citizen of China and have no status in the U.S., correct? We spoke of the issues that I was having trying to find the best method for opening an account for management by a U.S. Citizen, but funded by a citizen of China. We even had to switch brokers (from ATCbrokers to forex.com) because of this.

I may have unintentionally violated the terms of service with FOREX.com (gain capital Corp), but there were no violations pertaining to U.S. Regulations with the NFA or CFTC. You were not scammed by any stretch of the imagination, sir. You would have received your funds back as soon as the open trades were closed within the time limit granted in the LPOA. No new trades were opened using your funds once the written confirmation was received.

I also think you're having a hard time understanding how increasing exposure at random can cause a swing in performance. Trading my with my normal exposure on my strategy shows a different return than increasing risk at random because 20 and 40% are 2X and 4X my normal exposure (same TP, SL, just larger lot sizes) which means if the increase took place just prior to a losing trade, that losing trade is going to be greater (proportionally) than the previous wins. In theory, however, if trading continues to play out at the same exposure, then the reward would have increased as well. I will take the blame for that, because I've been trading with the same exposure and risk for years, and should have known better than to succumb to the wishes for an increase.