@Mark Miller (FortFS), great! Thank you for your reply. At last we are getting somewhere but I feel you are still deflecting.

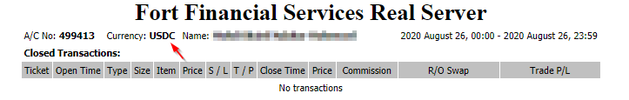

@ariel6984 please can you clarify the value of this account. The statement you posted indicates USD but apparently is USC

Mark, would you dispute the fact that the very last page of his statement is exactly as printed from your own MT4 platform? Put aside the false indignation for a while and focus on correcting such incorrect information as you find it. It helps to have correct facts at hand and you have a role to play in that. I understand we are talking about $1700 but lets, for the sake of this discussion, pretend that it is $10, as the amount is irrelevant, it is about the principle.

I sense your frustration but it is important that you keep working with us here. I am generally quite sympathetic towards brokers, so please help me to understand why you consider these actions as reasonable. I don't even have a horse in the race, I am simply Joe Public.

Following a logical approach to this issue, I still do not see how the punishment fits the crime. The KYC requirements that are imposed on you by payment processors are about the systems that you have in place, not about the individual client. You are going to have transgressors and you need to have a system in place to identify and deal with them. I doubt your payment processors require valid trades to be voided. If they do, perhaps you can tell us what happened with the OP's friend that has also breached your T&C.......I understand his account traded at a loss. Have you voided those trades and offered him his deposit back? But he didn't request a withdrawal, so you don't know he violated your T&C. Are you ever going to inform him of his violation? Will you be accepting further deposits from him.....is that not inviting penalties from your payment processors?

You see what I am getting at......your system of only checking at withdrawal is opportunistic. It places your clients in the position where they may trade for a period of time - all in violation of your T&C - and you can then choose to confiscate profits from the profitable traders whilst scoring against the losing traders.

You have also not addressed the $500 withdrawal limit.