GBPUSD

Correcting, but Growth may Resume

Current trend

The GBP/USD pair is confidently recovering its positions, adjusting to the mid-term downward trend. During the week, the price tested the 1.355 level, but could not break through it, as the US currency received support after the release of positive employment data and the publication of the minutes of the last meeting of the US Fed. According to the document, the regulator can start raising the interest rate much faster than previously planned, since the national labor market is close to full employment, and the inflation growth is protracted (the December employment indicator from ADP increased from 505K to 807K).

Nevertheless, the downward correction in the asset may be temporary, since the pound quotes are supported by the decision of the British authorities to abandon strict quarantine measures against the background of another wave of coronavirus in the country. During the week, British Prime Minister Boris Johnson once again stated that the current restrictions are sufficient to overcome the consequences of the pandemic, however, it already has a short-term negative effect on the economy. Thus, according to Springboard analysts, the number of customers in British stores decreased by 18.6% in December, as citizens minimized contacts, fearing to become infected with the new Omicron strain, and many of them were forced to work from home. As a result, sales volume, which usually grows before the New Year holidays, may decrease significantly, which, in turn, will slow down the recovery of the national economy. It also should be noted that in December, the index of business activity in the UK services sector decreased from 58.5 to 53.6, which was less than 53.2 expected by the market.

Support and resistance

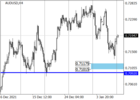

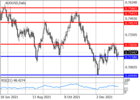

The key level for the “bulls” remains of 1.355, Fibo retracement 38.2%. Fixing above it will give the prospect of growth to 1.3672,(Fibo retracement 50.0%) and 1.3794 (Fibo retracement 61.8%). It will be possible to talk about a serious decline in quotes in case of a breakdown of 1.3428(Fibo retracement of 23.6%) and the middle line of the Bollinger Bands with targets at 1.3306 and 1.3184.

The upward movement of the Bollinger Bands and the growth of the MACD histogram in the positive zone indicate the continuation of the upward trend, but the downward reversal of the Stochastic does not exclude the continuation of the decline.

Resistance levels: 1.3550, 1.3672, 1.3794.

Support levels: 1.3428, 1.3306, 1.3184.