SOLID ECN LLC

Solid ECN Representative

- Messages

- 511

The European currency traded with mixed dynamics against the US dollar during the Asian session, consolidating near 1.05. The day before the euro made an attempt to grow, having received support from the optimistic statements of the President of the European Central Bank (ECB), but the "bulls" failed to consolidate on new local highs. EURUSD eventually returned to the "red" zone, continuing the development of flat dynamics in the short term.

The European regulator is likely to complete the asset buyback at the beginning of Q3 2022, after which it will start raising the interest rate. This was stated by the ECB President Christine Lagarde the day before, speaking in Ljubljana. Last month, officials continued their "dovish" policy from 2011 and left the interest rate on the main refinancing operations, the rate on the deposit facility and the rate on the marginal lending facility at 0.00%, -0.50% and 0.25%, respectively. Experts believe that the ECB will increase the figures in July and September, and bring the deposit rate to 1.5% within two years. However, much will depend on the development of the military conflict in Ukraine, where the situation is still extremely tense.

Meanwhile, Hungary announced its readiness to impose an embargo on Russian resources, but the Minister of Foreign Affairs and Trade, Péter Szijjártó, voiced a number of demands. In particular, he noted that the country expects concrete measures from the EU to reduce the negative consequences for the national economy if a decision is made. According to Szijjártó, official Budapest will support the pan-European embargo if it does not concern oil pipelines. Now about 65% of oil from Russia comes through the Druzhba pipeline, and the Hungarian economy does not yet have alternative options for replacing these resources.

Macroeconomic statistics from Europe published on Wednesday did not have a noticeable impact on the instrument's dynamics. Consumer Price Index in Germany in April showed an increase of 0.8%, which also fully coincided with market expectations. In annual terms, inflation fixed at around 7.4%.

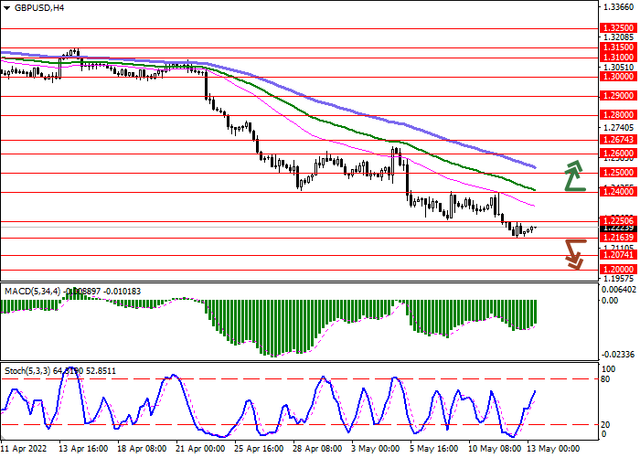

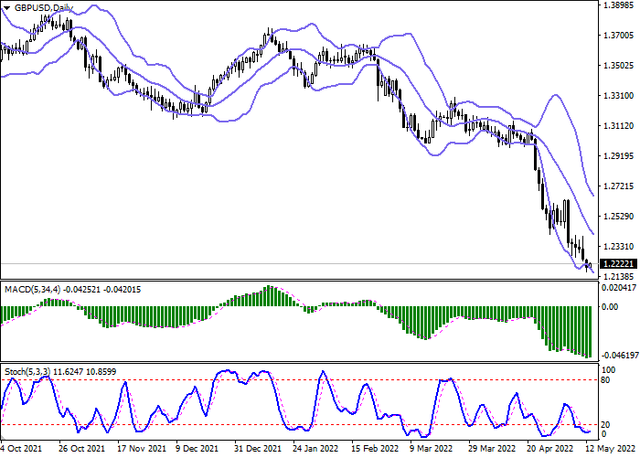

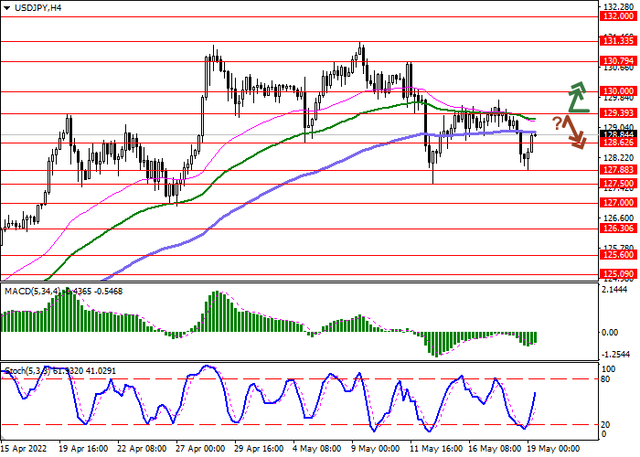

Bollinger Bands on the D1 chart still maintain a moderate downward direction. The price range is actively narrowing, reflecting the emergence of multidirectional trading dynamics in the short term. MACD is growing preserving a weak buy signal (located above the signal line). Stochastic, on the contrary, keeps its downward direction, indicating the predominance of "bearish" sentiment in the ultra-short term.

To open new trading positions, it is necessary to wait for the signals from technical indicators to be clarified.

Resistance levels: 1.0576, 1.064, 1.069, 1.0726 | Support levels: 1.05, 1.047, 1.04, 1.035