SOLID ECN LLC

Solid ECN Representative

- Messages

- 511

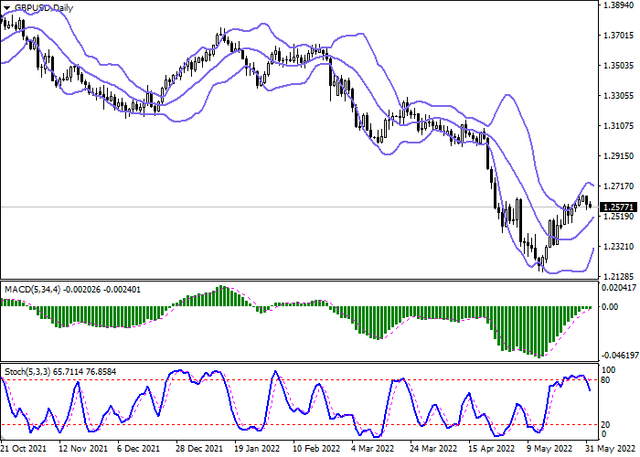

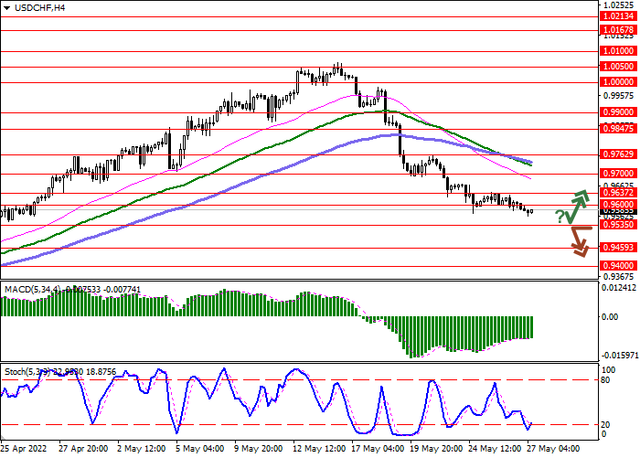

During the Asian session, the USDCHF pair is slightly corrected, renewing local lows from April 26. The asset is preparing to end trading with a fairly confident decline and continue the development of a strong "bearish" momentum formed last week.

The pressure on quotes is again exerted by uncertain US macroeconomic statistics, which increases the risk that the US Federal Reserve will break the interest rate hike cycle after its planned increase in June and July. Traders fear that the actions of financial regulators, which are due to the fight against high inflation, will lead to a noticeable slowdown in global economic growth. According to the revised data, the contraction of the US economy for the first quarter of this year amounted to 1.5%, which was 0.1% worse than the previous estimate.

On Friday, traders expect the publication in the US of April data on the dynamics of income and expenses of American citizens. Current forecasts suggest that revenue growth will remain flat at 0.5%, while spending could slow from 1.1% to 0.7%.

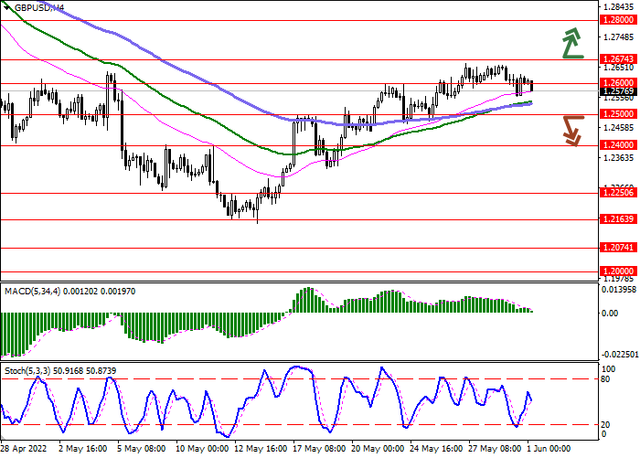

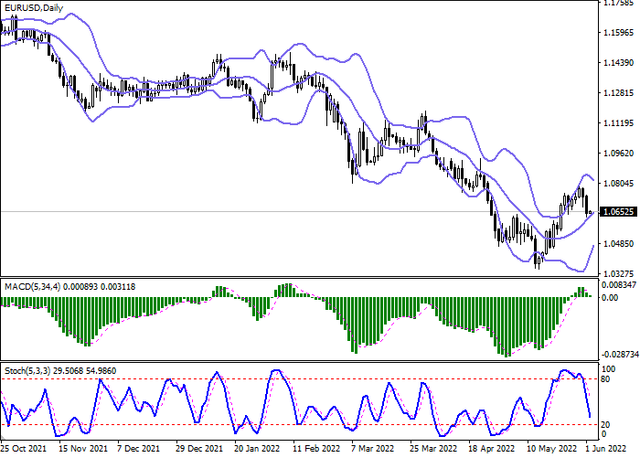

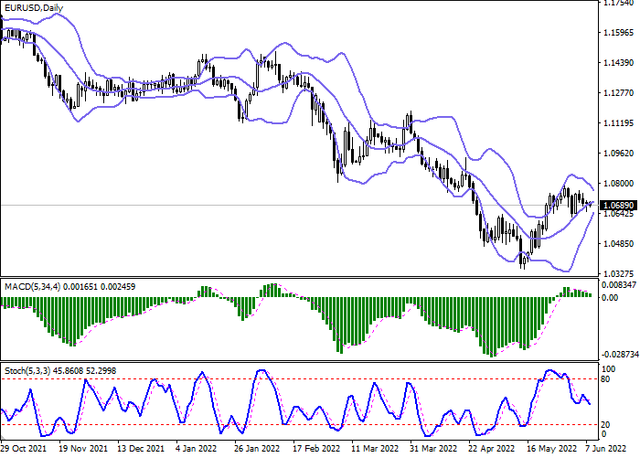

On the daily chart, Bollinger Bands are steadily declining: the price range expands, letting the "bears" renew local lows. The MACD indicator falls, keeping a strong sell signal (the histogram is below the signal line). Stochastic is close to its lows, signaling that USD may become oversold in the ultra-short term.

Resistance levels: 0.96, 0.9637, 0.97, 0.9762 | Support levels: 0.9535, 0.9459, 0.94, 0.93