SOLID ECN LLC

Solid ECN Representative

- Messages

- 511

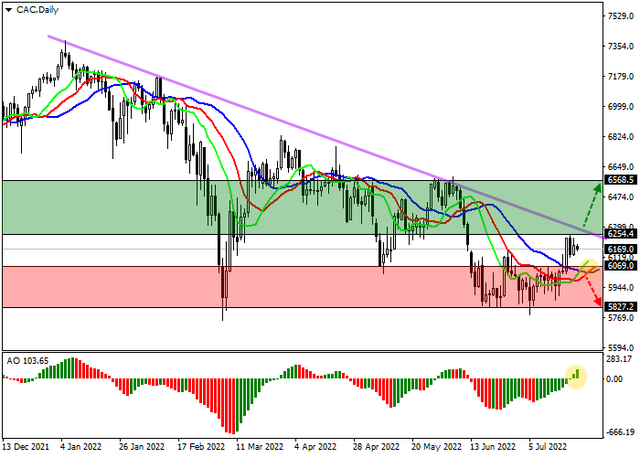

CAC 40 - French stock market is correcting upwards

Thales Group, a company producing information systems for aerospace, military and maritime applications, recorded quarterly revenue at the level of analysts' expectations in the region of 4.05 billion euros, surpassing the figure of the previous period at the level of 3.74 billion euros; and advertising and communication company Publicis Groupe reflected revenue of 3.07 billion euros, the best result since 2016. Macroeconomic data will also be published today, including Services and Manufacturing PMIs, where a decline to 52.7 points and 50.8 points, respectively, is projected.

The asset quotes are in the global downtrend, approaching the resistance line. Technical indicators have already reversed and issued a new buy signal: the fast Alligator indicator EMAs crossed the signal line from below, and the histogram of the AO oscillator moved to the buy area, forming ascending bars.

Support levels: 6070, 5827 | Resistance levels: 6254, 6568

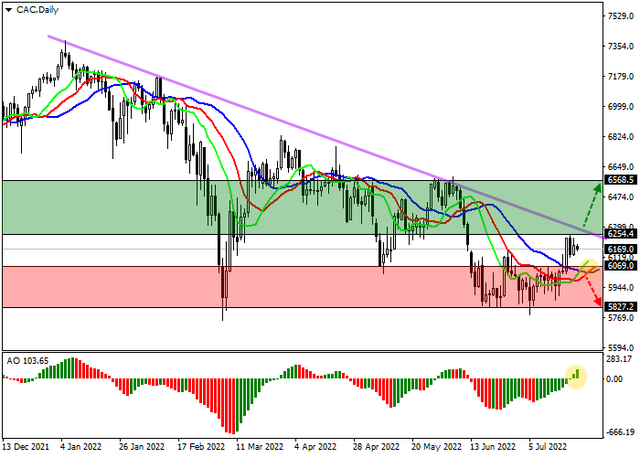

Thales Group, a company producing information systems for aerospace, military and maritime applications, recorded quarterly revenue at the level of analysts' expectations in the region of 4.05 billion euros, surpassing the figure of the previous period at the level of 3.74 billion euros; and advertising and communication company Publicis Groupe reflected revenue of 3.07 billion euros, the best result since 2016. Macroeconomic data will also be published today, including Services and Manufacturing PMIs, where a decline to 52.7 points and 50.8 points, respectively, is projected.

The asset quotes are in the global downtrend, approaching the resistance line. Technical indicators have already reversed and issued a new buy signal: the fast Alligator indicator EMAs crossed the signal line from below, and the histogram of the AO oscillator moved to the buy area, forming ascending bars.

Support levels: 6070, 5827 | Resistance levels: 6254, 6568