SOLID ECN LLC

Solid ECN Representative

- Messages

- 511

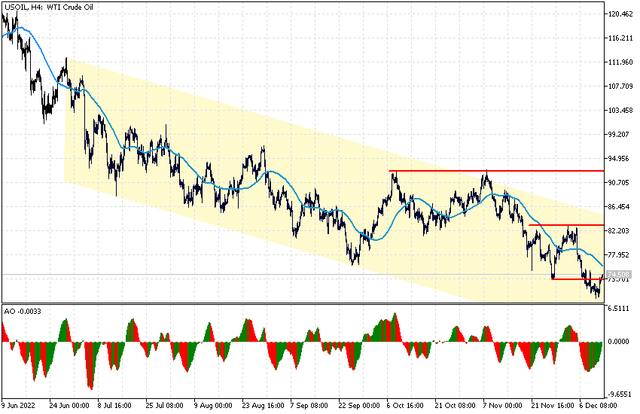

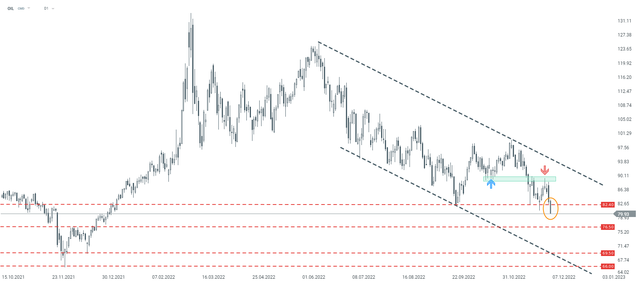

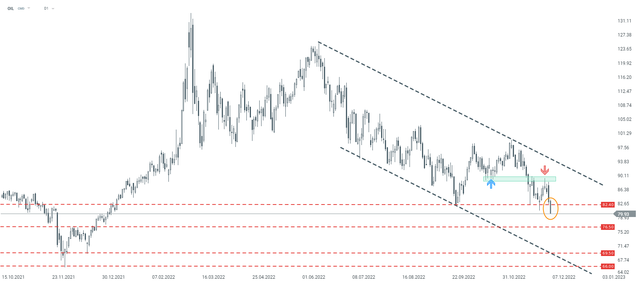

Crude oil sell-off intensifies

Oil prices continue to move sharply lower on Tuesday reaching a level not seen since the beginning of the year as rising demand concerns overshadowed the impact of EU price cap on Russian oil. Weak data from China's service sector, weakening manufacturing activity in the EU and US, expectations of further rate increases from major central banks and rebounding dollar put pressure on oil prices. A report that Russia was considering a oil-price floor provided only a brief respite for bulls as price resumed downward move in late afternoon. One needs to remember that if the price will drop below $70.0 per barrel, then this may force OPEC reaction.

Oil price fell below $80 a barrel, its lowest level this year. Looking at the D1 timeframe, one can notice a dynamic break below the support at 82.40, which could lead to a further sell-off. The next key support is located at $76.50.

Oil prices continue to move sharply lower on Tuesday reaching a level not seen since the beginning of the year as rising demand concerns overshadowed the impact of EU price cap on Russian oil. Weak data from China's service sector, weakening manufacturing activity in the EU and US, expectations of further rate increases from major central banks and rebounding dollar put pressure on oil prices. A report that Russia was considering a oil-price floor provided only a brief respite for bulls as price resumed downward move in late afternoon. One needs to remember that if the price will drop below $70.0 per barrel, then this may force OPEC reaction.

Oil price fell below $80 a barrel, its lowest level this year. Looking at the D1 timeframe, one can notice a dynamic break below the support at 82.40, which could lead to a further sell-off. The next key support is located at $76.50.