SOLID ECN LLC

Solid ECN Representative

- Messages

- 511

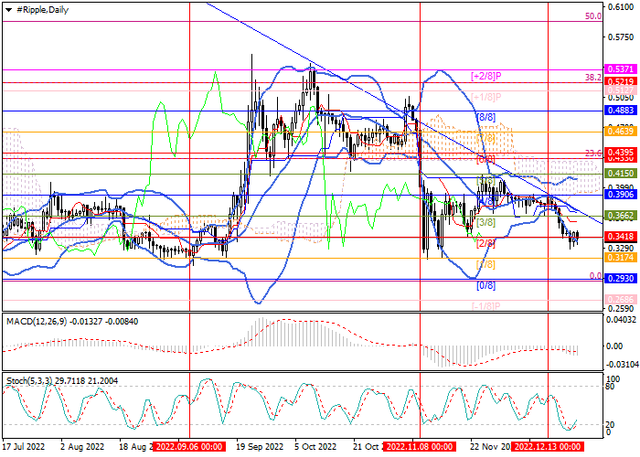

XRPUSD - Murray analysis

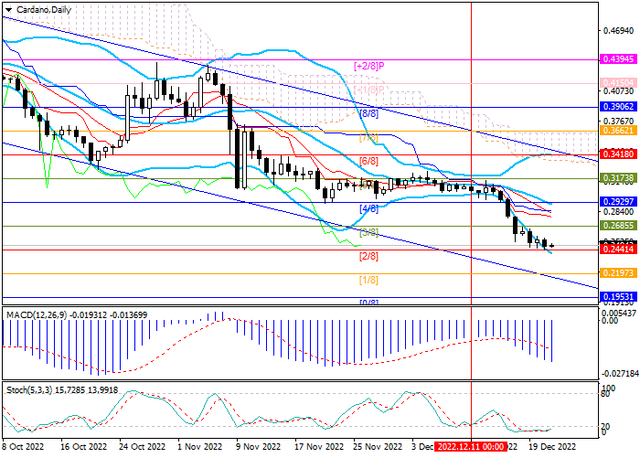

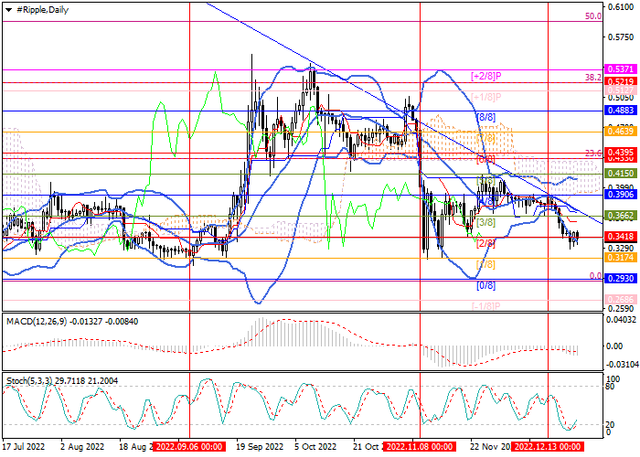

The XRPUSD pair continues to trade within the long-term descending channel: last week the quotes reached its upper limit around 0.3906 (the Murray level [4/8]), but they could not break higher and resumed the decline.

Currently, the price has fallen to the area of 0.3418 (Murray level [2/8]), consolidation below which will give the prospect of further decline to the levels of 0.2930 (Murray level [0/8], the area of June lows) and 0.2686 (Murray level [-1/8]). The key for the "bulls" is the 0.3662 mark (the Murray level [3/8]), supported by the middle line of the Bollinger Bands, in case of its breakout, the price will leave the framework of the descending channel and will be able to rise to the levels of 0.4150 (the Murray level [5/8]) and 0.4395 (the Murray level [6/8], the Fibo retracement 23.6%).

Resistance levels: 0.3662, 0.415, 0.4395 | Support levels: 0.3418, 0.2930, 0.2686

The XRPUSD pair continues to trade within the long-term descending channel: last week the quotes reached its upper limit around 0.3906 (the Murray level [4/8]), but they could not break higher and resumed the decline.

Currently, the price has fallen to the area of 0.3418 (Murray level [2/8]), consolidation below which will give the prospect of further decline to the levels of 0.2930 (Murray level [0/8], the area of June lows) and 0.2686 (Murray level [-1/8]). The key for the "bulls" is the 0.3662 mark (the Murray level [3/8]), supported by the middle line of the Bollinger Bands, in case of its breakout, the price will leave the framework of the descending channel and will be able to rise to the levels of 0.4150 (the Murray level [5/8]) and 0.4395 (the Murray level [6/8], the Fibo retracement 23.6%).

Resistance levels: 0.3662, 0.415, 0.4395 | Support levels: 0.3418, 0.2930, 0.2686