SOLID ECN LLC

Solid ECN Representative

- Messages

- 511

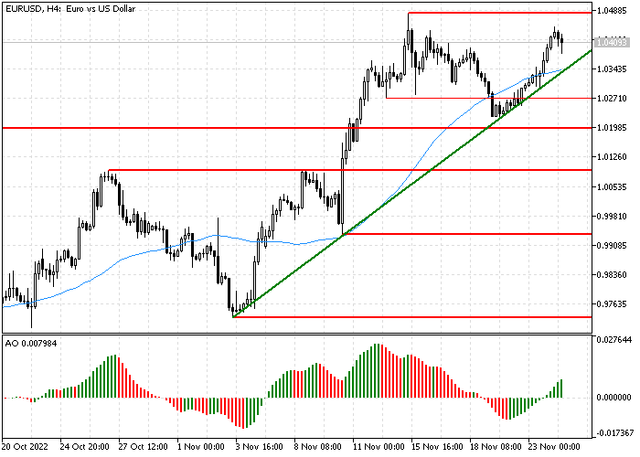

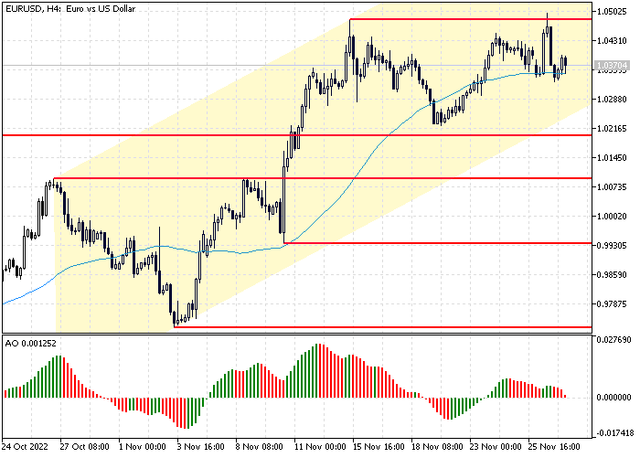

Euro sharpens decline to two-week low amid grim outlook

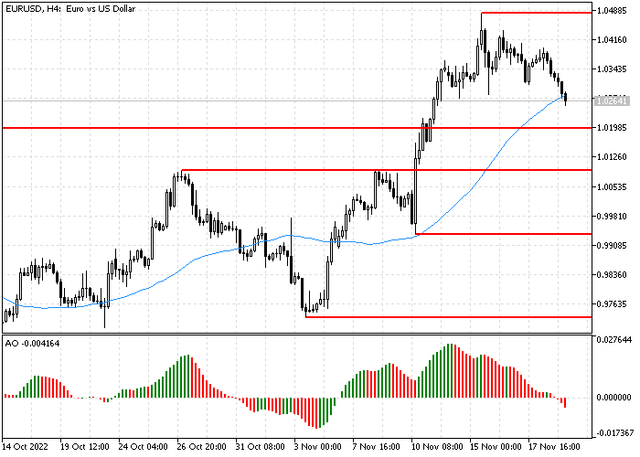

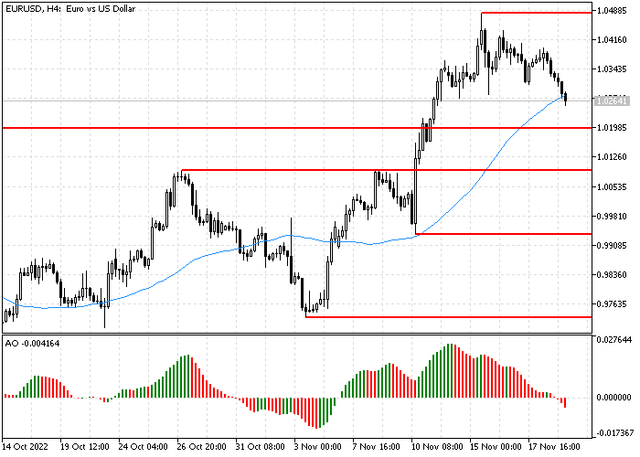

Euro fell in European trade against dollar for third straight session, hitting two-week lows amid grim outlook for European services and manufacturing, which could hinder the ECB's policy tightening plans. The dollar extended its gains following recent remarks by Fed officials, which confirms the ECB will carry on its battle against inflation in the US. EURUSD fell 0.7% fell 1.0252, the lowest since November 11, after losing 0.4% on Friday, the second loss in a row as two-year German treasury yields slowed down.

Euro fell 0.3% last week against dollar on profit-taking away from four-month highs at 1.0481.

Grim Outlook

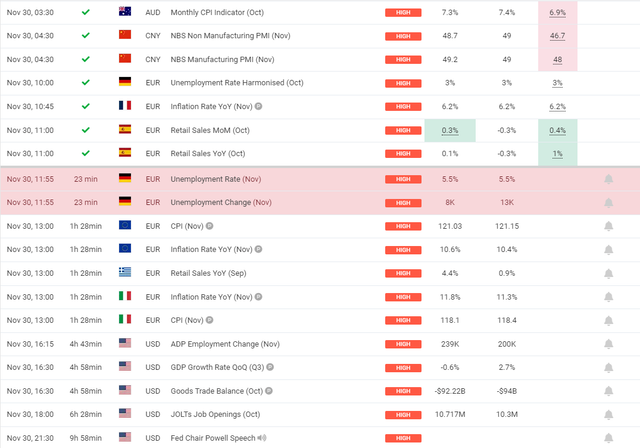

Europe's manufacturing PMI data are expected later today to show a slowdown in activities in November.

The data is expected to bring down bets on the European Central Bank's expected rate hikes at upcoming meetings.

The Dollar

The dollar index rose 0.6% on Monday on track for the third profit in a row, hitting two-week highs at 107.59 against a basket of major rivals.

Recent US data showed retail sales rose past estimates in October, while Fed officials such as San Francisco Fed President Mary Dale said it's reasonable the Fed will raise rates to 5.25% by early next year.

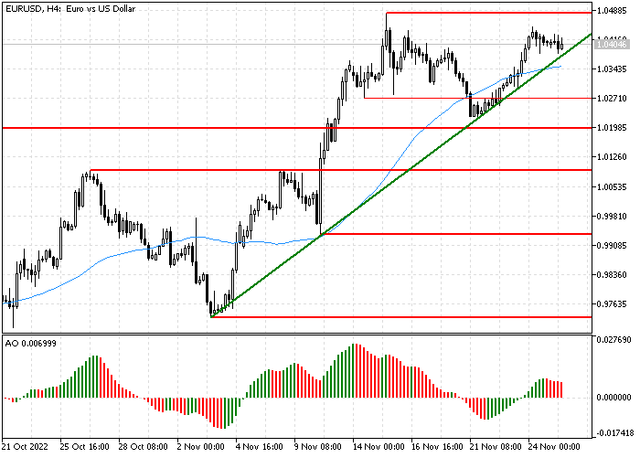

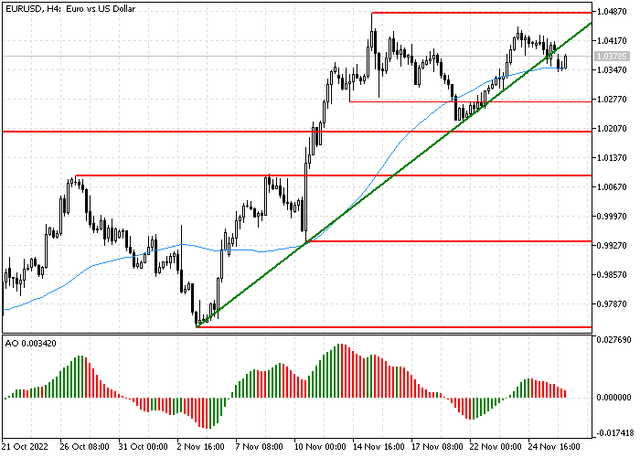

Euro fell in European trade against dollar for third straight session, hitting two-week lows amid grim outlook for European services and manufacturing, which could hinder the ECB's policy tightening plans. The dollar extended its gains following recent remarks by Fed officials, which confirms the ECB will carry on its battle against inflation in the US. EURUSD fell 0.7% fell 1.0252, the lowest since November 11, after losing 0.4% on Friday, the second loss in a row as two-year German treasury yields slowed down.

Euro fell 0.3% last week against dollar on profit-taking away from four-month highs at 1.0481.

Grim Outlook

Europe's manufacturing PMI data are expected later today to show a slowdown in activities in November.

The data is expected to bring down bets on the European Central Bank's expected rate hikes at upcoming meetings.

The Dollar

The dollar index rose 0.6% on Monday on track for the third profit in a row, hitting two-week highs at 107.59 against a basket of major rivals.

Recent US data showed retail sales rose past estimates in October, while Fed officials such as San Francisco Fed President Mary Dale said it's reasonable the Fed will raise rates to 5.25% by early next year.