SOLID ECN LLC

Solid ECN Representative

- Messages

- 511

Morning Market Review

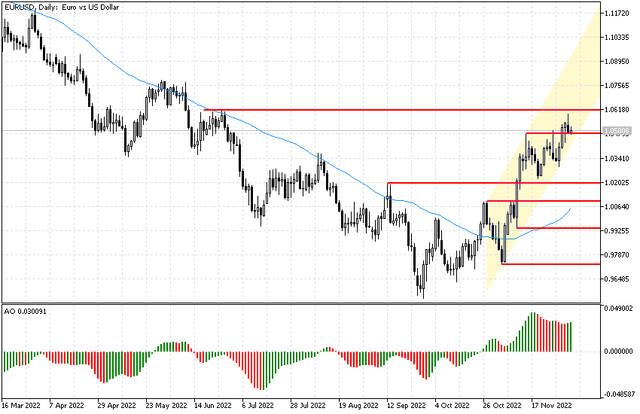

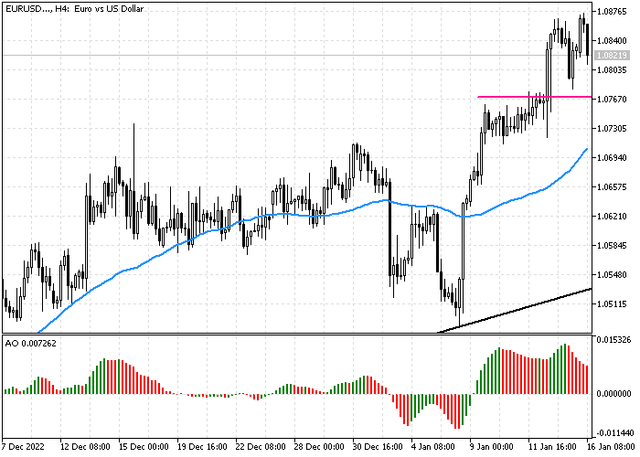

EURUSD

The European currency shows moderate growth, developing a strong "bullish" momentum, formed on November 30. The EUR/USD pair is testing the level of 1.0580 for a breakout, updating local highs from June 28. On Friday, December 2, investors reacted to the publication of the report on the US labor market for November, as a result of which the dollar attempted corrective growth, which ultimately did not result in the formation of any trend phenomena. November data showed an increase in the number of Nonfarm Payrolls by 263.0 thousand, which turned out to be significantly better than market expectations at the level of 200.0 thousand. The October indicator was revised from 261.0 thousand to 264.0 thousand. The Unemployment Rate remained at the same level of 3.7%, while the Average Hourly Earnings accelerated from 0.5% to 0.6% in monthly terms, contrary to forecasts of a slowdown to 0.3%, and in annual terms it corrected from 4.9% to 5.1%, beating expectations at 4.6%. The positions of the single currency were also supported by statistics from Europe on the dynamics of producer inflation. Producer Price Index in October fell by 2.9% after rising by 1.6% in the previous month, while analysts had projected a decline of 2.0%, and in annual terms, the indicator slowed down from 41.9% to 30.8% with the forecast of 31.5%.

GBPUSD

The British pound is trading with upward dynamics, updating local highs from June 17. The GBP/USD pair is testing 1.2340 for a breakout, and investors are waiting for new drivers in the market. In particular, data on business activity from S&P Global in the services sector for November is scheduled for release today. Forecasts suggest that the PMI in the UK will remain at the same level of 48.8 points, as well as the main European indicators should not change. Business activity statistics will also be released in the US, and analysts expect moderate growth here. The Institute for Supply Management (ISM) PMI is forecast to strengthen from 54.4 points to 55.6 points in November. So far, the report on the US labor market, which was released last Friday, remains in the focus of attention of traders, which again lowered investor confidence that the US Federal Reserve will ease the pace of monetary tightening. In December, the regulator is expected to increase the interest rate by only 50 basis points, partly due to the fact that the consumer inflation rate shows an unsustainable decline.

XAUUSD

Gold prices show moderate growth, again testing the level of 1810.00. The XAU/USD pair is updating local highs from July 5, receiving support from the growth of optimism regarding the Chinese economy. In particular, investors are reacting positively to the easing of quarantine restrictions in certain cities and regions of China, suggesting that this could become an impetus for the restoration of economic activity. In turn, gold positions remain under pressure after the publication of a rather strong report on the US labor market last Friday. The real dynamics turned out to be noticeably better than analysts' forecasts and reflected an increase in the number of Nonfarm Payrolls by 263.0 thousand in November, while the forecast was at the level of 200.0 thousand. Strong results support "hawkish" sentiment regarding the future monetary policy of the US Federal Reserve. However, markets still expect only a 50 basis point increase in interest rates in December.