SOLID ECN LLC

Solid ECN Representative

- Messages

- 511

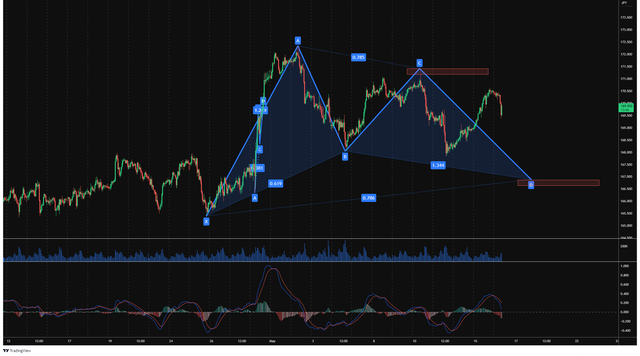

GBPJPY Gartley - Still a Valid Structure?

A bullish Gartley could be forming if we can hold below point C and drop down to the 169.00 area for the completion of the pattern and form our PRZ zone.

Watching the price action yesterday it felt like there was little to stop the rally, however overnight the dynamic has changed so as it stands the structure is still there.

From here we MUST stay under point C to stand a chance of forming a Bullish Gartley correctly.

Still all to play for at the moment though - watch this space!

%15 Bonus | Swap Free | Raw Spread