The FPA invited the Company to update this discussion on Feb 12, 2020 at 1:00 PM

Thanks, i sent requests to all of there emails addresses, Alla, Jacob, Harley, typical no response tho, ive noticed support saying they will do trade investigations on the review page regards to slippage, yet think markets did two trade investigations and said there was no issues, then compliance took over double the time to respond, i had to chase them up weekly. then there was over 10 times the slippage that they first said there was, looking at the other scam alert that was margin called on a hedged trade they closed all positions at same price yet with mine they couldn't do this, its amazing what a broker will do to make extra money off a client. i took information into there office in Melbourne i was happy to wait till they where free but instead of seeing me they called security to escort me out. (they requested i provide more information, its been about 3 weeks since i asked compliance questions on information they provided that contradicts other information they have provided still no response, think markets have tried to hush me by saying if i provide case information they have provided they will get AFCA to review it and maybe stop my case.

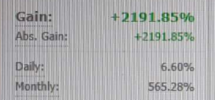

this is a joke, they manipulate charts use plugins to cause slippage and hold up trades, advertise as MS execution i cant share the average times and the difference per day but shows a clear pattern of them playing games, this is over a year old now. if they didnt want me trading with them they could of asked me to leave not run plugins stealing off me until i couldn't turn a profit, the day everything got alot worse was the day i had a random call from a account manager asking things like do you trade manually etc.. i had sent a email a week before saying things where going on yet the account manager told me things were fine and he could see my latency etc..

they also ran the ICO for think coin, which they re named as trade connect still dont have there working platform years later sold it for 25 cents sitting around 1 cent,

to better sell the ICO scam they said they would list on the ASX and did a IPO but never listed, this company is just one scam after another..

can we speak about my case on here and the lies you have told or are you still keeping me quiet, if you where a honest transparent broker you would reply to my emails and see what you did as its very clear your risk/dealing desk played games changing things on the back end of my account targeting my account and you'd pay me back

everything your risk desk has said in emails and our communication contradicts other things they say, why do you think that would be think markets? do you think maybe they"re lying?

just how head of compliance said there was no more slippage yet we know the date you made that excel sheet Alla..

this will end up with think markets complaining to there lawyer but its not okay to lie to clients or manipulate there accounts and not provide the service you advertise, especially when a client asks what is going on and sends a email and talks to a account manager before any losing days, you could of been honest or simply said you cant trade with us as we cant provide the fills you need, please withdraw your funds, its happened before and thats what a transparent broker does

can you be transparent?

can you reply to my email showing what your head of risk said contradicts what he provided?

can you return my account to the day the account manager wasn't transparent with me and groomed me to stay?