forexteamau

Sergeant

- Messages

- 148

This is the story how I was misled and scammed by ICmarkets and lost $28000 ( All my savings plus the money I borrowed to survive their changes) in this financial hardship

I know this company has its own cyber army and white knights who come to their rescue in all forums and reviews but I've had enough trauma and stress and I do not want anyone else rub salt on my wounds. I appreciate your help.

1. I registered my account with this broker in 2017

2. I was dealing with small amount of money these years. trading Euro USD when I had time . Company advertises to contact them for information and assistant so I contacted them twice asking about swap rates for keeping CFDs for long term Once in later part of 2019 and again a few days before my investment.

3. Company did not provide my chat records for later part of 2019 despite my requests and even intially denied having such a chat with me about swap rate in March which I will share the evidence with you in the next post.

But fortunately I had a copy of my conversation with their support before my investment . First time they gave me some fixed rates and told me that swap rate depends on the lot size and even gave me a fixed quotation for keeping stock for a couple of months .

Second time I asked the same questions and they said it depends on the lot size "only" and refer me to a calculator with fix rates and also swap rate blog did not indicate anything about changes. I asked if these rates are calculated daily as you can see and support told me again it depends on the lot size as you can see in the bellow transcript. red highlighted sentences are my questions

4. I opened my Brent position on 13th of March based on information provided to me . I looked for a AUS200 . It had negative swap on both sides. Brent has characteristic of cash settlement at the end of contract and has no risk of going negative unlike WTI so I chose this instrument because interest rate was very low but positive for long position and was getting daily interest rate as advertised during the March.

5. A few days after my investment I contacted them again because I was worried about leverage restriction. live chat they lied to me and misled me again and told me that ICmarkets has never done leverage restriction before and as you can see I even believed them at the end of our conversation.

later I found out they have done it many times with evidence which I will share later but support just gave me false information and said it's very rare and I relied on this info as well

6. On 3rd of April after trump tweet, Market suddenly went in my favor and a large swap about -570 AUD was applied to my account

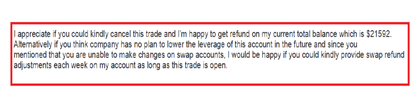

7. I contacted this broker immediately and told them that I will report the matter to relevant authorities also requested full refund .

This was their reply:

8. Later they made $532.26 adjustment out of almost $570 swap charge . Evidence is available but I'm only limited to 10 screenshot to upload in this post

Then I realized I was still being charged about $100 a day which tripped on Wednesdays. swap rate page changed to negative rate as well as you can see.

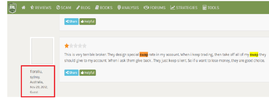

9. I logged my complaint with AFCA , I contacted them again and asked them to make sure that they do not have any plan to reduce my account leverage in the future, because Brent price was going higher and market was getting better after OPEC meeting. They did not reply to my question and sent an e-mail as "Acknowledgement" and referred me to their compliance and ignored my question and compliance started throwing $500 for settlement when I had almost $22000 funds with them at that time.

I was also told that complaint takes long time so I opened more trades and was forced to change my strategy to naturalize their swap rate while my complaint was being processed. only 2 days after that on 23 of April, They sent an e-mail that they want to reduce my account leverage from 1:500 to 1:10 at 15 PM server time which was 22 PM my local time but they reduced it in the middle of night around 5 AM ,I could not sleep due to stress and I had only a few hours to borrow money to avoid margin call. Suddenly margin went around 100%. I was forced to close some of my positions in loss ($5000) to survive the margin restriction that night even interest rate increased to almost -15 !

10. Later I contacted other Australian brokers and realized that they were offering highest leverage and did not restrict it . I have their transcripts as evidence. my friend also mentioned that she registered an account with same ICmarkets AU on 28th of April and requested 1:500 leverage and they offered her the highest leverage for energies! she even called them and they confirmed the 1:500 and opened her temporary account. I checked their website and realized there is no way to find out who is affected by margin restriction . website shows 1:500 at all times. they can restrict it for any client they want with unregulated discretion!

11. After I heard the story I contacted the same day and this what they told me.

12. I lost my trust in this broker and closed all my positions in loss because I knew they could have restrict the leverage again in the middle of night while my account was very vulnerable or increase the negative interest rate again to take the rest of my balance and It is very interesting that what ICMarkets replied back in return which I will share it with you in my next post

ASIC keeps sending templates.They have power and money so they can bleed us dry. This is how you get ripped off and I warned you!

I know this company has its own cyber army and white knights who come to their rescue in all forums and reviews but I've had enough trauma and stress and I do not want anyone else rub salt on my wounds. I appreciate your help.

1. I registered my account with this broker in 2017

2. I was dealing with small amount of money these years. trading Euro USD when I had time . Company advertises to contact them for information and assistant so I contacted them twice asking about swap rates for keeping CFDs for long term Once in later part of 2019 and again a few days before my investment.

3. Company did not provide my chat records for later part of 2019 despite my requests and even intially denied having such a chat with me about swap rate in March which I will share the evidence with you in the next post.

But fortunately I had a copy of my conversation with their support before my investment . First time they gave me some fixed rates and told me that swap rate depends on the lot size and even gave me a fixed quotation for keeping stock for a couple of months .

Second time I asked the same questions and they said it depends on the lot size "only" and refer me to a calculator with fix rates and also swap rate blog did not indicate anything about changes. I asked if these rates are calculated daily as you can see and support told me again it depends on the lot size as you can see in the bellow transcript. red highlighted sentences are my questions

4. I opened my Brent position on 13th of March based on information provided to me . I looked for a AUS200 . It had negative swap on both sides. Brent has characteristic of cash settlement at the end of contract and has no risk of going negative unlike WTI so I chose this instrument because interest rate was very low but positive for long position and was getting daily interest rate as advertised during the March.

5. A few days after my investment I contacted them again because I was worried about leverage restriction. live chat they lied to me and misled me again and told me that ICmarkets has never done leverage restriction before and as you can see I even believed them at the end of our conversation.

later I found out they have done it many times with evidence which I will share later but support just gave me false information and said it's very rare and I relied on this info as well

6. On 3rd of April after trump tweet, Market suddenly went in my favor and a large swap about -570 AUD was applied to my account

7. I contacted this broker immediately and told them that I will report the matter to relevant authorities also requested full refund .

This was their reply:

8. Later they made $532.26 adjustment out of almost $570 swap charge . Evidence is available but I'm only limited to 10 screenshot to upload in this post

Then I realized I was still being charged about $100 a day which tripped on Wednesdays. swap rate page changed to negative rate as well as you can see.

9. I logged my complaint with AFCA , I contacted them again and asked them to make sure that they do not have any plan to reduce my account leverage in the future, because Brent price was going higher and market was getting better after OPEC meeting. They did not reply to my question and sent an e-mail as "Acknowledgement" and referred me to their compliance and ignored my question and compliance started throwing $500 for settlement when I had almost $22000 funds with them at that time.

I was also told that complaint takes long time so I opened more trades and was forced to change my strategy to naturalize their swap rate while my complaint was being processed. only 2 days after that on 23 of April, They sent an e-mail that they want to reduce my account leverage from 1:500 to 1:10 at 15 PM server time which was 22 PM my local time but they reduced it in the middle of night around 5 AM ,I could not sleep due to stress and I had only a few hours to borrow money to avoid margin call. Suddenly margin went around 100%. I was forced to close some of my positions in loss ($5000) to survive the margin restriction that night even interest rate increased to almost -15 !

10. Later I contacted other Australian brokers and realized that they were offering highest leverage and did not restrict it . I have their transcripts as evidence. my friend also mentioned that she registered an account with same ICmarkets AU on 28th of April and requested 1:500 leverage and they offered her the highest leverage for energies! she even called them and they confirmed the 1:500 and opened her temporary account. I checked their website and realized there is no way to find out who is affected by margin restriction . website shows 1:500 at all times. they can restrict it for any client they want with unregulated discretion!

11. After I heard the story I contacted the same day and this what they told me.

12. I lost my trust in this broker and closed all my positions in loss because I knew they could have restrict the leverage again in the middle of night while my account was very vulnerable or increase the negative interest rate again to take the rest of my balance and It is very interesting that what ICMarkets replied back in return which I will share it with you in my next post

ASIC keeps sending templates.They have power and money so they can bleed us dry. This is how you get ripped off and I warned you!