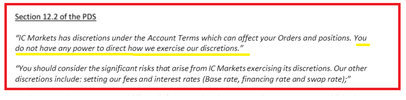

Maybe they have the right to change leverage if they give notice or put it in their T/C? In any case, it is painful to to experience a leverage drop.

Answer to your question post 43

https://www.forexpeacearmy.com/community/threads/ic-markets-scam-43-450-loss.65348/page-5

btw, how was this solved on the aussie side…..

https://www.smh.com.au/business/mar...ers-furious-after-losses-20150127-12ypsm.html

with these mega hundreds of Billions turnover, maybe someone should take the time to produce some authentic financial statements, a must, think ASIC also in charge of this ?... or is it considered as au. military defense data, also the CY Branch, think you need to write to their Registrar

….kind of funny a tiny, tiny country hardly 25.m people and most of their broker talk about many hundreds of billions turnover