Stavro D'Amore

Former FPA Special Consultant

- Messages

- 547

Hello All,

Today we have CA sentiment coming out, please see my trade plan for this release.

CA Core Retail Sales m/m

Forecast 0.2%

Previous -0.1%

Pair to trade: USD/CAD

Numbers we need: BUY USD/CAD -0.3%

SELL USD/CAD 0.7%

Economical Impact: Critical

Typical Result: Good for currency

Occurrence: monthly, about 50 days after the month ends

Spike Probability: Very Good, 50 pips if triggered

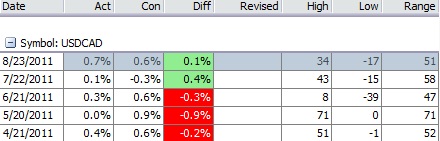

Previous Results and Pip ranges Average pip range 50

About our Triggers:

CA Core Retail Sales m/m is forecasted to arrive at 0.2%.

We are looking for a deviation of 0.5% on this trade.

If we get -0.3% or lower I will look to enter a LONG position on USD/CAD and if we get 0.7% or greater I will go SHORT on USD/CAD.

Should this report be triggered, we can expect to see about 50pips on the initial spike.

NOTE: I will not take retracement on this trade unless our triggers are hit or I see a minimum of 30+ pips move

What is it? And why does the market care?

The Core Retail Sales is a monthly measurement of all goods sold by retailers based on a sampling of retail stores of different types and sizes in Canada, excluding auto. The Auto market tends to be very volatile and distorts the underlying actual trend. The Core data is therefore thought to be a better gauge of spending trend as it excludes auto. It is an important indicator of consumer spending and also correlated to consumer confidence and considered as a pace indicator of the Canadian economy.

A higher than expected reading should be taken as positive/bullish for the CAD

A lower than expected reading should be taken as negative/bearish for the CAD

Method I use to trade this:

Stavro D’Amore Trading Method

I will look for a 30-50% retracement in the original spike before entering a trade; I will be looking at a 5 minute chart. I will sell half my position as soon as I hit the original high point of the first initial spike and place a SL at the original spike price.

NOTE: I will not take retracement on this trade unless our triggers are hit or I see a minimum of 30+ pips move

My TP level would be just before a resistance level or if the chart decides to form a support level, looking at a 15 minute chart time frame to analyse this.

I do recommend spike trading as an option because the liquidity is very good at the moment if you are using an ECN broker.

Historical Chart and Data for CA Core Retail Sales

All the best

Stavro D’Amore

Today we have CA sentiment coming out, please see my trade plan for this release.

CA Core Retail Sales m/m

Forecast 0.2%

Previous -0.1%

Pair to trade: USD/CAD

Numbers we need: BUY USD/CAD -0.3%

SELL USD/CAD 0.7%

Economical Impact: Critical

Typical Result: Good for currency

Occurrence: monthly, about 50 days after the month ends

Spike Probability: Very Good, 50 pips if triggered

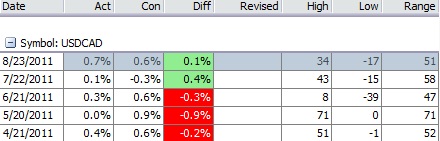

Previous Results and Pip ranges Average pip range 50

About our Triggers:

CA Core Retail Sales m/m is forecasted to arrive at 0.2%.

We are looking for a deviation of 0.5% on this trade.

If we get -0.3% or lower I will look to enter a LONG position on USD/CAD and if we get 0.7% or greater I will go SHORT on USD/CAD.

Should this report be triggered, we can expect to see about 50pips on the initial spike.

NOTE: I will not take retracement on this trade unless our triggers are hit or I see a minimum of 30+ pips move

What is it? And why does the market care?

The Core Retail Sales is a monthly measurement of all goods sold by retailers based on a sampling of retail stores of different types and sizes in Canada, excluding auto. The Auto market tends to be very volatile and distorts the underlying actual trend. The Core data is therefore thought to be a better gauge of spending trend as it excludes auto. It is an important indicator of consumer spending and also correlated to consumer confidence and considered as a pace indicator of the Canadian economy.

A higher than expected reading should be taken as positive/bullish for the CAD

A lower than expected reading should be taken as negative/bearish for the CAD

Method I use to trade this:

Stavro D’Amore Trading Method

I will look for a 30-50% retracement in the original spike before entering a trade; I will be looking at a 5 minute chart. I will sell half my position as soon as I hit the original high point of the first initial spike and place a SL at the original spike price.

NOTE: I will not take retracement on this trade unless our triggers are hit or I see a minimum of 30+ pips move

My TP level would be just before a resistance level or if the chart decides to form a support level, looking at a 15 minute chart time frame to analyse this.

I do recommend spike trading as an option because the liquidity is very good at the moment if you are using an ECN broker.

Historical Chart and Data for CA Core Retail Sales

All the best

Stavro D’Amore

Last edited by a moderator: