tickmill-news

Tickmill Representative

- Messages

- 79

EURUSD and USJDPY analysis: strong dollar caps any upside but situation could quickly change

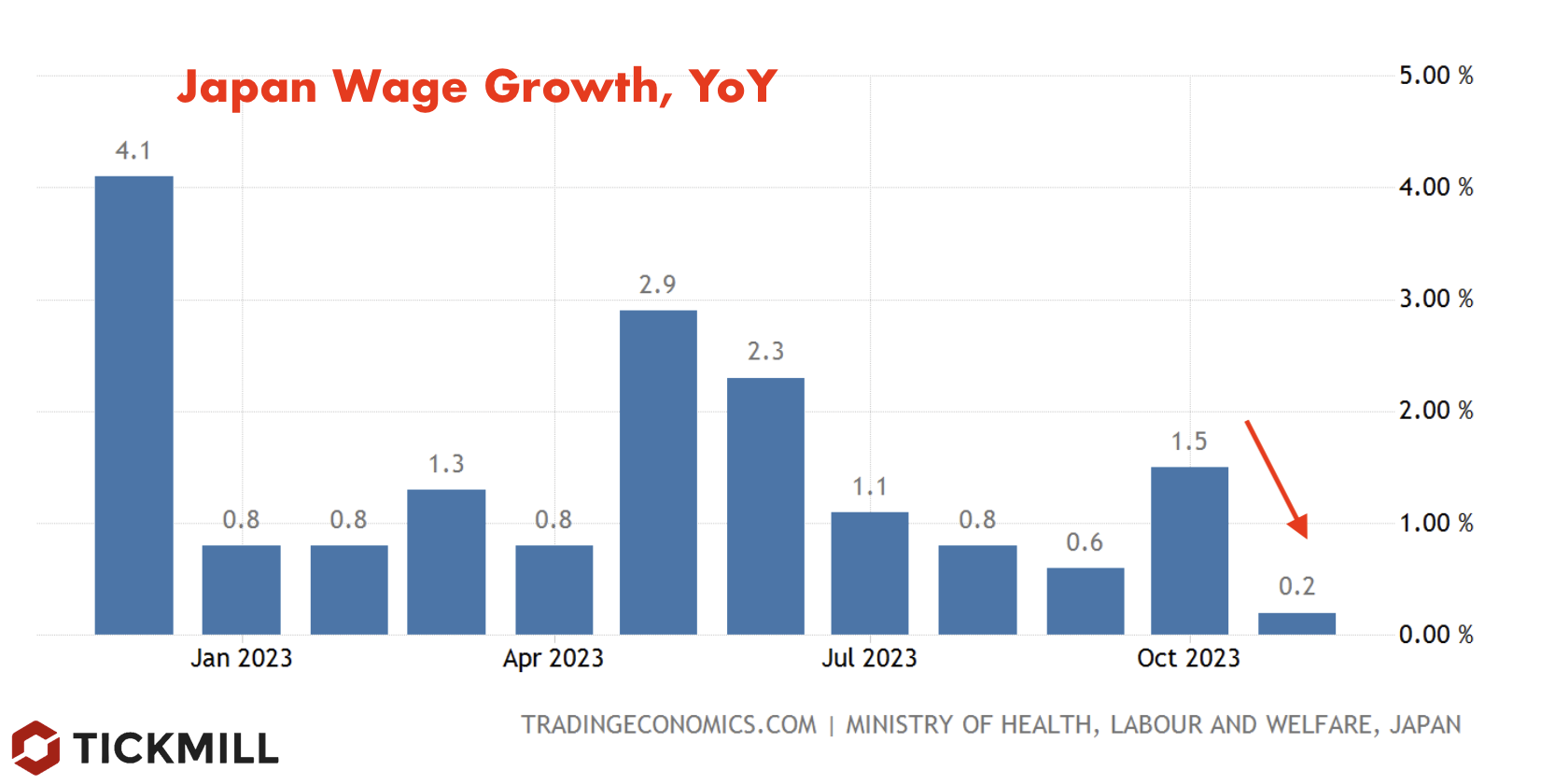

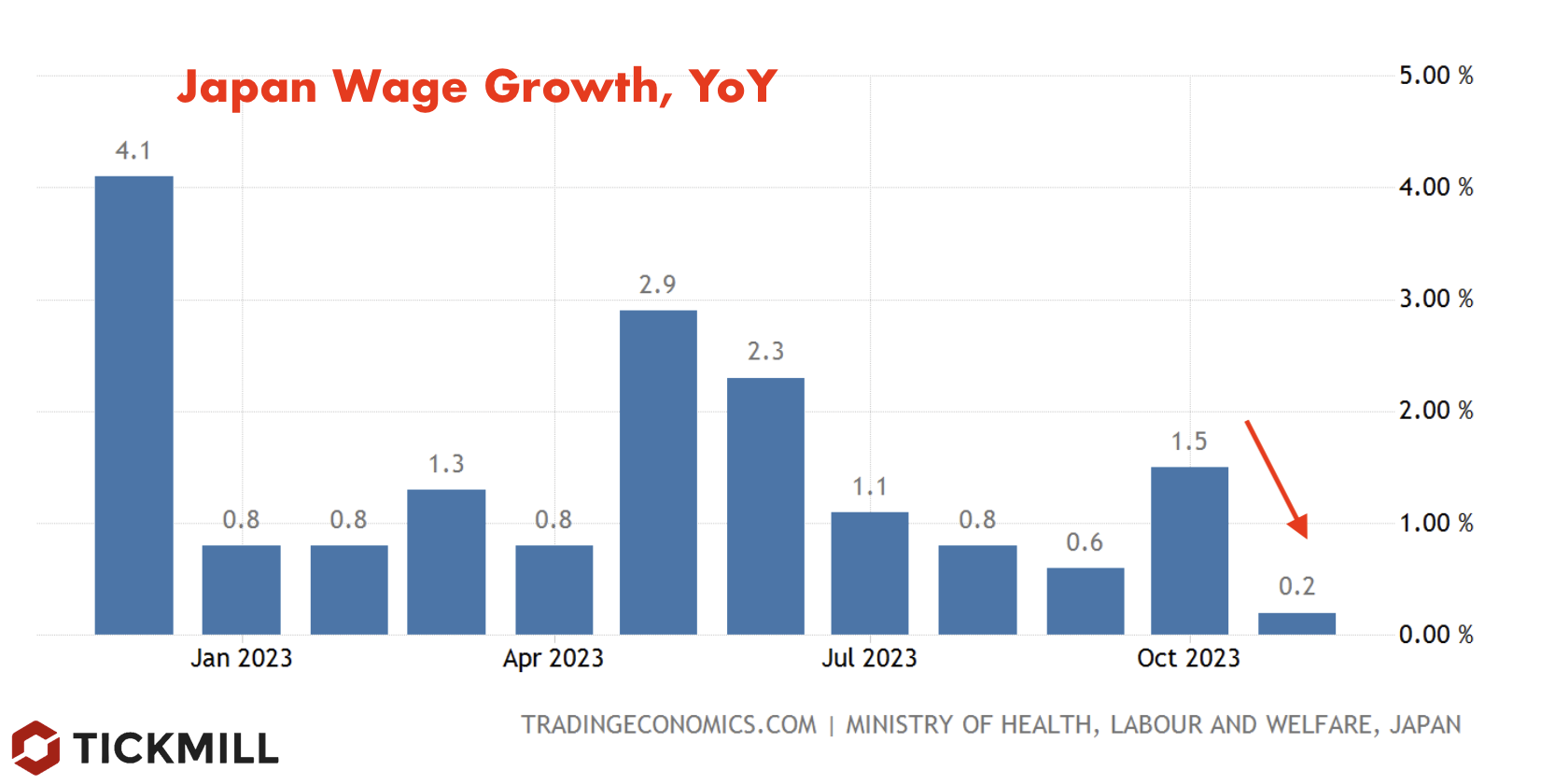

The Bank of Japan left the parameters of monetary policy unchanged at today's meeting. BOJ Governor Ueda adopted an ambiguous position regarding withdrawal from QE policy and interest rate hikes, even though in the last quarter of last year, the Japanese yen significantly strengthened on expectations that the BOJ would begin tapering its accommodative policy and 'catch up' with its counterparts in monetary tightening. Trying to explain the indecision, the BOJ chief referred to the uncertainty associated with negotiations on wage hikes by major Japanese companies. Without wage hikes, raising interest rates would be risky, as the BOJ could inadvertently trigger deflationary pressure in the economy and undermine all progress on inflation. Fragility of the situation is underscored by the fact that wage growth in Japan slowed to just 0.2% in November of last year after decent figures in several previous months:

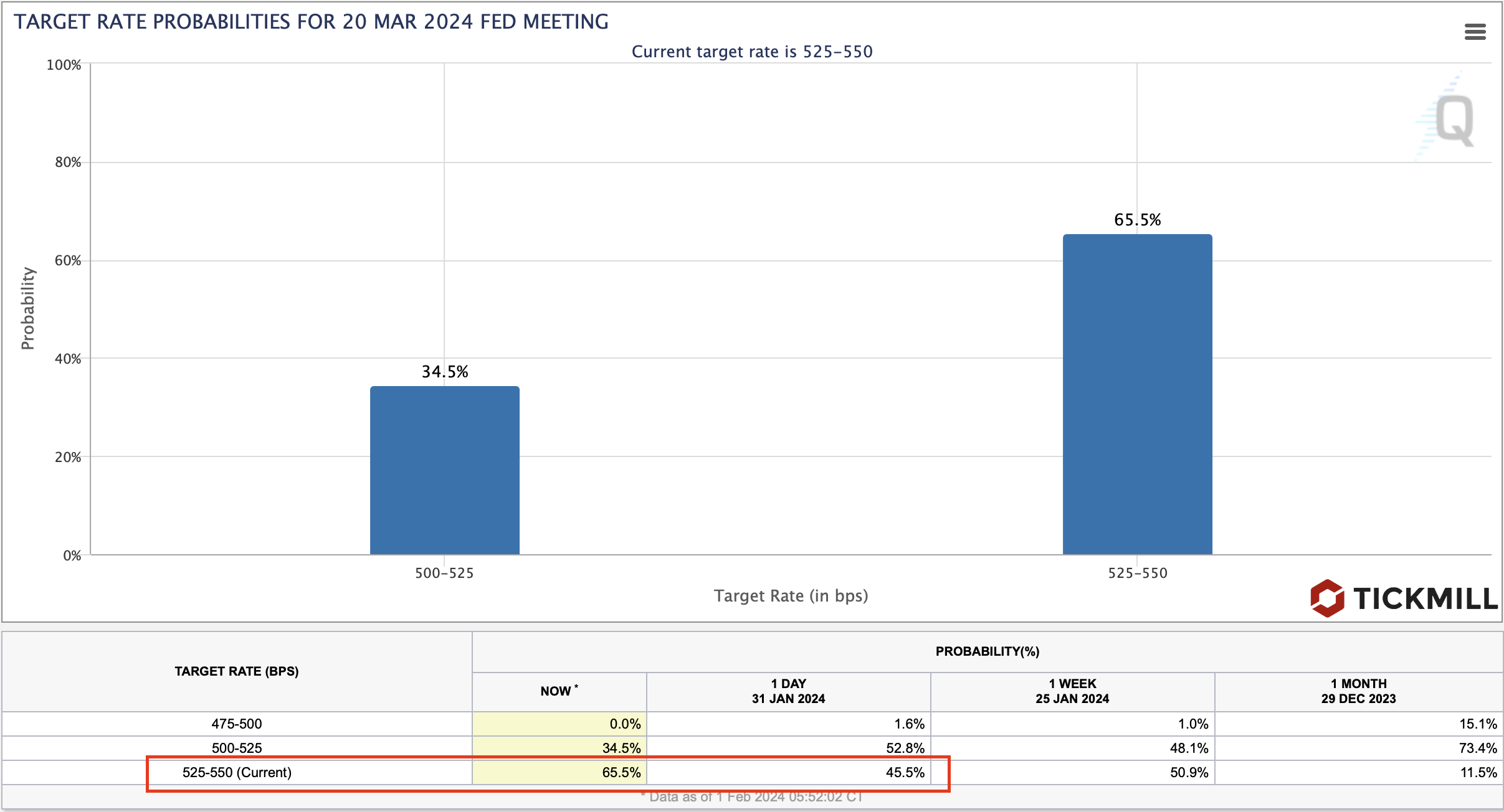

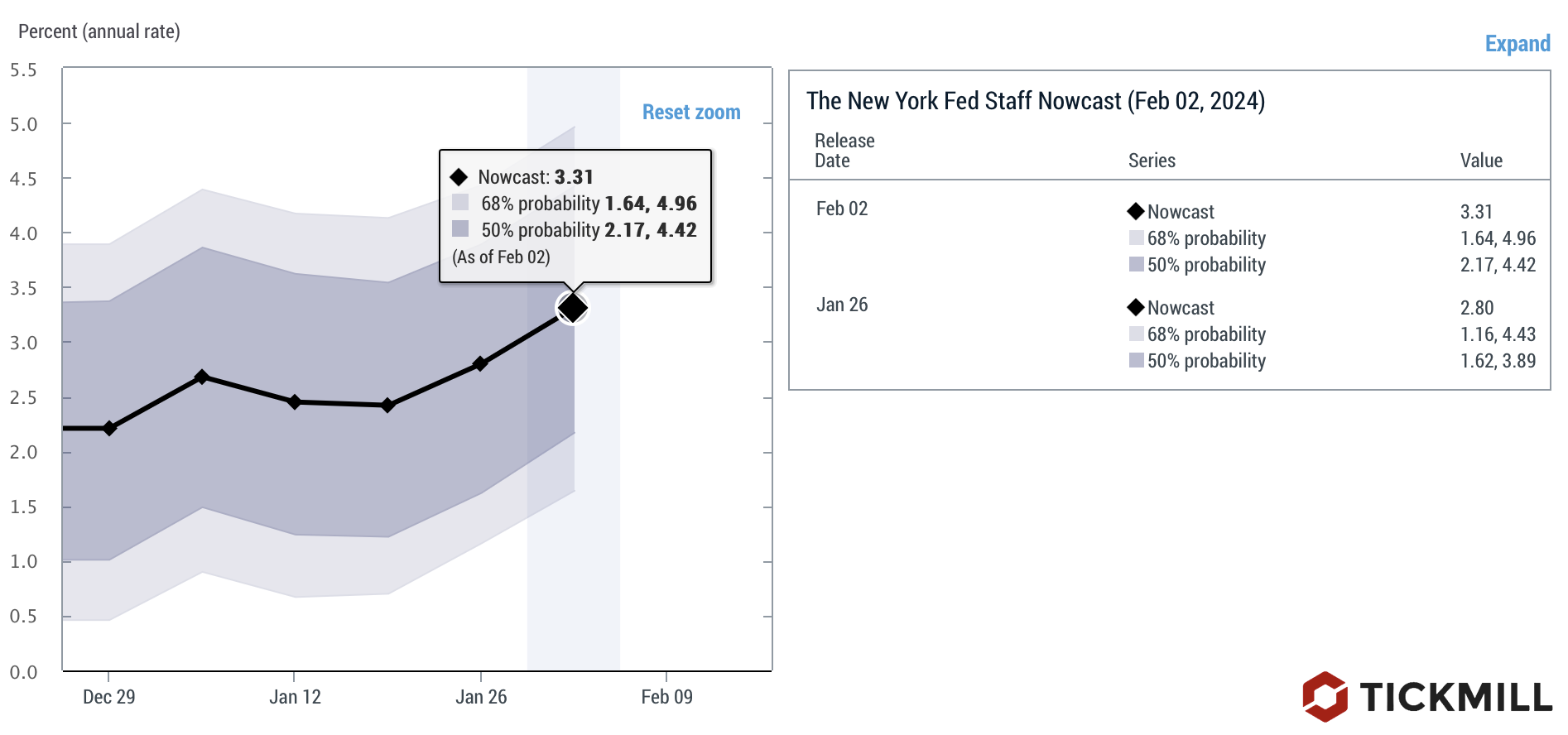

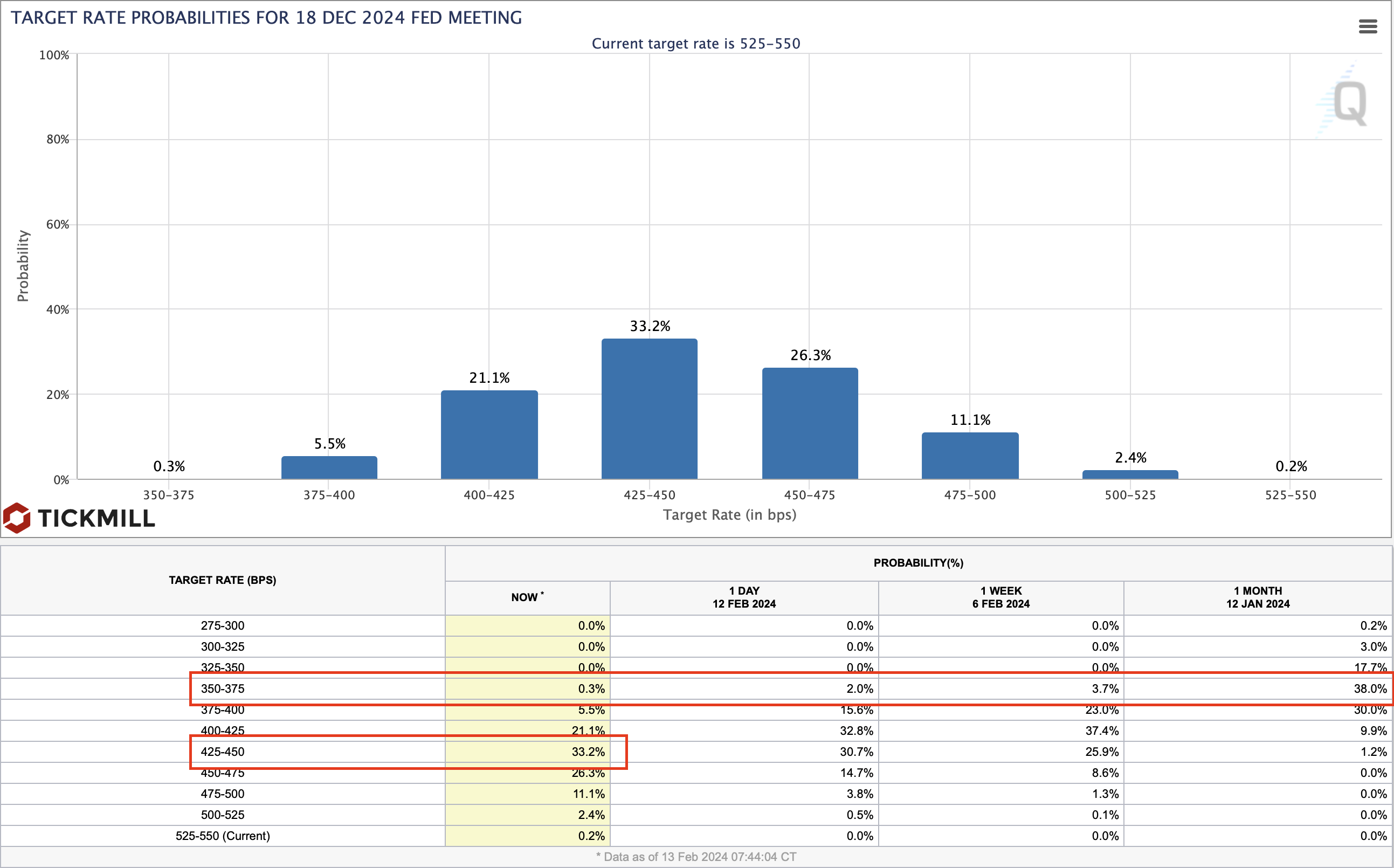

Societe Generale believes that, at the moment, USDJPY is overvalued, and alignment with current yield spreads between Japanese and American bonds (one of the main factors driving yen demand) would be achieved at a cheaper USDJPY rate. However, it is worth noting that current rates in the U.S. reflect the shift in market expectations that the first rate cut in the U.S. is being pushed from March to May, following a series of strong reports on the American economy in January. If the positive series of fundamental data on the U.S. is interrupted, USDJPY should move lower, aligning with the yield differentials.

From a technical analysis perspective, the upward trend in USDJPY that started early last year was disrupted at the end of October when speculation arose that the Bank of Japan would begin unwinding its ultra-accommodative policy. The price broke the ascending channel, declined until the end of the year, but turned around at the beginning of the new year. The reversal zone was around 140 yen per dollar, where a long-term support line also passed (orange line on the chart):

The fact that the price held above the long-term uptrend line and energetically began to rise after the New Year indicates that there are long-term investors in the market expecting the overall trend of yen depreciation to continue. Short-term and medium-term resistance levels for the pair will be 148 (where the price is currently) and the area of 152 yen per dollar. In case of a breakthrough and consolidation, the rally may only accelerate.

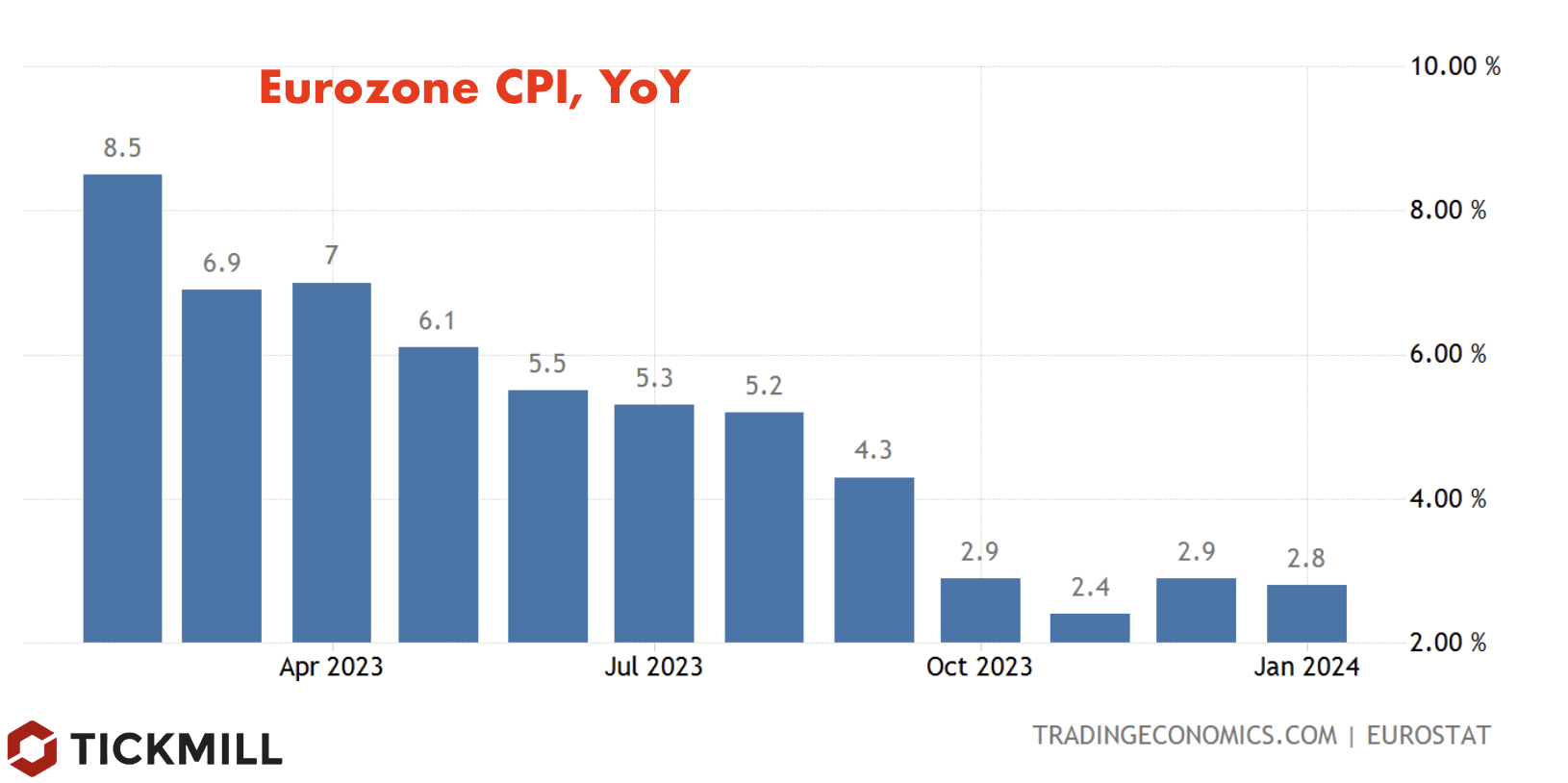

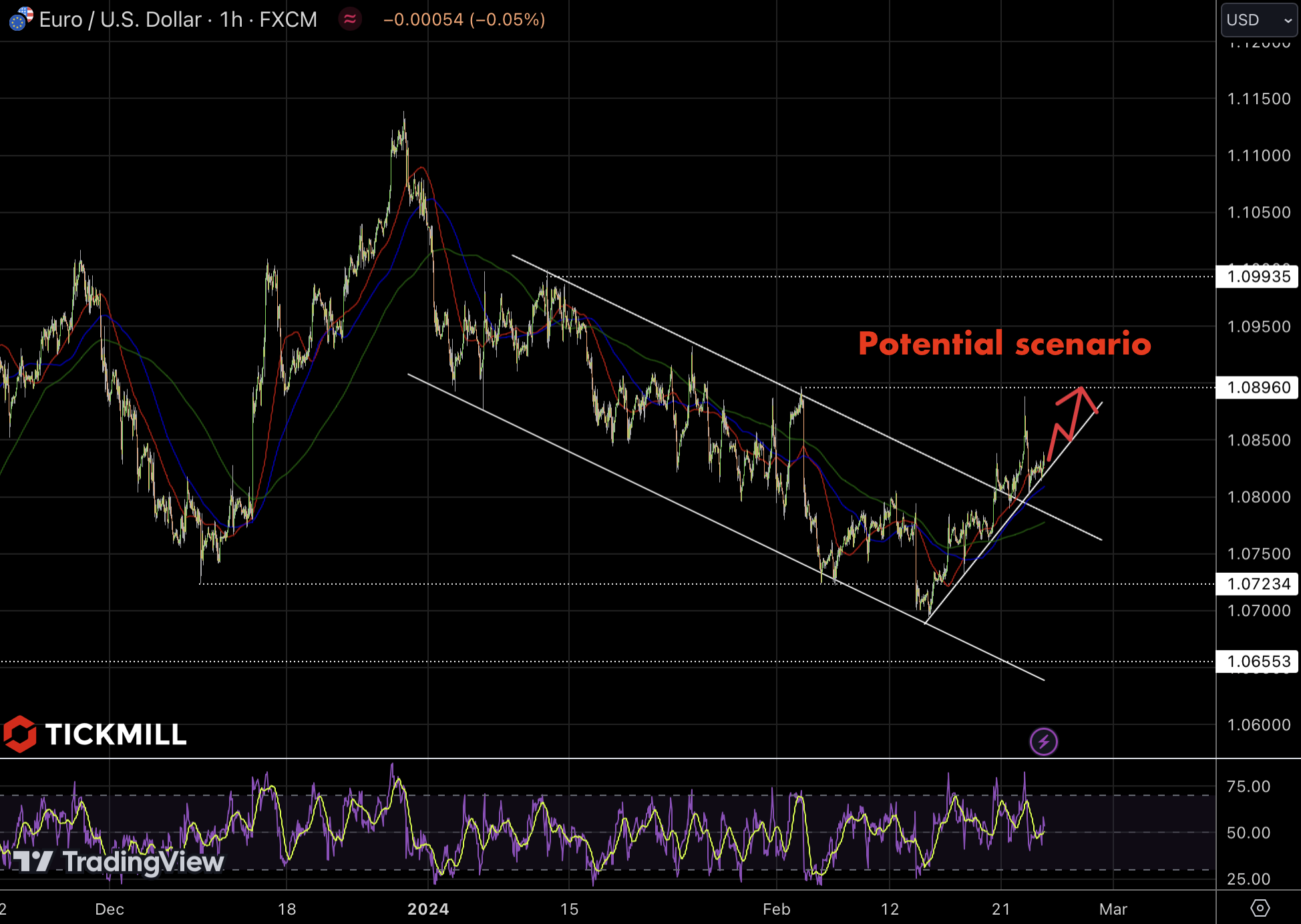

The EURUSD pair continues to fluctuate in a narrow range of 1.085-1.09 on Tuesday, to which it shifted after the release of the U.S. inflation report and strong labor market data (initial unemployment claims) last week. The earlier range was 1.09-1.10. Interestingly, the pair still cannot determine its direction and simply moves from range to range. This indicates that both the ECB and the Fed have not formed a market consensus that they are transitioning to a policy easing cycle. This week, clarity is expected to come from the ECB on Thursday, as well as EU services and manufacturing PMI on Wednesday. These will be preliminary PMI readings from HCOB for the first month of this year. A slight improvement is expected for the EU and Germany (more precisely, the pace of activity deterioration will slow down slightly). As for the ECB meeting, the market will assess whose side Lagarde will ultimately take – the hawks or doves of the Governing Council. Unlike the Fed, where there is a relative consensus, ECB officials are divided – some are eager to cut rates, while others prefer to wait for more convincing signals from the inflation front before changing rates.

From a technical point of view, short-term risks for EURUSD are tilted towards the downside, albeit slightly. Attempting to go long on the pair can be considered in the area of 1.08 (the December low of last year):

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

The Bank of Japan left the parameters of monetary policy unchanged at today's meeting. BOJ Governor Ueda adopted an ambiguous position regarding withdrawal from QE policy and interest rate hikes, even though in the last quarter of last year, the Japanese yen significantly strengthened on expectations that the BOJ would begin tapering its accommodative policy and 'catch up' with its counterparts in monetary tightening. Trying to explain the indecision, the BOJ chief referred to the uncertainty associated with negotiations on wage hikes by major Japanese companies. Without wage hikes, raising interest rates would be risky, as the BOJ could inadvertently trigger deflationary pressure in the economy and undermine all progress on inflation. Fragility of the situation is underscored by the fact that wage growth in Japan slowed to just 0.2% in November of last year after decent figures in several previous months:

Societe Generale believes that, at the moment, USDJPY is overvalued, and alignment with current yield spreads between Japanese and American bonds (one of the main factors driving yen demand) would be achieved at a cheaper USDJPY rate. However, it is worth noting that current rates in the U.S. reflect the shift in market expectations that the first rate cut in the U.S. is being pushed from March to May, following a series of strong reports on the American economy in January. If the positive series of fundamental data on the U.S. is interrupted, USDJPY should move lower, aligning with the yield differentials.

From a technical analysis perspective, the upward trend in USDJPY that started early last year was disrupted at the end of October when speculation arose that the Bank of Japan would begin unwinding its ultra-accommodative policy. The price broke the ascending channel, declined until the end of the year, but turned around at the beginning of the new year. The reversal zone was around 140 yen per dollar, where a long-term support line also passed (orange line on the chart):

The fact that the price held above the long-term uptrend line and energetically began to rise after the New Year indicates that there are long-term investors in the market expecting the overall trend of yen depreciation to continue. Short-term and medium-term resistance levels for the pair will be 148 (where the price is currently) and the area of 152 yen per dollar. In case of a breakthrough and consolidation, the rally may only accelerate.

The EURUSD pair continues to fluctuate in a narrow range of 1.085-1.09 on Tuesday, to which it shifted after the release of the U.S. inflation report and strong labor market data (initial unemployment claims) last week. The earlier range was 1.09-1.10. Interestingly, the pair still cannot determine its direction and simply moves from range to range. This indicates that both the ECB and the Fed have not formed a market consensus that they are transitioning to a policy easing cycle. This week, clarity is expected to come from the ECB on Thursday, as well as EU services and manufacturing PMI on Wednesday. These will be preliminary PMI readings from HCOB for the first month of this year. A slight improvement is expected for the EU and Germany (more precisely, the pace of activity deterioration will slow down slightly). As for the ECB meeting, the market will assess whose side Lagarde will ultimately take – the hawks or doves of the Governing Council. Unlike the Fed, where there is a relative consensus, ECB officials are divided – some are eager to cut rates, while others prefer to wait for more convincing signals from the inflation front before changing rates.

From a technical point of view, short-term risks for EURUSD are tilted towards the downside, albeit slightly. Attempting to go long on the pair can be considered in the area of 1.08 (the December low of last year):

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.