tickmill-news

Tickmill Representative

- Messages

- 79

What does seasonality tell us about equity markets growth in February?

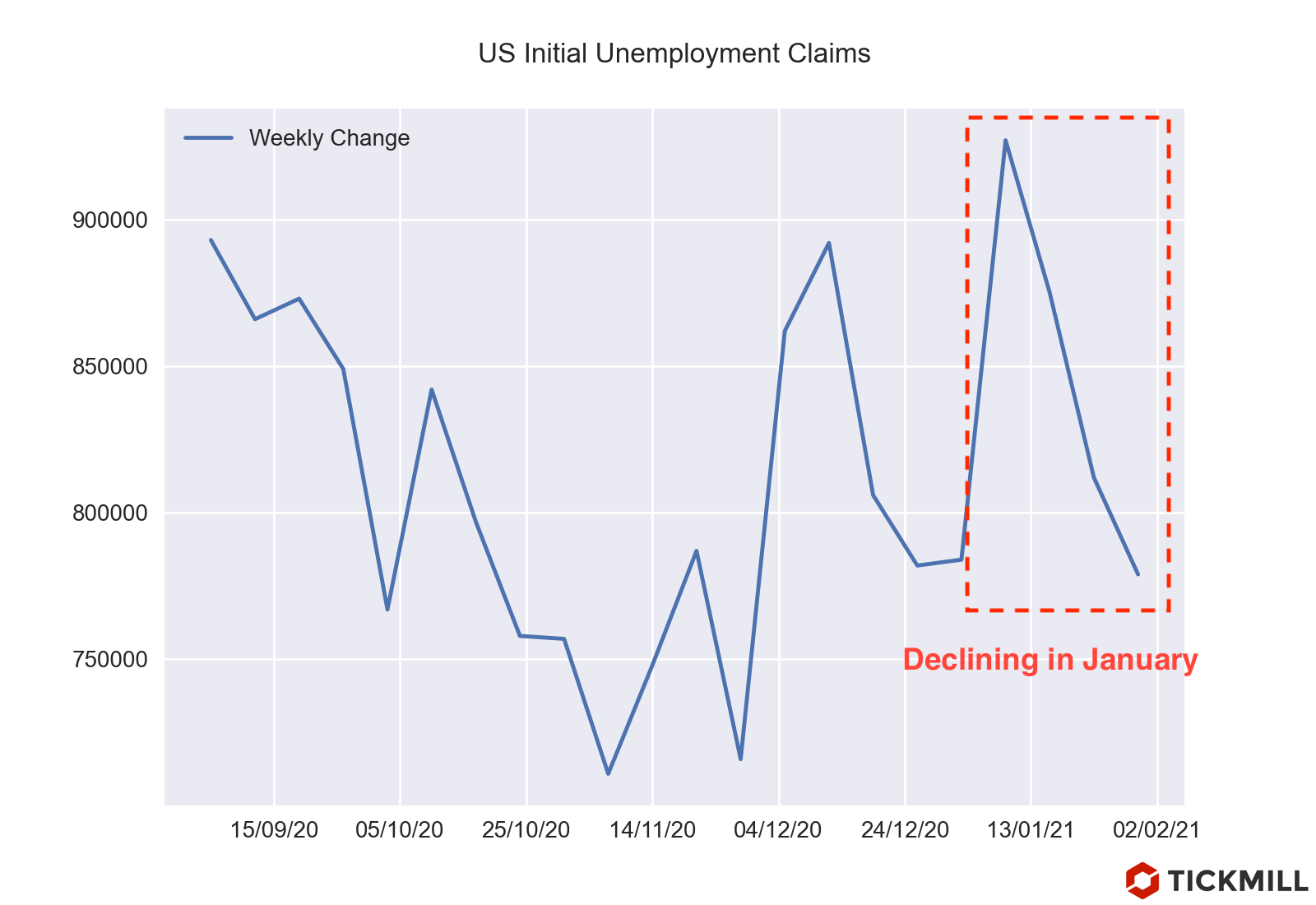

US consumer confidence ticked higher in January, but details of the Conference Board report showed persistent concerns of households about job opportunities. This suggests weak labor market dynamics could extend into January, following negative NFP surprise in December.

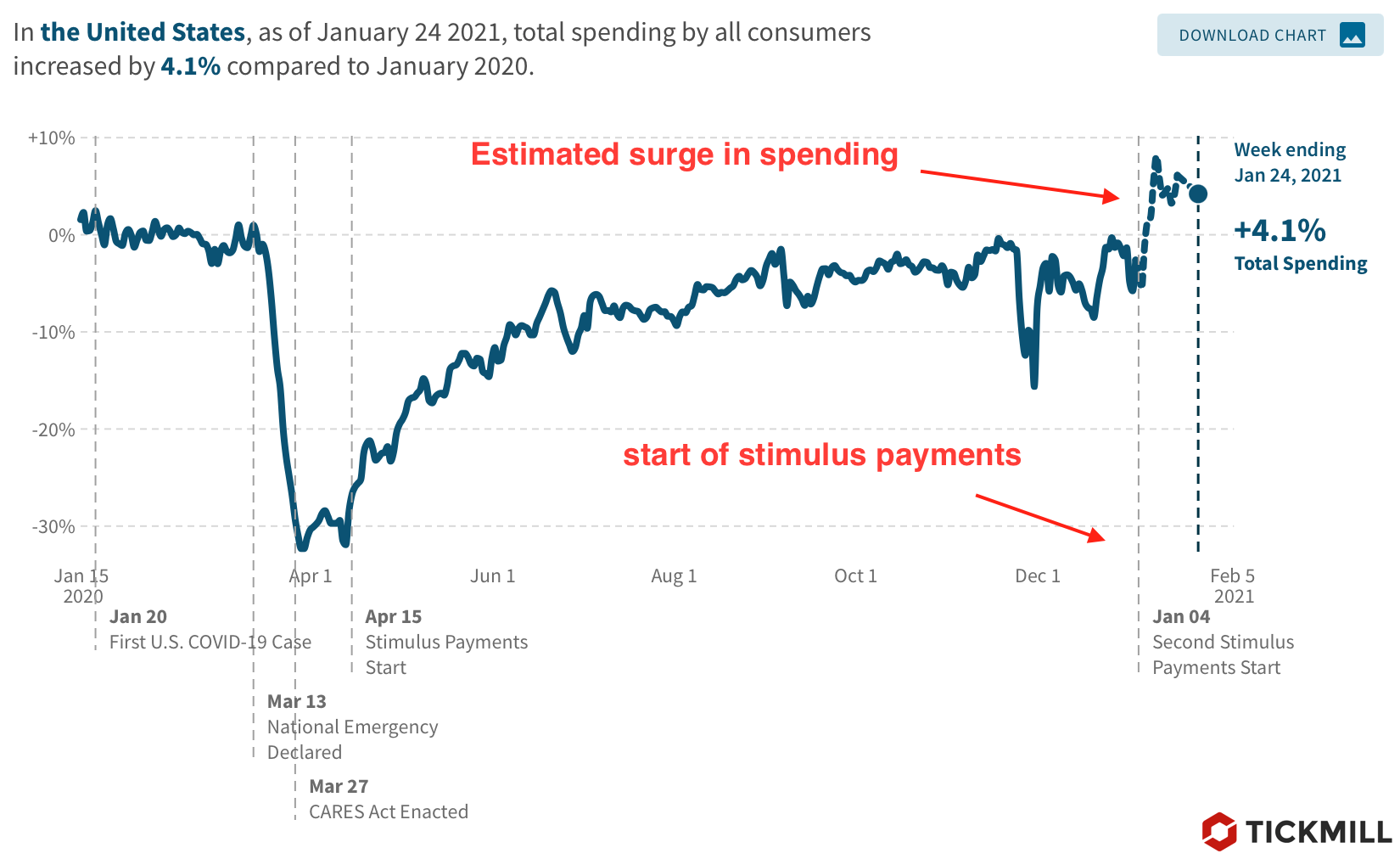

Nonetheless, the Conference Board survey showed that US households remain optimistic and are planning to buy real estate and cars within the next 6 months. The US economy is driven by consumption and the data gives hope that the forecasts for economic expansion in the first quarter will justify elevated equity valuations.

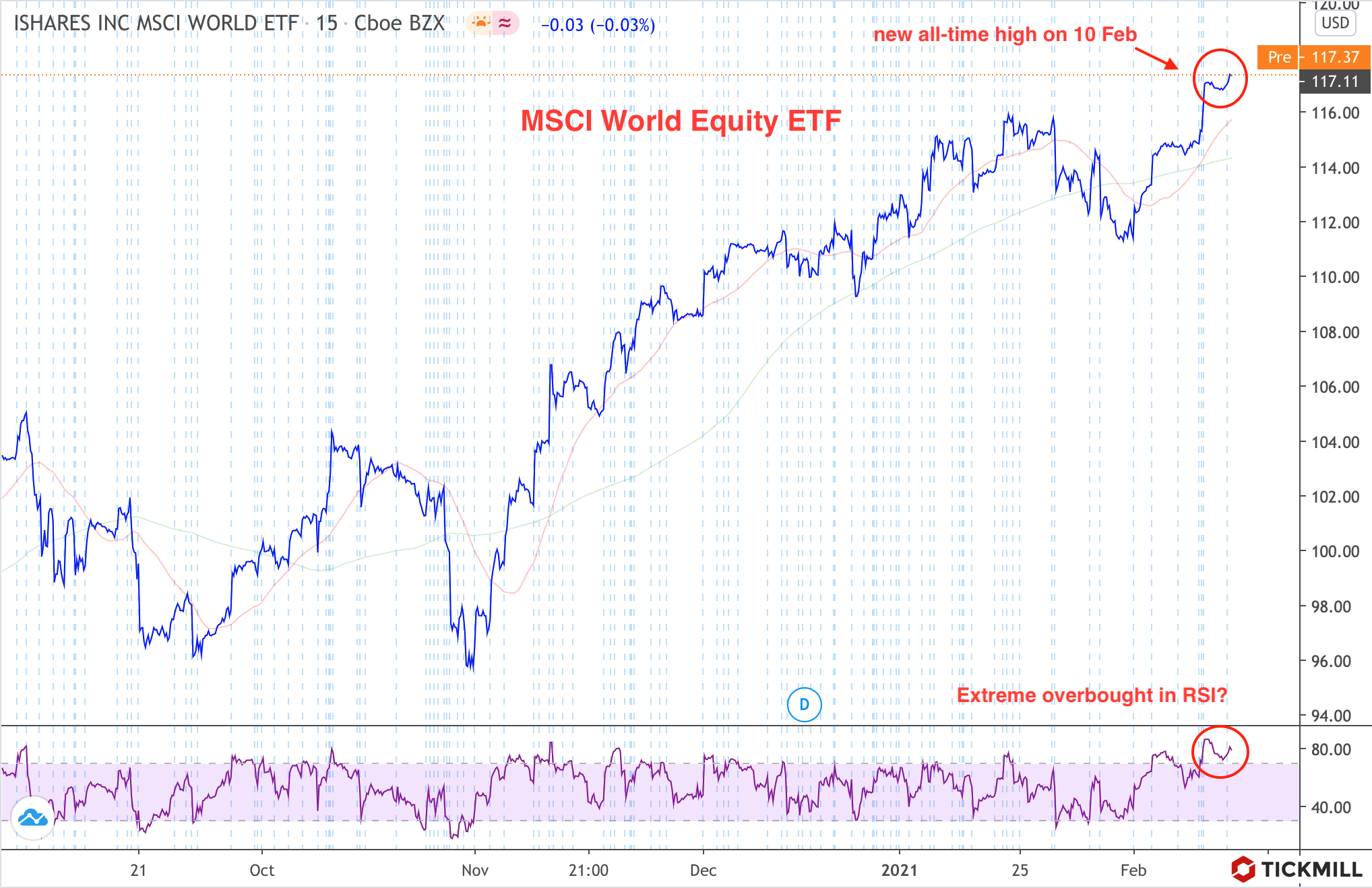

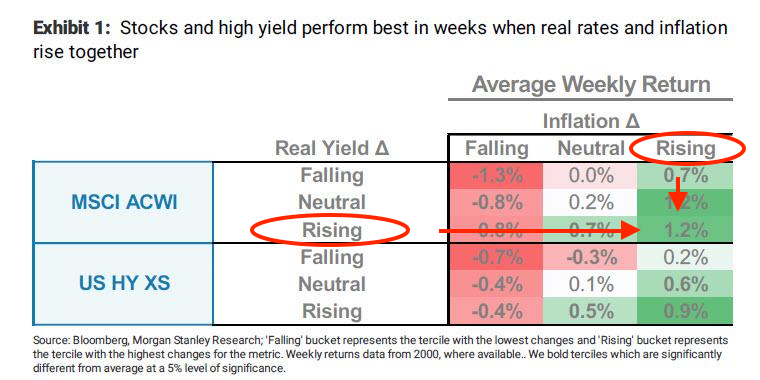

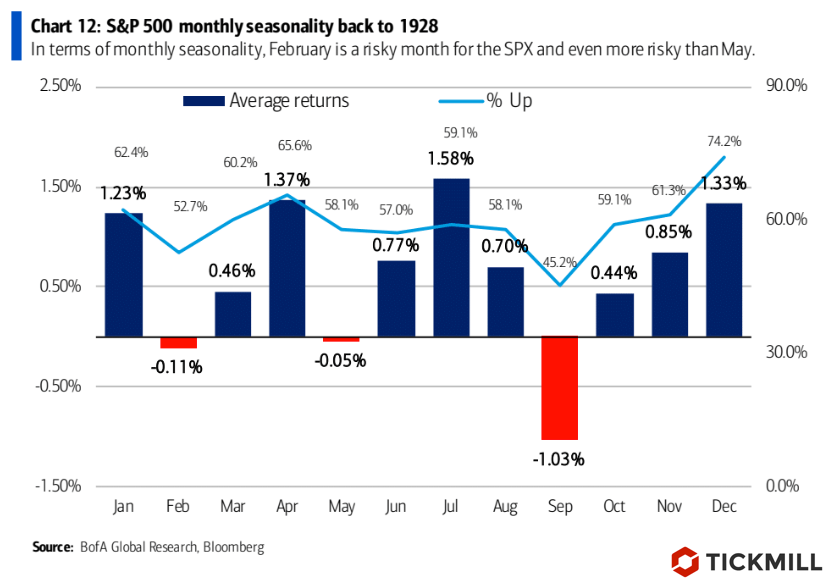

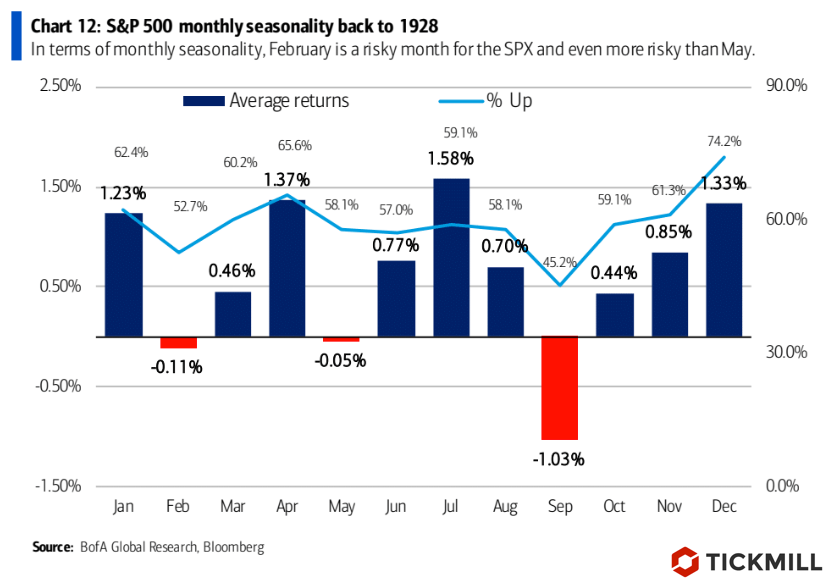

In addition to the feeling of overbought in the market, the bullish trend is at risk due to news background turning less rosy. This is a shift in expectations regarding the US stimulus package (towards a smaller size, ~ $ 1 tn., against the expected $2 tn.), and numerous reports that vaccine manufacturers are delaying supplies, which slows down vaccinations, delaying the start of easing of lockdowns. It is worth to pay attention to seasonality factor, which tells us that equity market grows weakly in February, and on average experiences a correction:

The US consumer sentiment index rose from 87.1 to 89.3 in January. It cannot be ruled out that the main merit came from the $900 billion in aid to the economy which the government approved in December, helping economy to avert a hit to propensity to consumption.

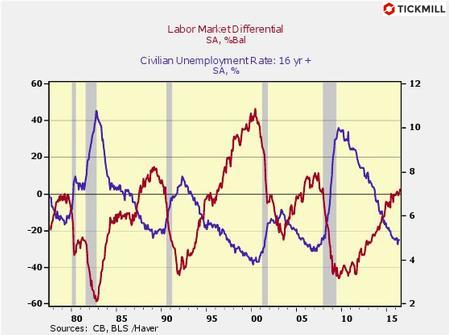

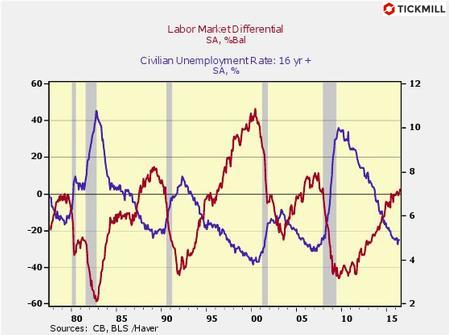

In terms of the report's connection to the labor market, a highly correlated with unemployment rate indicator called labor market differential declined from -1.9 points in December to -3.2 points in January. The correlation with unemployment rate looks really tight:

This useful indicator is calculated on the basis of the attitude of those respondents who believe that there are enough vacancies in the labor market to those who believe that it is difficult to find a job. The decline in the index increases the chances that we will see a negative surprise in Payrolls in February, as happened with the January report. That can be a catalyst for equity market correction.

Worsening expectations for the European economy in line with the latest data on the state of the business climate in Germany, indices of activity in the manufacturing sector and consumer optimism in Germany and France, worsened outlook for European assets. European stocks remain on the defensive, with the Euro down 0.25% against the dollar and about the same against the pound. German GFk Consumer Confidence Index fell from -7.5 to -15.6, indicating an increase in deflation risks. French consumers were also disappointed by the outlook for personal incomes with the index falling short of market expectations in January.

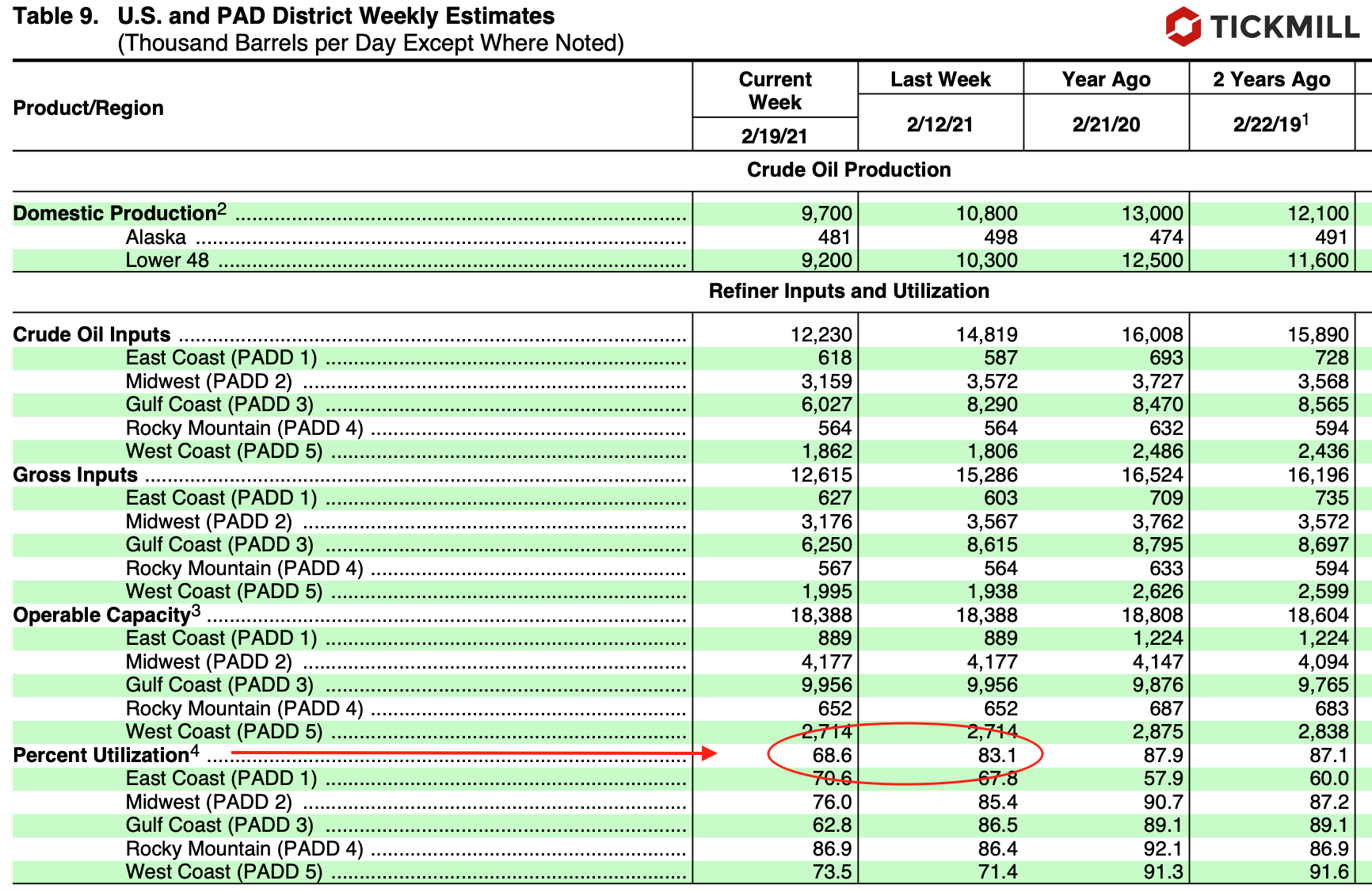

Oil prices were supported by API data, as well as Chinese statistics on new cases of Covid-19, which showed a further decline, thus reducing the risk of new lockdowns. If the EIA data confirms the API estimate for reserves, the price of WTI is likely to try to test $53 today, in part thanks to momentum from Tuesday.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

US consumer confidence ticked higher in January, but details of the Conference Board report showed persistent concerns of households about job opportunities. This suggests weak labor market dynamics could extend into January, following negative NFP surprise in December.

Nonetheless, the Conference Board survey showed that US households remain optimistic and are planning to buy real estate and cars within the next 6 months. The US economy is driven by consumption and the data gives hope that the forecasts for economic expansion in the first quarter will justify elevated equity valuations.

In addition to the feeling of overbought in the market, the bullish trend is at risk due to news background turning less rosy. This is a shift in expectations regarding the US stimulus package (towards a smaller size, ~ $ 1 tn., against the expected $2 tn.), and numerous reports that vaccine manufacturers are delaying supplies, which slows down vaccinations, delaying the start of easing of lockdowns. It is worth to pay attention to seasonality factor, which tells us that equity market grows weakly in February, and on average experiences a correction:

The US consumer sentiment index rose from 87.1 to 89.3 in January. It cannot be ruled out that the main merit came from the $900 billion in aid to the economy which the government approved in December, helping economy to avert a hit to propensity to consumption.

In terms of the report's connection to the labor market, a highly correlated with unemployment rate indicator called labor market differential declined from -1.9 points in December to -3.2 points in January. The correlation with unemployment rate looks really tight:

This useful indicator is calculated on the basis of the attitude of those respondents who believe that there are enough vacancies in the labor market to those who believe that it is difficult to find a job. The decline in the index increases the chances that we will see a negative surprise in Payrolls in February, as happened with the January report. That can be a catalyst for equity market correction.

Worsening expectations for the European economy in line with the latest data on the state of the business climate in Germany, indices of activity in the manufacturing sector and consumer optimism in Germany and France, worsened outlook for European assets. European stocks remain on the defensive, with the Euro down 0.25% against the dollar and about the same against the pound. German GFk Consumer Confidence Index fell from -7.5 to -15.6, indicating an increase in deflation risks. French consumers were also disappointed by the outlook for personal incomes with the index falling short of market expectations in January.

Oil prices were supported by API data, as well as Chinese statistics on new cases of Covid-19, which showed a further decline, thus reducing the risk of new lockdowns. If the EIA data confirms the API estimate for reserves, the price of WTI is likely to try to test $53 today, in part thanks to momentum from Tuesday.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.