Tifia FX

TifiaFx Representative

- Messages

- 30

EUR/USD: Eurodollar remains under pressure

06/03/2019

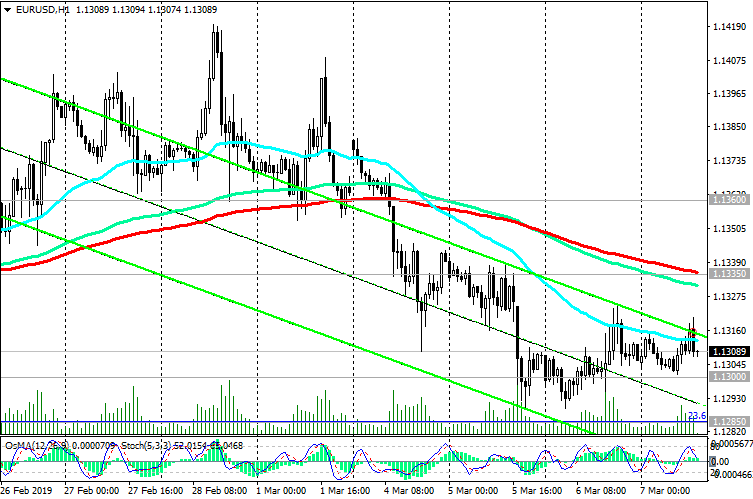

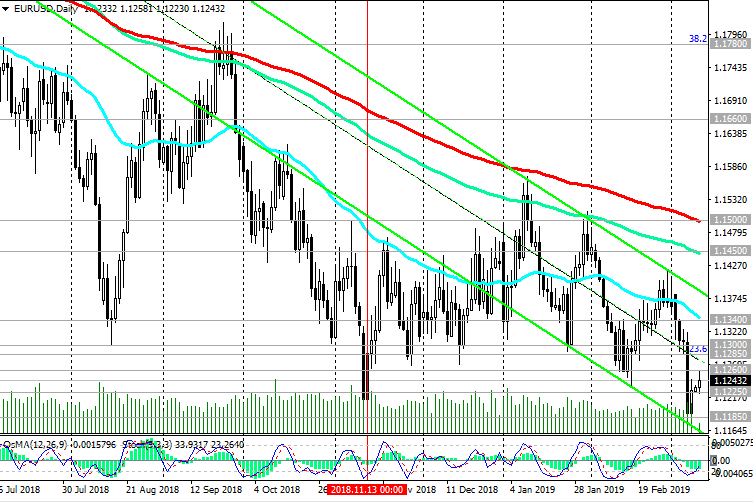

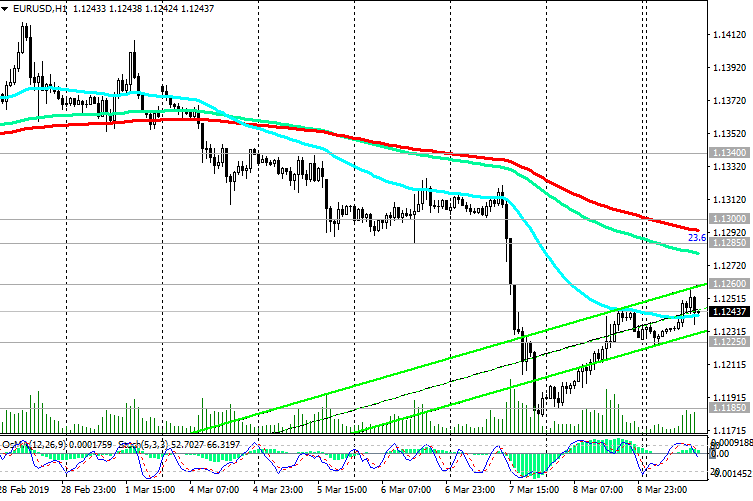

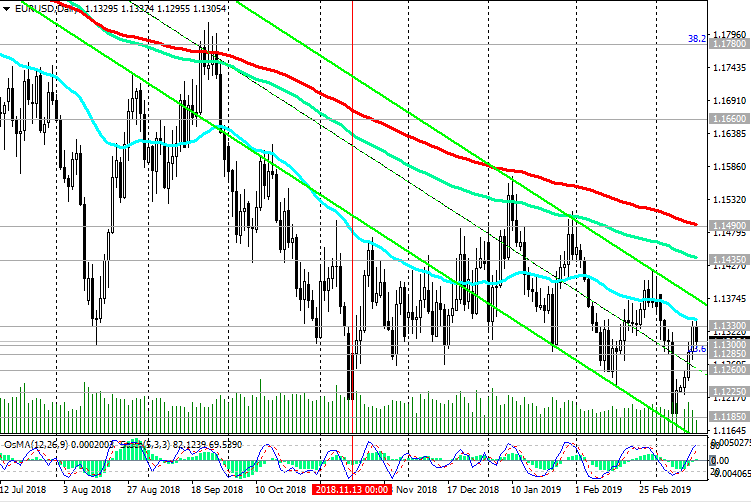

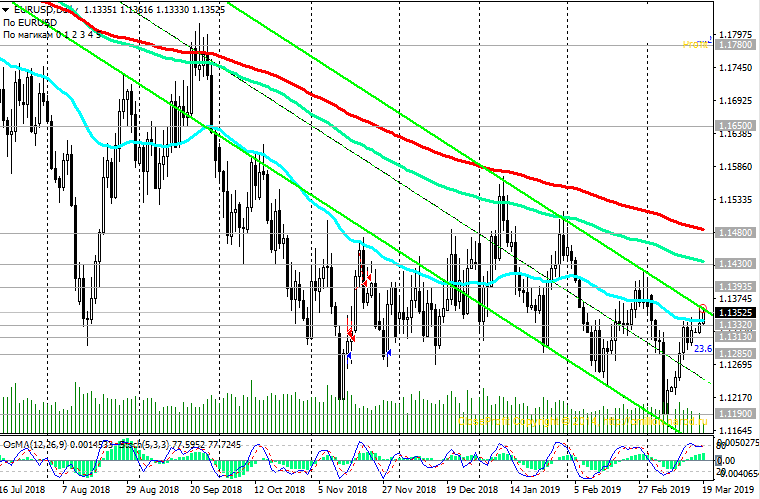

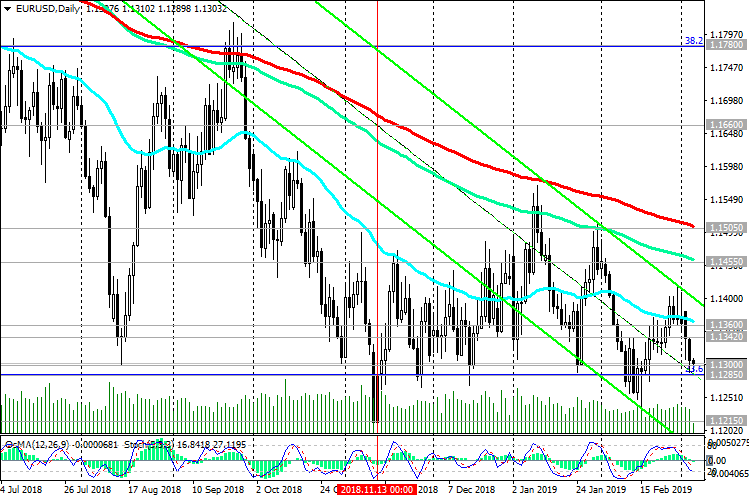

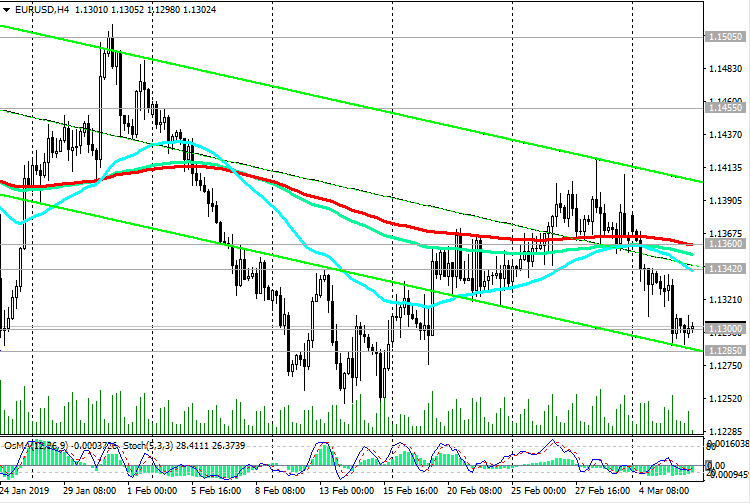

Despite the positive macro statistics received on Tuesday from Europe, the Eurodollar could not strengthen. Moreover, on Tuesday, the EUR / USD pair fell, losing about 30 points, to the level of 1.1308. Reducing the pair is contributed by the general strengthening of the dollar, and expectations of restrained statements at tomorrow's meeting of the ECB regarding the prospects for monetary policy. As expected, the ECB will maintain its current monetary policy and reduce expectations for growth of the European economy and inflation in the Eurozone. Many market participants expect the rate to be raised by the ECB not earlier than mid-2020.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

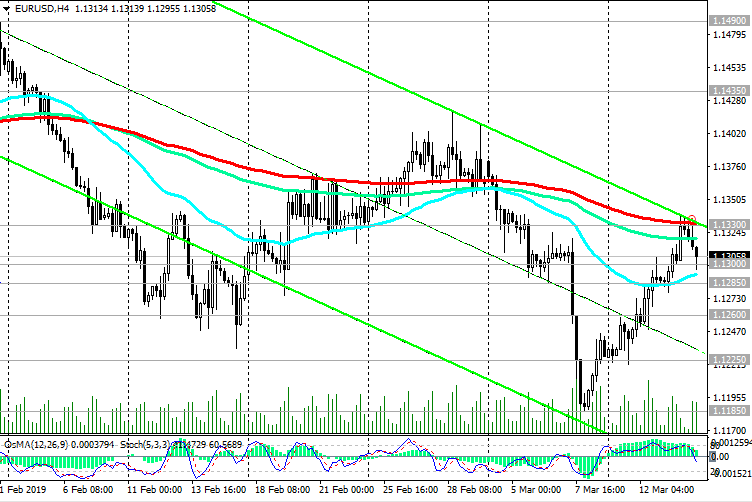

On Wednesday, the EUR / USD remains under pressure, bargaining near the local support level of 1.1300.

In the event of a breakdown of this support level, EUR / USD will move to targets at support levels of 1.1270 (December lows), 1.1215 (November and year lows), 1.1200, 1.1120, 1.1000.

Purchases with targets at resistance levels 1.1455 (ЕМА144 on the daily chart), 1.1505 (ЕМА200 on the daily chart) are possible only after the breakdown of the resistance level 1.1360 (ЕМА200 on the 4-hour chart, ЕМА50 on the daily chart). The long-term bearish trend, which began in May 2014 near the 1.3870 mark, remains.

Short positions are preferred.

Support Levels: 1.1300, 1.1285, 1.1215, 1.1120, 1.1000

Resistance Levels: 1.1342, 1.1360, 1.1455, 1.1505

Trading recommendations

Sell in the market. Stop-Loss 1.1345. Take-Profit 1.1285, 1.1215, 1.1120, 1.1000

Buy Stop 1.1350. Stop Loss 1.1280. Take-Profit 1.1400, 1.1455, 1.1500

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

06/03/2019

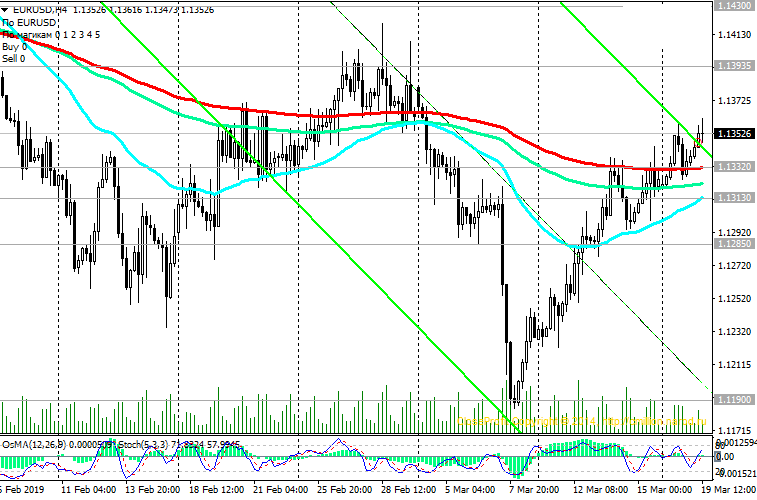

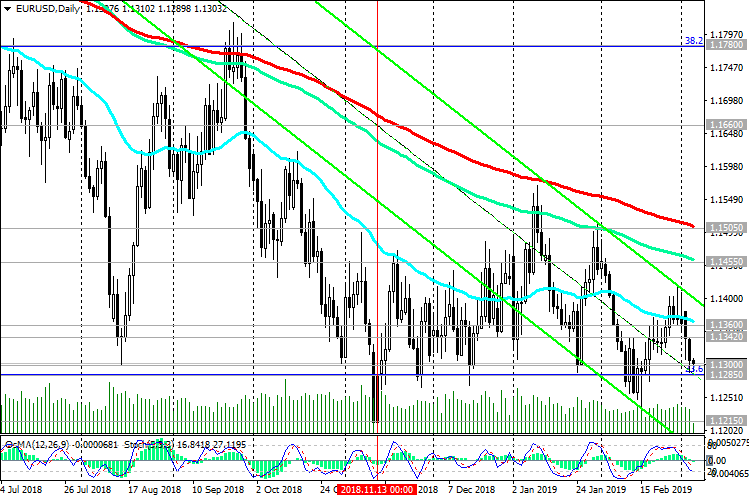

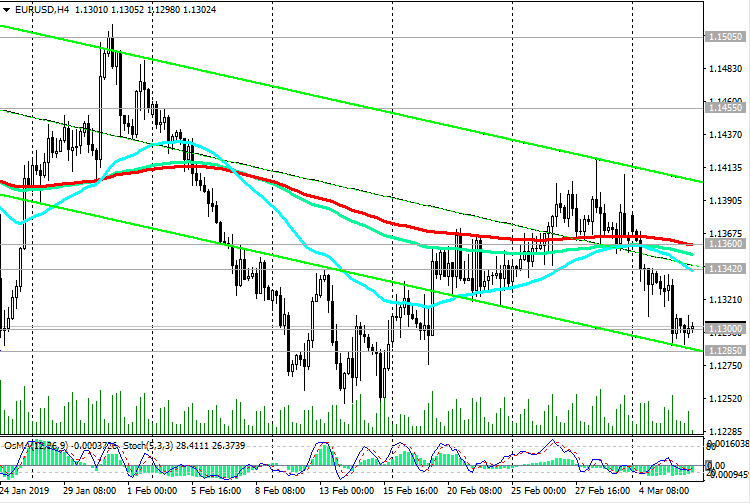

Despite the positive macro statistics received on Tuesday from Europe, the Eurodollar could not strengthen. Moreover, on Tuesday, the EUR / USD pair fell, losing about 30 points, to the level of 1.1308. Reducing the pair is contributed by the general strengthening of the dollar, and expectations of restrained statements at tomorrow's meeting of the ECB regarding the prospects for monetary policy. As expected, the ECB will maintain its current monetary policy and reduce expectations for growth of the European economy and inflation in the Eurozone. Many market participants expect the rate to be raised by the ECB not earlier than mid-2020.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

On Wednesday, the EUR / USD remains under pressure, bargaining near the local support level of 1.1300.

In the event of a breakdown of this support level, EUR / USD will move to targets at support levels of 1.1270 (December lows), 1.1215 (November and year lows), 1.1200, 1.1120, 1.1000.

Purchases with targets at resistance levels 1.1455 (ЕМА144 on the daily chart), 1.1505 (ЕМА200 on the daily chart) are possible only after the breakdown of the resistance level 1.1360 (ЕМА200 on the 4-hour chart, ЕМА50 on the daily chart). The long-term bearish trend, which began in May 2014 near the 1.3870 mark, remains.

Short positions are preferred.

Support Levels: 1.1300, 1.1285, 1.1215, 1.1120, 1.1000

Resistance Levels: 1.1342, 1.1360, 1.1455, 1.1505

Trading recommendations

Sell in the market. Stop-Loss 1.1345. Take-Profit 1.1285, 1.1215, 1.1120, 1.1000

Buy Stop 1.1350. Stop Loss 1.1280. Take-Profit 1.1400, 1.1455, 1.1500

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com