Tifia FX

TifiaFx Representative

- Messages

- 30

EUR/USD: Fed meeting

03/20/2019

The dollar retains mainly the position before the publication at 18:00 (GMT) of the decision on the interest rate of the Fed. On Wednesday, futures for the dollar index DXY, which measures the value of the dollar against a basket of 6 major world currencies, is trading near 95.93, down 66 points from the closing price last Friday, but up 10 points from the closing price on Tuesday.

Market participants do not expect changes in monetary policy at this Fed meeting, which will end on Wednesday with the publication of a rate decision and a press conference. Its beginning is scheduled for 18:30 (GMT).

Probably, the Fed will again declare patience, as well as lower forecasts for interest rates and US economic growth. It is possible that the leaders of the Fed will declare that the key rate has reached its peak. To restore funding for the US economy from abroad, the dollar must weaken.

Earlier, US President Donald Trump also repeatedly criticized the Fed’s monetary policy against the backdrop of low inflation in the country.

Nevertheless, the demand for the dollar may remain in the medium and long term against the backdrop of international trade wars, regardless of the actions of the Fed. The US economy still looks more stable than other major global economies.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

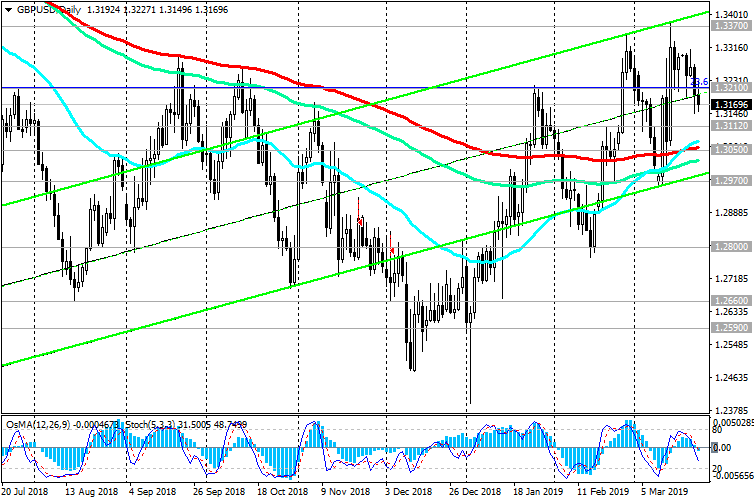

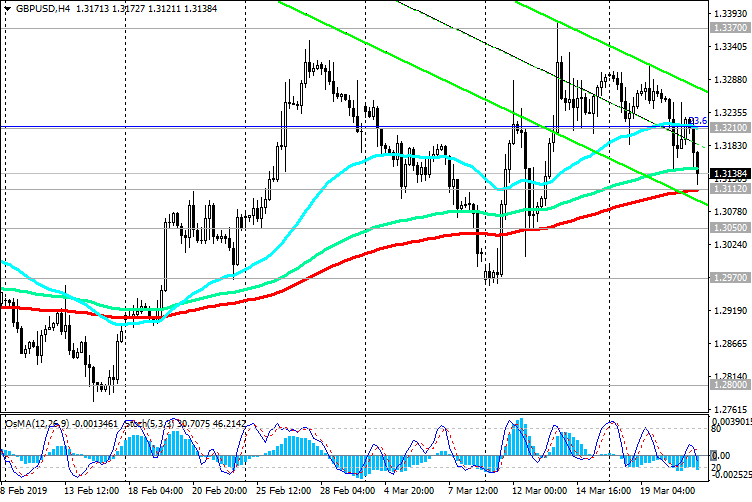

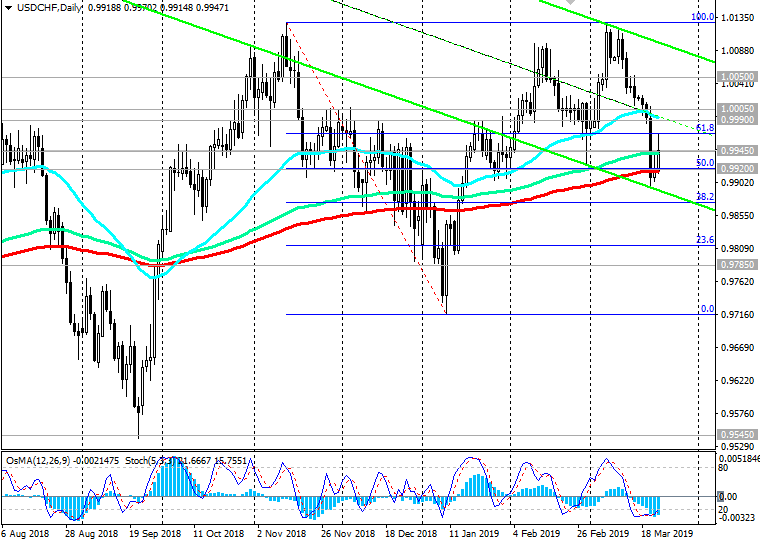

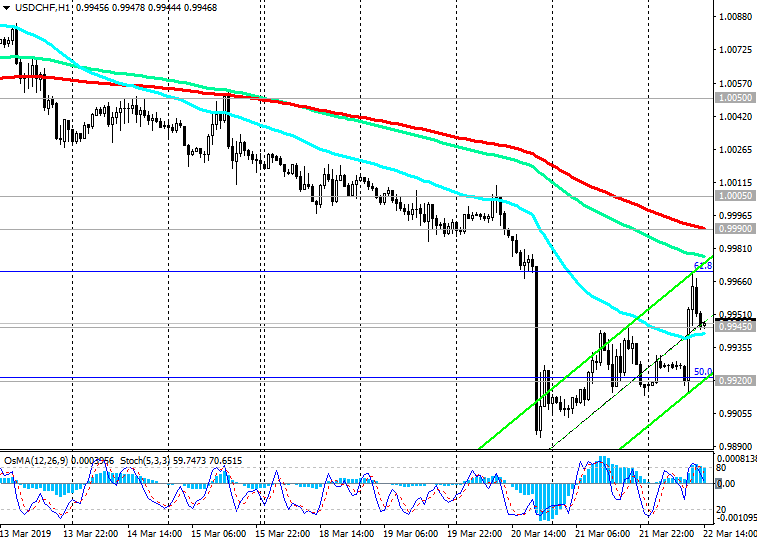

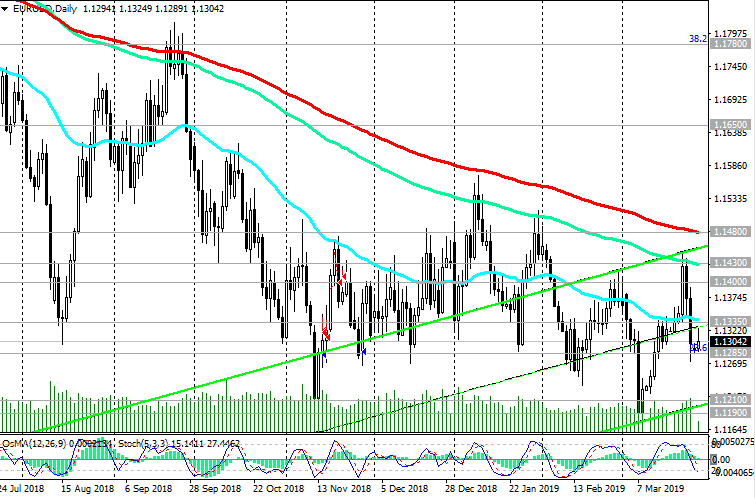

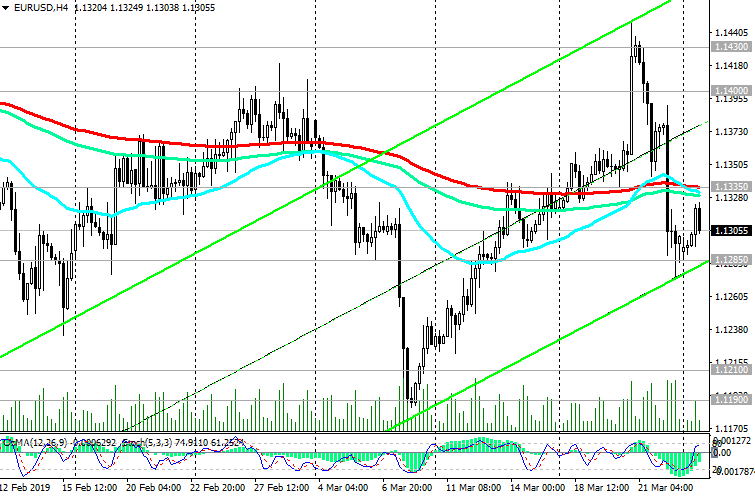

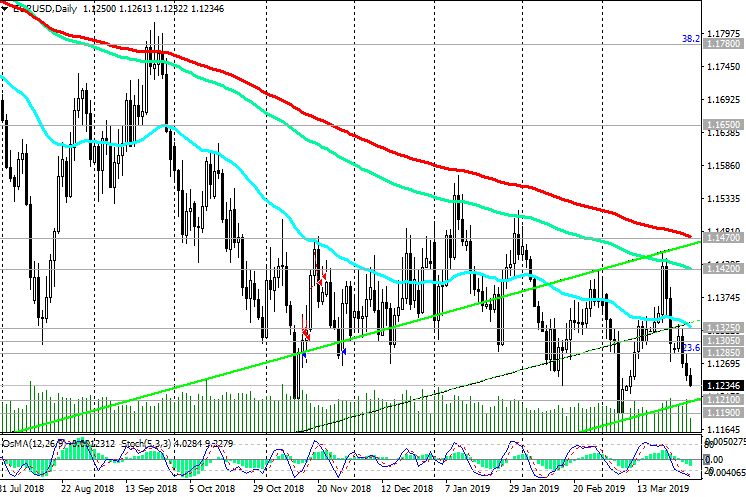

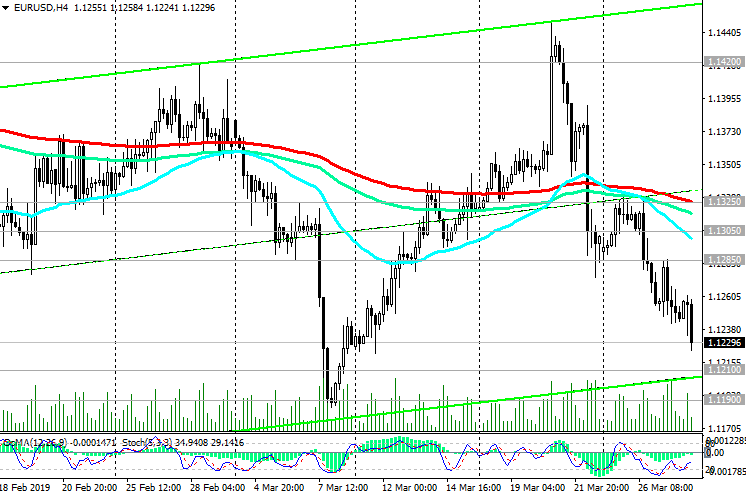

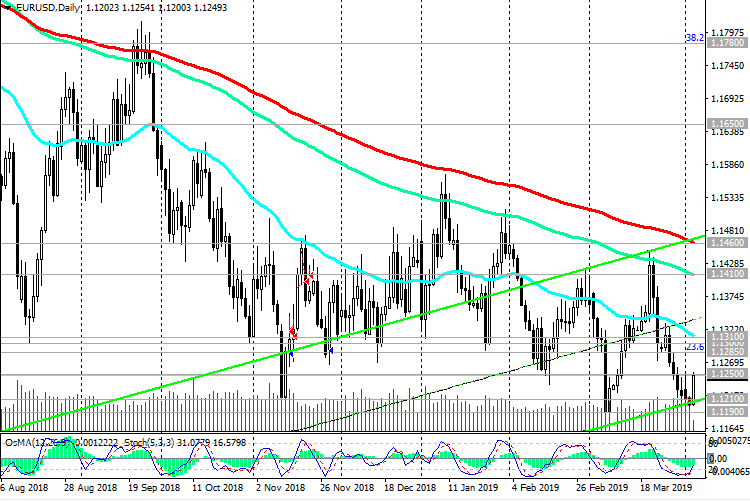

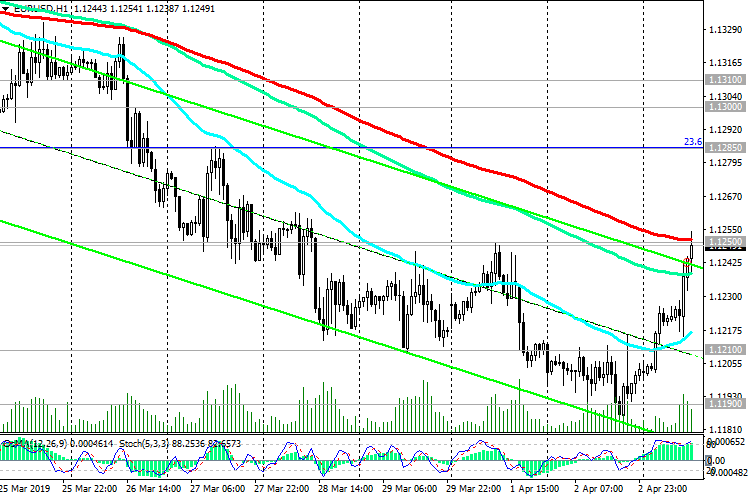

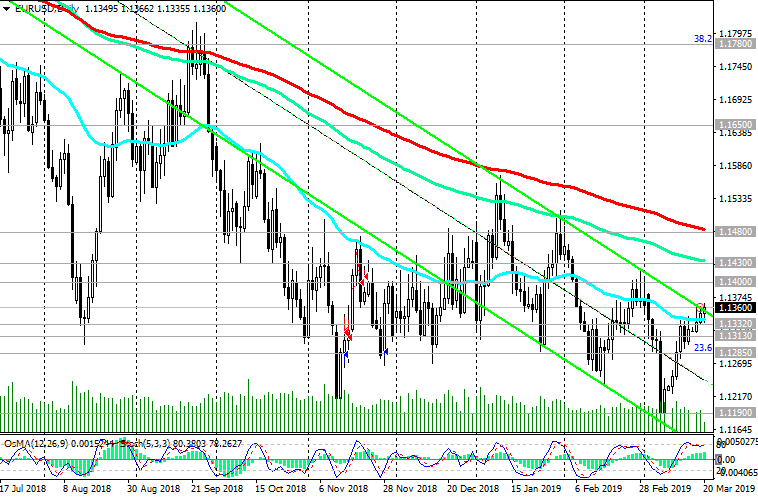

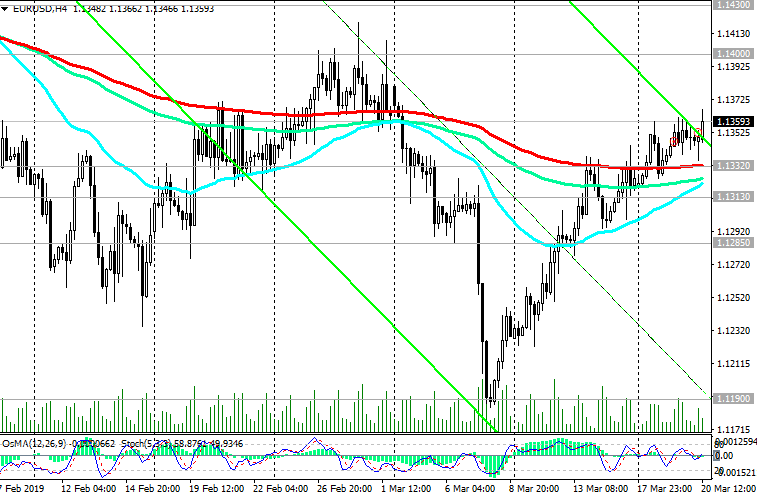

On Wednesday, the EUR / USD is trying to develop an upward trend above the support level of 1.1332 (ЕМА200 on the 4-hour chart). Below this level, downward dynamics prevail. The breakdown of the support level of 1.1313 (EMA200 on the 1-hour chart) will be a signal to resume sales.

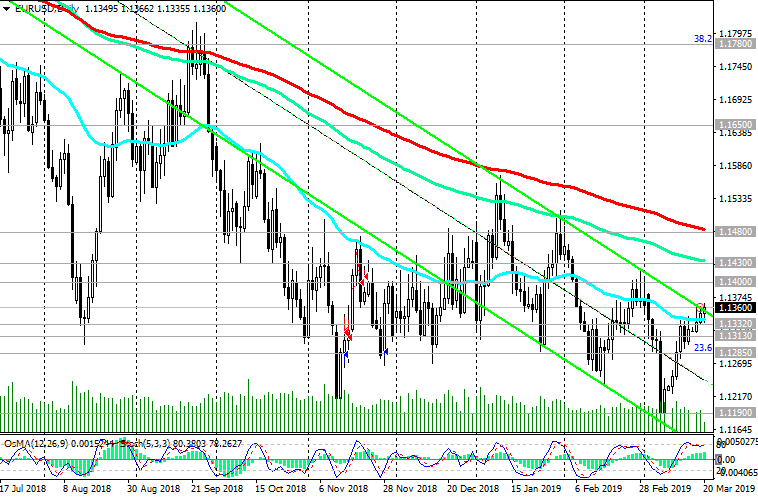

The targets for the decline after the breakdown of the support level of 1.1285 (the Fibonacci level of 23.6% of the correction to the fall from the level of 1.3900 that began in May 2014) will be the support levels of 1.1185, 1.1120, 1.1000.

The long-term bearish trend, which began in May 2014 near the 1.3870 mark, remains.

Short positions are preferred.

Long positions will become relevant after EUR / USD is fixed in the zone above the local resistance level of 1.1350.

Support Levels: 1.1332, 1.1313, 1.1300, 1.1285, 1.1260, 1.1225, 1.1185, 1.1120, 1.1000

Resistance Levels: 1.1350, 1.1400, 1.1430, 1.1480

Trading recommendations

Sell Stop 1.1330. Stop-Loss 1.1365. Take-Profit 1.1313, 1.1300, 1.1285, 1.1260, 1.1225, 1.1185, 1.1120

Buy Stop 1.1365. Stop-Loss 1.1330. Take-Profit 1.1400, 1.1430, 1.1480

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

03/20/2019

The dollar retains mainly the position before the publication at 18:00 (GMT) of the decision on the interest rate of the Fed. On Wednesday, futures for the dollar index DXY, which measures the value of the dollar against a basket of 6 major world currencies, is trading near 95.93, down 66 points from the closing price last Friday, but up 10 points from the closing price on Tuesday.

Market participants do not expect changes in monetary policy at this Fed meeting, which will end on Wednesday with the publication of a rate decision and a press conference. Its beginning is scheduled for 18:30 (GMT).

Probably, the Fed will again declare patience, as well as lower forecasts for interest rates and US economic growth. It is possible that the leaders of the Fed will declare that the key rate has reached its peak. To restore funding for the US economy from abroad, the dollar must weaken.

Earlier, US President Donald Trump also repeatedly criticized the Fed’s monetary policy against the backdrop of low inflation in the country.

Nevertheless, the demand for the dollar may remain in the medium and long term against the backdrop of international trade wars, regardless of the actions of the Fed. The US economy still looks more stable than other major global economies.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

On Wednesday, the EUR / USD is trying to develop an upward trend above the support level of 1.1332 (ЕМА200 on the 4-hour chart). Below this level, downward dynamics prevail. The breakdown of the support level of 1.1313 (EMA200 on the 1-hour chart) will be a signal to resume sales.

The targets for the decline after the breakdown of the support level of 1.1285 (the Fibonacci level of 23.6% of the correction to the fall from the level of 1.3900 that began in May 2014) will be the support levels of 1.1185, 1.1120, 1.1000.

The long-term bearish trend, which began in May 2014 near the 1.3870 mark, remains.

Short positions are preferred.

Long positions will become relevant after EUR / USD is fixed in the zone above the local resistance level of 1.1350.

Support Levels: 1.1332, 1.1313, 1.1300, 1.1285, 1.1260, 1.1225, 1.1185, 1.1120, 1.1000

Resistance Levels: 1.1350, 1.1400, 1.1430, 1.1480

Trading recommendations

Sell Stop 1.1330. Stop-Loss 1.1365. Take-Profit 1.1313, 1.1300, 1.1285, 1.1260, 1.1225, 1.1185, 1.1120

Buy Stop 1.1365. Stop-Loss 1.1330. Take-Profit 1.1400, 1.1430, 1.1480

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com