Tifia FX

TifiaFx Representative

- Messages

- 30

XAU/USD: Current Dynamics

05/04/2019

Futures on the dollar index DXY, reflecting its value against a basket of 6 major currencies, is traded on Friday in a narrow range, near the mark of 96.92. Investors are waiting for publication at 12:30 (GMT) of data from the US labor market.

It is expected that the number of new jobs outside the agricultural sector of the US economy in March was 180,000 (against +20,000 in February), while unemployment remained at the same level of 3.8%. These are strong indicators that can support the dollar.

If the growth of NFP is below 100,000, this may cause concern for investors and economists, indicating that the growth of the American economy is slowing.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

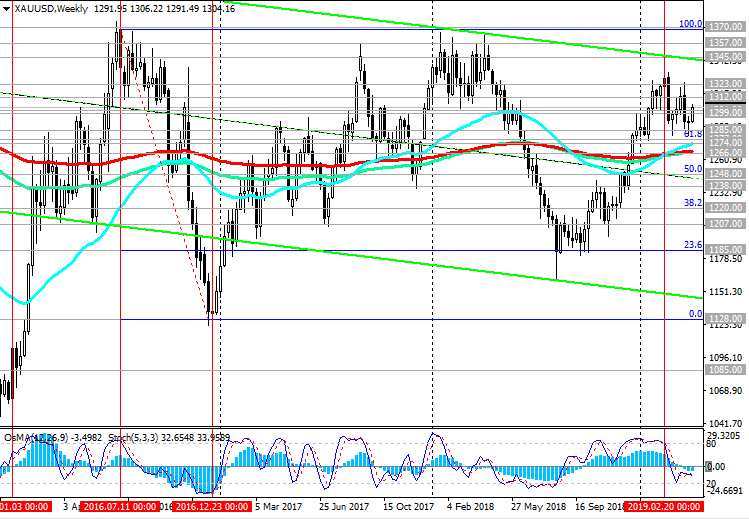

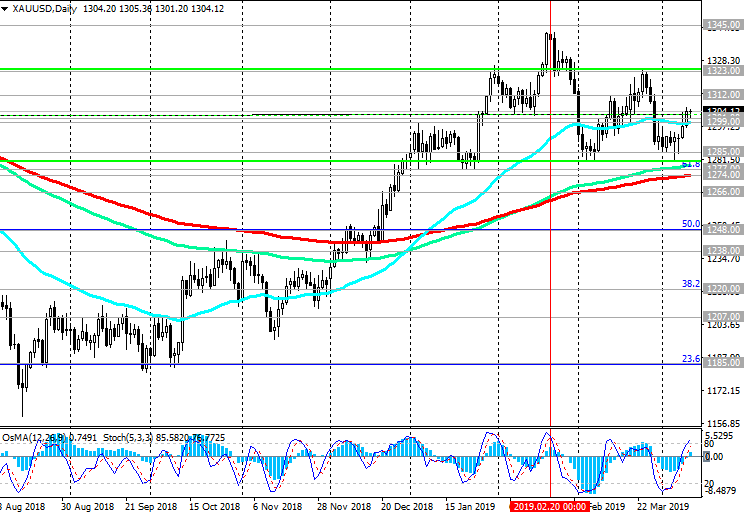

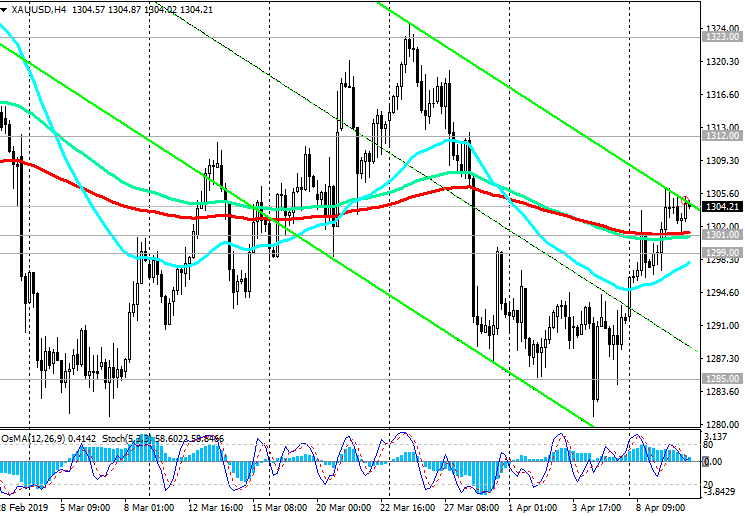

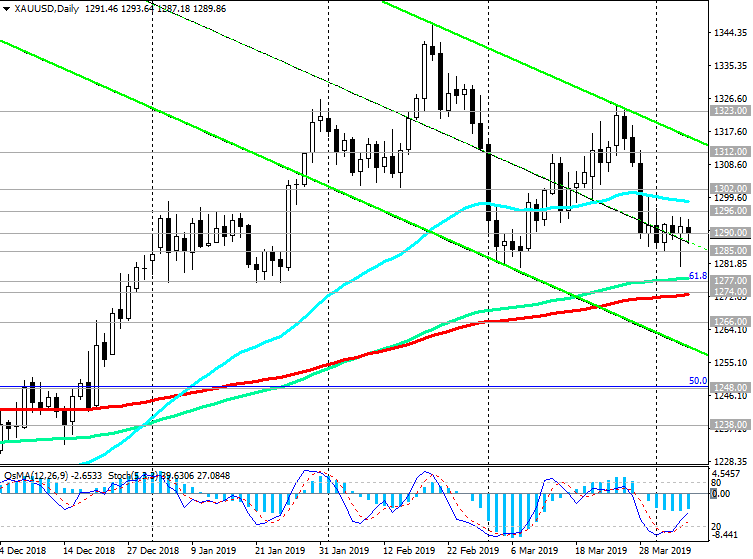

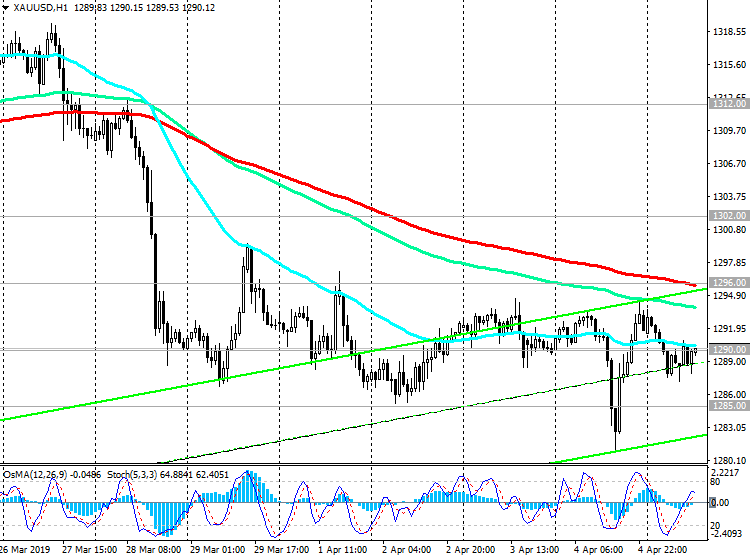

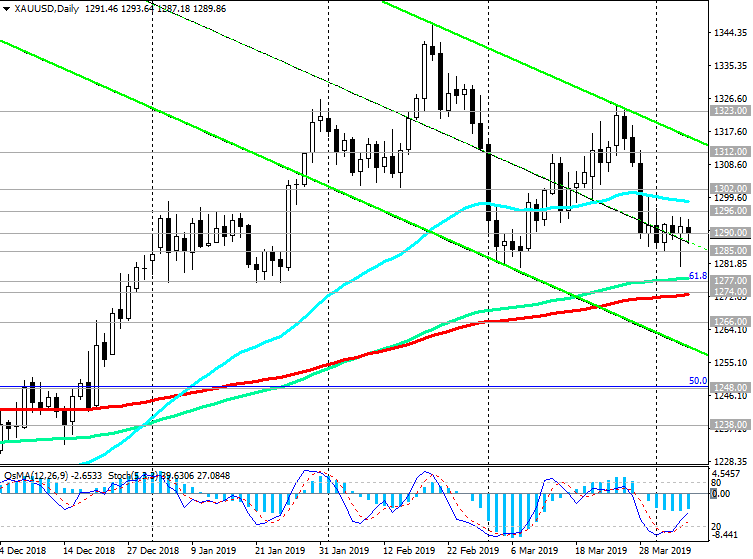

Meanwhile, the last 6 days, the XAU / USD pair is in a narrow range near the current levels due to the lack of strong drivers for further movement either down or up. Probably, today will provide investors with such guidelines. A strong report from the US labor market will strengthen the dollar and send a pair of XAU / USD to strong support levels of 1277.00 (EMA144 on the daily chart and Fibonacci 61.8% level of the correction to the decline wave since July 2016), 1274.00 (EMA200 on the daily chart).

Breakdown of the support level of 1266.00 (ЕМА200 on the weekly chart) will return XAU / USD to the global bearish trend that began in 2012 near the mark of 1795.00 and direct it to the support levels of 1197.00 (November lows), 1185.00 (Fibonacci 23.6%), 1160.00 (minimums of 2018).

The weak data on the labor market, on the contrary, will increase the attractiveness of gold. The immediate targets for the growth of XAU / USD will be resistance levels of 1323.00, 1345.00 (highs of February and 2019).

Support Levels: 1285.00, 1277.00, 1274.00, 1266.00, 1248.00

Resistance Levels: 1296.00, 1302.00, 1312.00, 1323.00, 1345.00, 1357.00, 1365.00, 1370.00

Trading recommendations

Sell Stop 1284.00. Stop-Loss 1297.00. Take-Profit 1277.00, 1274.00, 1266.00, 1248.00, 1234.00, 1220.00, 1197.00, 1185.00, 1160.00

Buy Stop 1297.00. Stop-Loss 1284.00. Take-Profit 1302.00, 1312.00, 1323.00, 1345.00, 1357.00, 1365.00, 1370.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

05/04/2019

Futures on the dollar index DXY, reflecting its value against a basket of 6 major currencies, is traded on Friday in a narrow range, near the mark of 96.92. Investors are waiting for publication at 12:30 (GMT) of data from the US labor market.

It is expected that the number of new jobs outside the agricultural sector of the US economy in March was 180,000 (against +20,000 in February), while unemployment remained at the same level of 3.8%. These are strong indicators that can support the dollar.

If the growth of NFP is below 100,000, this may cause concern for investors and economists, indicating that the growth of the American economy is slowing.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

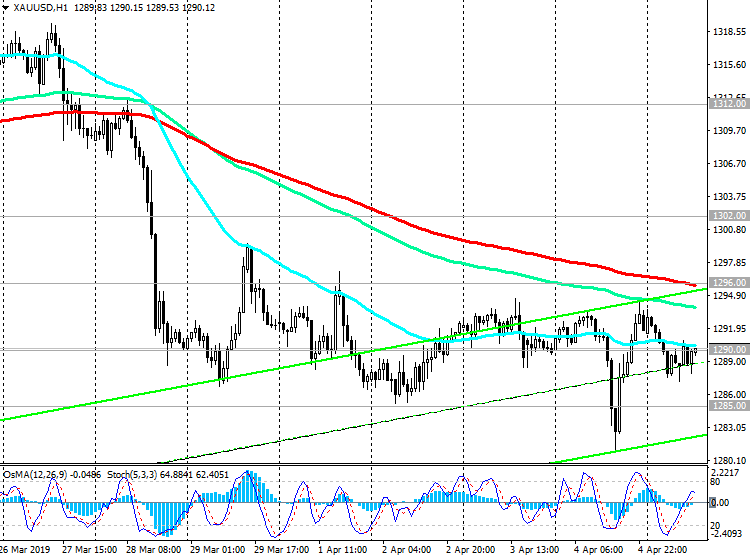

Meanwhile, the last 6 days, the XAU / USD pair is in a narrow range near the current levels due to the lack of strong drivers for further movement either down or up. Probably, today will provide investors with such guidelines. A strong report from the US labor market will strengthen the dollar and send a pair of XAU / USD to strong support levels of 1277.00 (EMA144 on the daily chart and Fibonacci 61.8% level of the correction to the decline wave since July 2016), 1274.00 (EMA200 on the daily chart).

Breakdown of the support level of 1266.00 (ЕМА200 on the weekly chart) will return XAU / USD to the global bearish trend that began in 2012 near the mark of 1795.00 and direct it to the support levels of 1197.00 (November lows), 1185.00 (Fibonacci 23.6%), 1160.00 (minimums of 2018).

The weak data on the labor market, on the contrary, will increase the attractiveness of gold. The immediate targets for the growth of XAU / USD will be resistance levels of 1323.00, 1345.00 (highs of February and 2019).

Support Levels: 1285.00, 1277.00, 1274.00, 1266.00, 1248.00

Resistance Levels: 1296.00, 1302.00, 1312.00, 1323.00, 1345.00, 1357.00, 1365.00, 1370.00

Trading recommendations

Sell Stop 1284.00. Stop-Loss 1297.00. Take-Profit 1277.00, 1274.00, 1266.00, 1248.00, 1234.00, 1220.00, 1197.00, 1185.00, 1160.00

Buy Stop 1297.00. Stop-Loss 1284.00. Take-Profit 1302.00, 1312.00, 1323.00, 1345.00, 1357.00, 1365.00, 1370.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com