Tifia FX

TifiaFx Representative

- Messages

- 30

NZD/USD: dynamics and recommendations

08/15/2019

Since the opening of today's trading day, the American dollar has been declining. At the beginning of today's European session, DXY dollar index futures are trading near 97.70, 12 pips below the opening price of today's trading day. Meanwhile, commodity currencies, including the New Zealand dollar, also remain under pressure amid a worsening trade war between the US and China.

New Zealand's export-oriented economy is extremely vulnerable amid escalating trade war between the US and China.

Last week, the RBNZ cut the rate by 50 bp to 1.00%, explaining this decision by the worsening trade war between the US and China and the loss of momentum in the New Zealand economy.

RBNZ leaders believe that wage growth remains weak. At the same time, inflationary expectations are falling, and low levels of business confidence indicate a slowdown in hiring and wage growth.

There is growing concern among participants in international financial markets that the slowdown in economic growth and the threat of recession will spread to the whole world, including China, the United States, and their trade and economic partners. It can be assumed that the global cycle of rate cuts will gain momentum in the next few months.

In the current situation, further easing of the monetary policy of the RB of New Zealand should be expected, which is a strong negative factor for NZD.

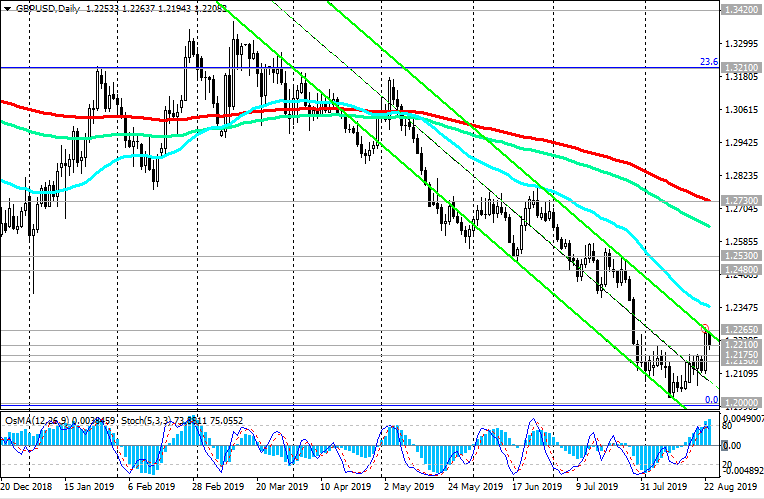

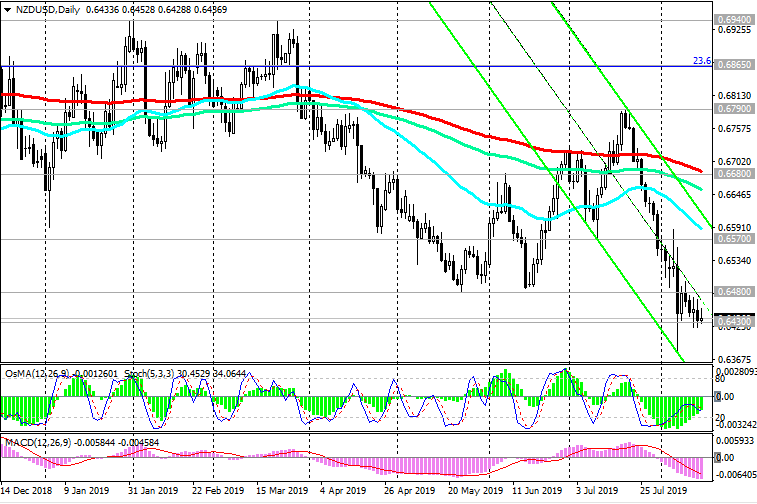

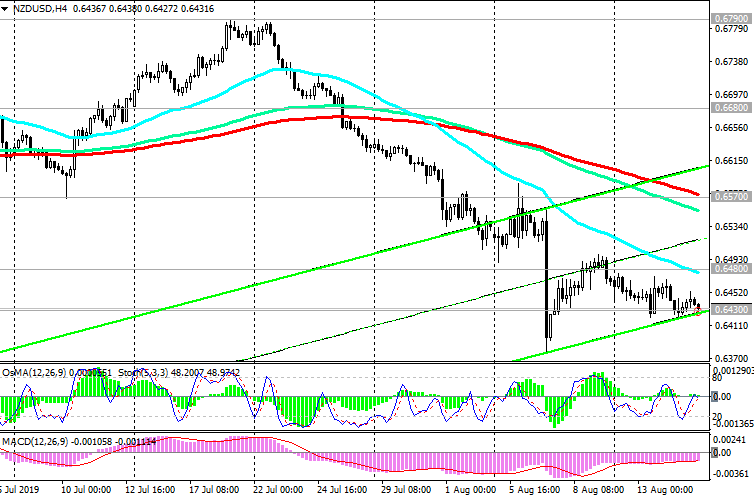

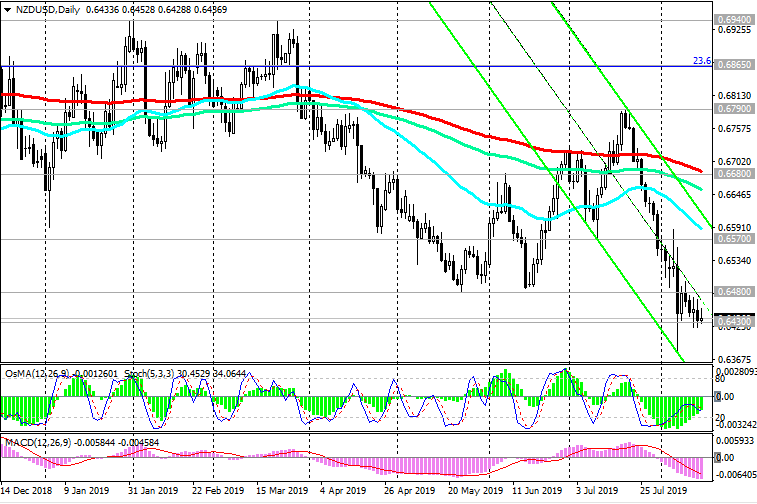

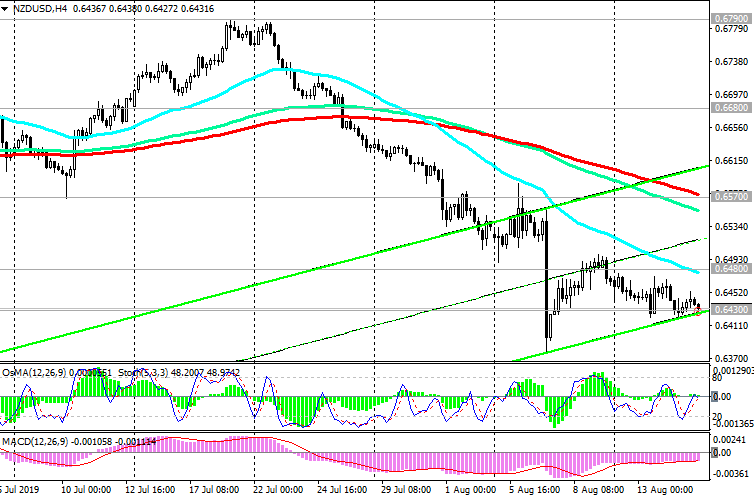

Currently, NZD / USD is trading near the level and the local support level of 0.6430 (October 2018 lows).

A breakdown of this level will provoke a further decrease in NZD / USD with targets at support levels of 0.6400, 0.6300, 0.6260 (Fibonacci level of 0% and minimums of the global wave of pair decline from the level of 0.8820).

Short positions are preferable, unless, of course, the Fed also begins to aggressively lower the interest rate amid ongoing events in the financial markets.

Below the resistance level of 0.6680 (ЕМА200 on the daily chart), the bearish trend NZD / USD prevails.

Support Levels: 0.6430, 0.6400, 0.6300, 0.6260

Resistance Levels: 0.6480, 0.6570, 0.6635, 0.6680, 0.6700, 0.6790

Trading Scenarios

Sell by market. Stop-Loss 0.6490. Take-Profit 0.6400, 0.6300, 0.6260

Buy Stop 0.6510. Stop-Loss 0.6460. Take-Profit 0.6570, 0.6600, 0.6680

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

08/15/2019

Since the opening of today's trading day, the American dollar has been declining. At the beginning of today's European session, DXY dollar index futures are trading near 97.70, 12 pips below the opening price of today's trading day. Meanwhile, commodity currencies, including the New Zealand dollar, also remain under pressure amid a worsening trade war between the US and China.

New Zealand's export-oriented economy is extremely vulnerable amid escalating trade war between the US and China.

Last week, the RBNZ cut the rate by 50 bp to 1.00%, explaining this decision by the worsening trade war between the US and China and the loss of momentum in the New Zealand economy.

RBNZ leaders believe that wage growth remains weak. At the same time, inflationary expectations are falling, and low levels of business confidence indicate a slowdown in hiring and wage growth.

There is growing concern among participants in international financial markets that the slowdown in economic growth and the threat of recession will spread to the whole world, including China, the United States, and their trade and economic partners. It can be assumed that the global cycle of rate cuts will gain momentum in the next few months.

In the current situation, further easing of the monetary policy of the RB of New Zealand should be expected, which is a strong negative factor for NZD.

Currently, NZD / USD is trading near the level and the local support level of 0.6430 (October 2018 lows).

A breakdown of this level will provoke a further decrease in NZD / USD with targets at support levels of 0.6400, 0.6300, 0.6260 (Fibonacci level of 0% and minimums of the global wave of pair decline from the level of 0.8820).

Short positions are preferable, unless, of course, the Fed also begins to aggressively lower the interest rate amid ongoing events in the financial markets.

Below the resistance level of 0.6680 (ЕМА200 on the daily chart), the bearish trend NZD / USD prevails.

Support Levels: 0.6430, 0.6400, 0.6300, 0.6260

Resistance Levels: 0.6480, 0.6570, 0.6635, 0.6680, 0.6700, 0.6790

Trading Scenarios

Sell by market. Stop-Loss 0.6490. Take-Profit 0.6400, 0.6300, 0.6260

Buy Stop 0.6510. Stop-Loss 0.6460. Take-Profit 0.6570, 0.6600, 0.6680

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com