Tifia FX

TifiaFx Representative

- Messages

- 30

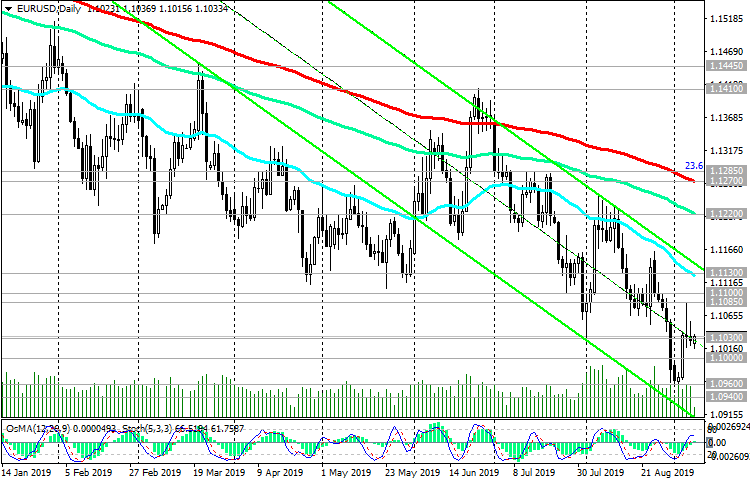

EUR/USD: Current Dynamics

08/29/2019

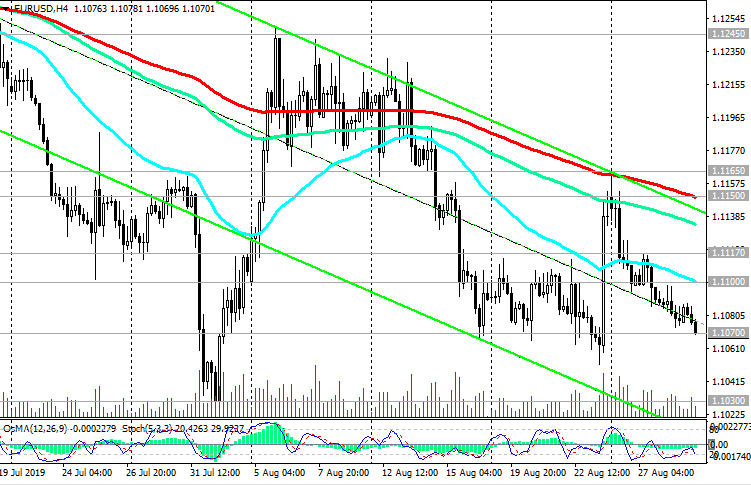

On Thursday, the EUR / USD pair is trading in the range near the local support level and the mark of 1.1070. The euro remains under pressure in anticipation of a significant easing of monetary policy at the ECB meeting on September 12. Olli Rehn, a member of the ECB's Governing Council, said in the middle of the month that the European Central Bank will announce a substantial stimulus package in September that will exceed investors' expectations.

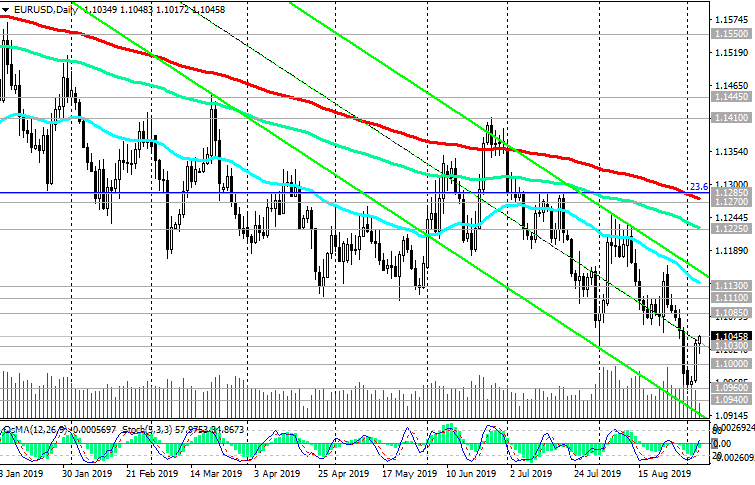

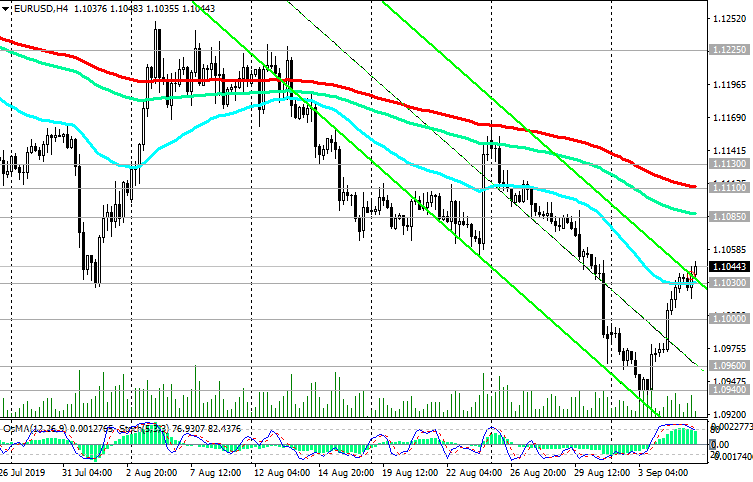

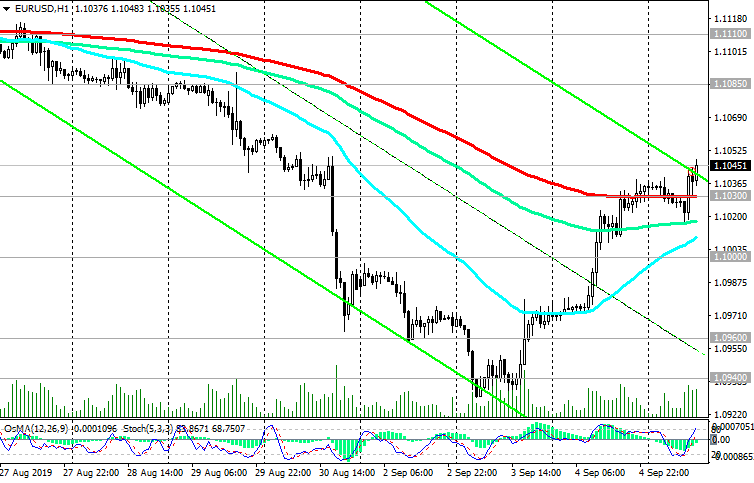

OsMA and Stochastic indicators on the 4-hour, daily, weekly charts recommend short positions, confirming the prevalence of downward dynamics.

The immediate goals in the event of a further decrease in EUR / USD will be the support levels of 1.1030 (local minimum), 1.1000.

In an alternative scenario, a breakdown of the short-term resistance level of 1.1110 (ЕМА200 on a 1-hour chart) may become a signal to start an upward correction. The target is located at resistance levels 1.1150 (ЕМА200 on the 4-hour chart and the upper line of the descending channel on the daily chart), 1.1165 (local maximums and ЕМА50 on the daily chart).

However, this is an unlikely scenario. In the current situation, short positions are preferred.

At 12:00 (GMT) inflation indicators in Germany will be published. Recent data indicate weak inflationary pressures in Germany.

Forecast for August (preliminary estimate): + 1.2%. The growth of the Harmonized Consumer Price Index (HICP) is a positive factor for the euro. If the data for August turn out to be worse than the forecast or the previous value (+ 1.1%), then the euro will be under additional negative pressure.

Support Levels: 1.1070, 1.1030, 1.1000

Resistance Levels: 1.1100, 1.1117, 1.1150, 1.1165, 1.1200, 1.1245, 1.1285

Trading Recommendations

Sell by market. Stop-Loss 1.1120. Take-Profit 1.1030, 1.1000

Buy Stop 1.1120. Stop-Loss 1.1060. Take-Profit 1.1150, 1.1165, 1.1200, 1.1245

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

08/29/2019

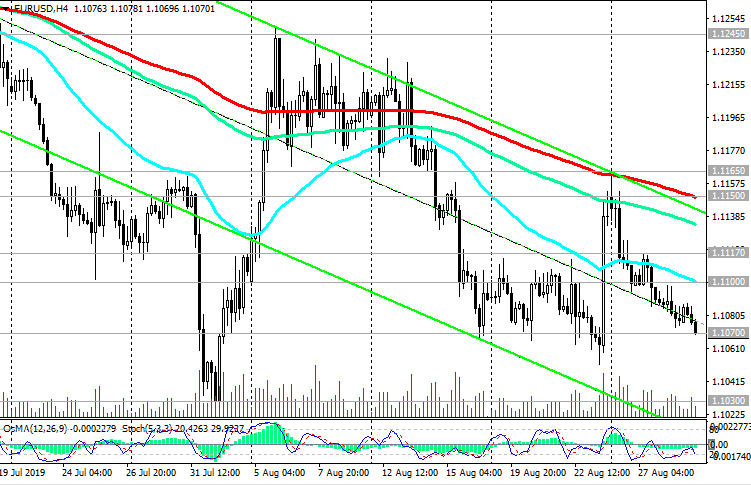

On Thursday, the EUR / USD pair is trading in the range near the local support level and the mark of 1.1070. The euro remains under pressure in anticipation of a significant easing of monetary policy at the ECB meeting on September 12. Olli Rehn, a member of the ECB's Governing Council, said in the middle of the month that the European Central Bank will announce a substantial stimulus package in September that will exceed investors' expectations.

OsMA and Stochastic indicators on the 4-hour, daily, weekly charts recommend short positions, confirming the prevalence of downward dynamics.

The immediate goals in the event of a further decrease in EUR / USD will be the support levels of 1.1030 (local minimum), 1.1000.

In an alternative scenario, a breakdown of the short-term resistance level of 1.1110 (ЕМА200 on a 1-hour chart) may become a signal to start an upward correction. The target is located at resistance levels 1.1150 (ЕМА200 on the 4-hour chart and the upper line of the descending channel on the daily chart), 1.1165 (local maximums and ЕМА50 on the daily chart).

However, this is an unlikely scenario. In the current situation, short positions are preferred.

At 12:00 (GMT) inflation indicators in Germany will be published. Recent data indicate weak inflationary pressures in Germany.

Forecast for August (preliminary estimate): + 1.2%. The growth of the Harmonized Consumer Price Index (HICP) is a positive factor for the euro. If the data for August turn out to be worse than the forecast or the previous value (+ 1.1%), then the euro will be under additional negative pressure.

Support Levels: 1.1070, 1.1030, 1.1000

Resistance Levels: 1.1100, 1.1117, 1.1150, 1.1165, 1.1200, 1.1245, 1.1285

Trading Recommendations

Sell by market. Stop-Loss 1.1120. Take-Profit 1.1030, 1.1000

Buy Stop 1.1120. Stop-Loss 1.1060. Take-Profit 1.1150, 1.1165, 1.1200, 1.1245

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com