Tifia FX

TifiaFx Representative

- Messages

- 30

GBP/USD: the pound may also be under pressure

10/03/2020

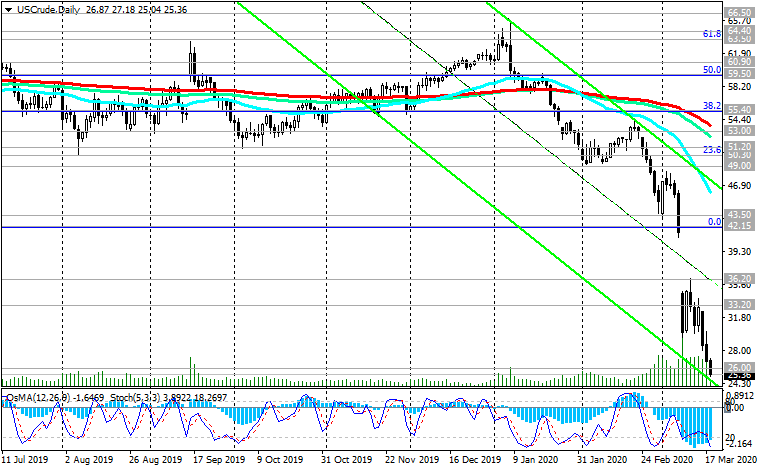

After sharp movements in the financial and commodity markets on Monday, caused by the collapse of stock indices and oil prices, a pullback occurs on Tuesday, although markets are still far from complete stabilization. It is possible that everything is just beginning and the worst is to come. Last Friday, OPEC and Russia were unable to reach an agreement to reduce oil production. In response to the failure of the deal, Saudi Arabia has lowered the selling price of oil and is going to increase the supply. The price war in the oil market may negatively affect other markets.

Negative sentiment prevails in the markets, triggered by investor fear over the coronavirus and price war, which could erupt in the oil market. Investors are forced to sell the dollar and risky assets, going into defensive assets such as yen, gold, government bonds. Yields on 10-year US bonds fell on Monday to 0.342%, the absolute minimum, and gold quotes last Monday exceeded $ 1,700.00 an ounce, although they subsequently declined to $ 1,680.00 an ounce. The dollar fell especially significantly against European currencies and the yen.

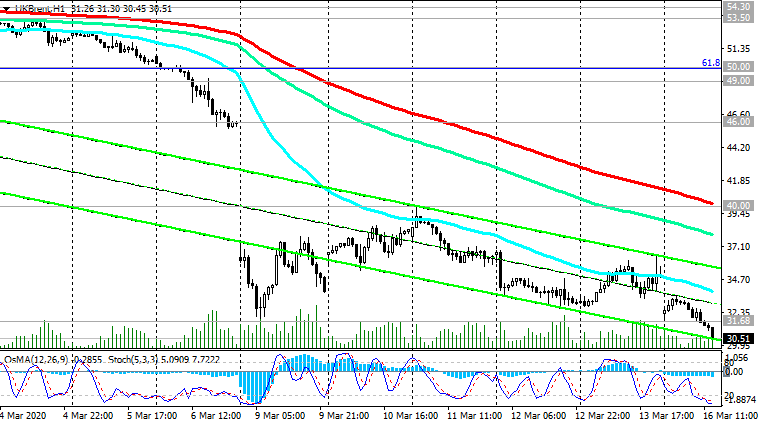

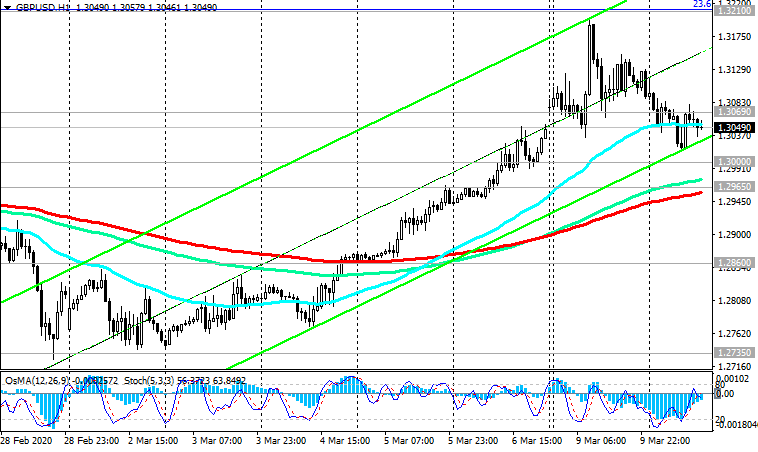

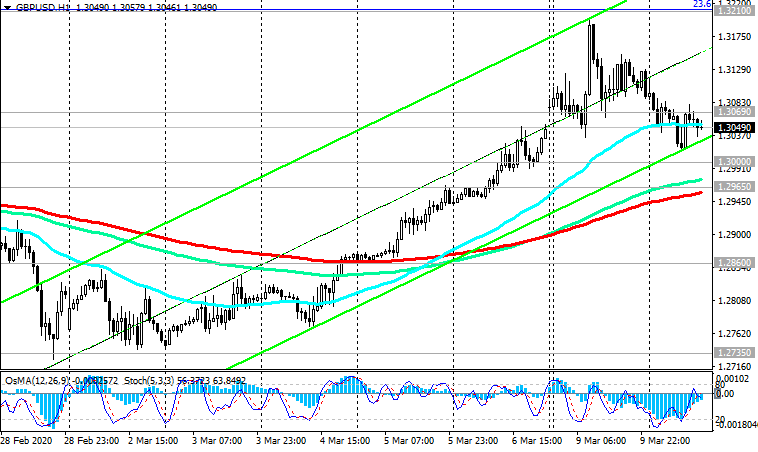

At the beginning of today's European session, GBP / USD is trading near 1.3050, while the dollar is gradually winning back the positions it lost on Monday, although it remains vulnerable on the eve of the Fed meeting on March 17-18.

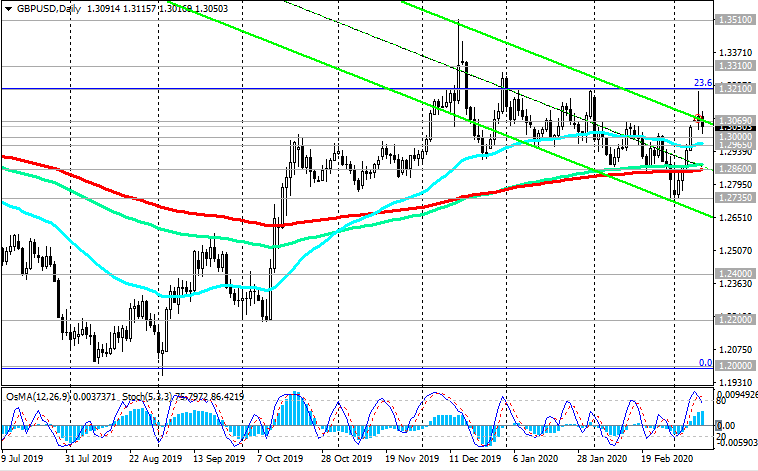

GBP / USD continues to trade in the zone above the important support level of 1.2860 (ЕМА200 on the daily chart). In case of breakdown of the resistance levels 1.3210 (Fibonacci level 23.6% of the correction to the reduce of the GBP / USD in the wave that began in July 2014 near the level of 1.7200), 1.3310 (EMA200 on the weekly chart) GBP / USD will resume the upward trend and head towards the levels resistance 1.3960 (Fibonacci level 38.2%), 1.4350 (highs of 2018), which will talk about breaking the bearish trend GBP / USD.

The first signal for the implementation of an alternative negative scenario will be a breakdown of the short-term support level of 1.2965 (ЕМА200 on the 4-hour and 1-hour charts). The reduction targets are located at the support levels of 1.2735 (lows of March), 1.2590 (lows of May 2019 and the lower border of the descending channel on the daily chart), 1.2400, 1.2200 (lows of October), 1.2000 (lows of 2019 and the Fibonacci level of 0%).

Bank of England future manager Andrew Bailey said last week that the central bank could take stimulus measures before the scheduled meeting (March 26) if it considers that the economy urgently needs support in the wake of the coronavirus epidemic. Many economists expect the UK central bank to lower its key interest rate to 0.5% from 0.75% this month. This may adversely affect pound quotes. If the Bank of England favors a further reduction in the interest rate, then the pound, which for the time being remains stable, may weaken sharply.

Support Levels: 1.3000, 1.2965, 1.2860, 1.2735, 1.2590, 1.2400, 1.2200, 1.2000

Resistance Levels: 1.3069, 1.3210, 1.3310, 1.3510, 1.3960

Trading Scenarios

Sell Stop 1.2955. Stop-Loss 1.3075. Take-Profit 1.2860, 1.2735, 1.2590, 1.2400, 1.2200, 1.2000

Buy Stop 1.3075. Stop-Loss 1.2955. Take-Profit 1.3210, 1.3310, 1.3510, 1.3960

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

10/03/2020

After sharp movements in the financial and commodity markets on Monday, caused by the collapse of stock indices and oil prices, a pullback occurs on Tuesday, although markets are still far from complete stabilization. It is possible that everything is just beginning and the worst is to come. Last Friday, OPEC and Russia were unable to reach an agreement to reduce oil production. In response to the failure of the deal, Saudi Arabia has lowered the selling price of oil and is going to increase the supply. The price war in the oil market may negatively affect other markets.

Negative sentiment prevails in the markets, triggered by investor fear over the coronavirus and price war, which could erupt in the oil market. Investors are forced to sell the dollar and risky assets, going into defensive assets such as yen, gold, government bonds. Yields on 10-year US bonds fell on Monday to 0.342%, the absolute minimum, and gold quotes last Monday exceeded $ 1,700.00 an ounce, although they subsequently declined to $ 1,680.00 an ounce. The dollar fell especially significantly against European currencies and the yen.

At the beginning of today's European session, GBP / USD is trading near 1.3050, while the dollar is gradually winning back the positions it lost on Monday, although it remains vulnerable on the eve of the Fed meeting on March 17-18.

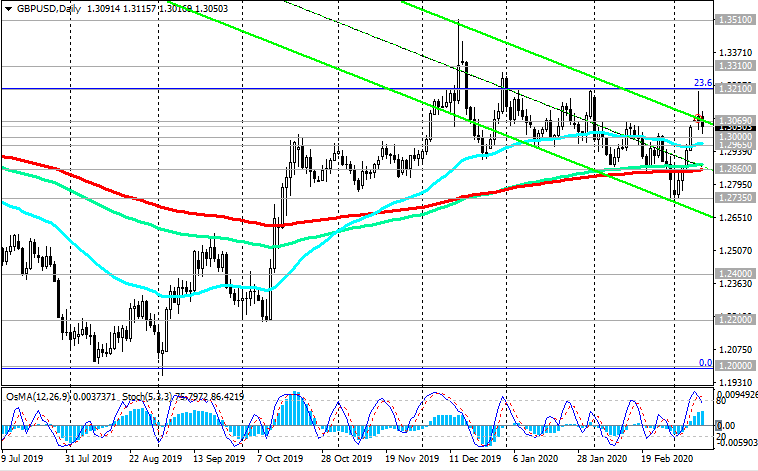

GBP / USD continues to trade in the zone above the important support level of 1.2860 (ЕМА200 on the daily chart). In case of breakdown of the resistance levels 1.3210 (Fibonacci level 23.6% of the correction to the reduce of the GBP / USD in the wave that began in July 2014 near the level of 1.7200), 1.3310 (EMA200 on the weekly chart) GBP / USD will resume the upward trend and head towards the levels resistance 1.3960 (Fibonacci level 38.2%), 1.4350 (highs of 2018), which will talk about breaking the bearish trend GBP / USD.

The first signal for the implementation of an alternative negative scenario will be a breakdown of the short-term support level of 1.2965 (ЕМА200 on the 4-hour and 1-hour charts). The reduction targets are located at the support levels of 1.2735 (lows of March), 1.2590 (lows of May 2019 and the lower border of the descending channel on the daily chart), 1.2400, 1.2200 (lows of October), 1.2000 (lows of 2019 and the Fibonacci level of 0%).

Bank of England future manager Andrew Bailey said last week that the central bank could take stimulus measures before the scheduled meeting (March 26) if it considers that the economy urgently needs support in the wake of the coronavirus epidemic. Many economists expect the UK central bank to lower its key interest rate to 0.5% from 0.75% this month. This may adversely affect pound quotes. If the Bank of England favors a further reduction in the interest rate, then the pound, which for the time being remains stable, may weaken sharply.

Support Levels: 1.3000, 1.2965, 1.2860, 1.2735, 1.2590, 1.2400, 1.2200, 1.2000

Resistance Levels: 1.3069, 1.3210, 1.3310, 1.3510, 1.3960

Trading Scenarios

Sell Stop 1.2955. Stop-Loss 1.3075. Take-Profit 1.2860, 1.2735, 1.2590, 1.2400, 1.2200, 1.2000

Buy Stop 1.3075. Stop-Loss 1.2955. Take-Profit 1.3210, 1.3310, 1.3510, 1.3960

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com