Tifia FX

TifiaFx Representative

- Messages

- 30

XAU/USD: positive dynamics of gold remains

24/03/2020

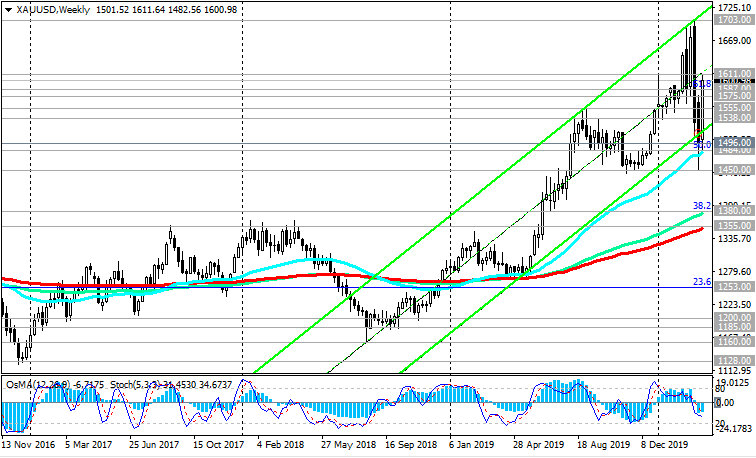

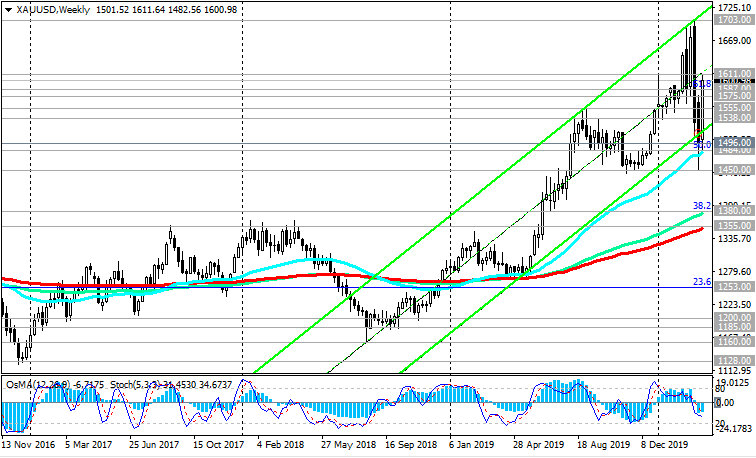

At the beginning of this month, having reached a new, more than 7-year high, near the mark of 1703.00, over the next 2 weeks the XAU / USD pair fell by 250 points (more than 17%), to the 1452.00 mark. Investors were forced to sell their gold reserves, hedging stock market transactions and covering margin stake requirements.

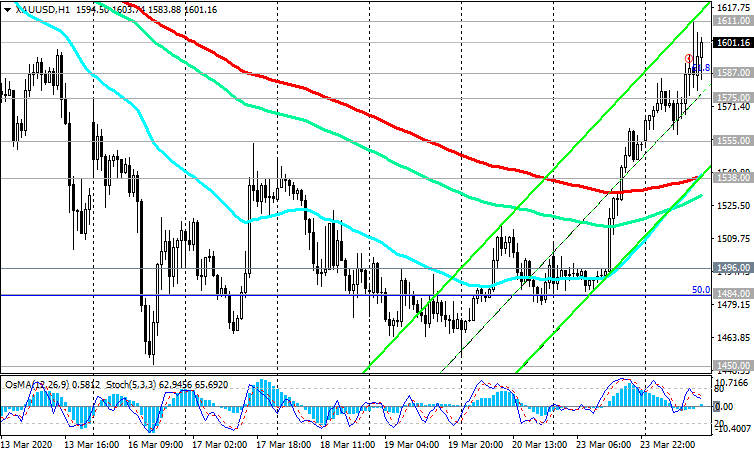

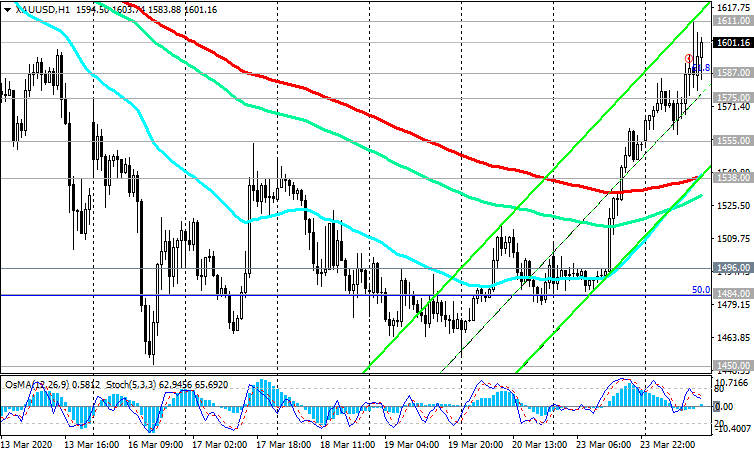

However, the growth of gold quotes seems to have resumed. Having bounced from the strong support levels of 1496.00 (ЕМА200 on the daily chart), 1484.00 (Fibonacci level 50% of the correction to the wave of decline since September 2011 and the mark of 1920.00), the XAU / USD has increased by 6.5% since the beginning of the week, today reaching an intraday maximum near the mark of 1611.00.

The aggressive stimulating actions of the Fed and the weakening of the dollar against this background contribute to the growth of gold quotes.

On Monday, the Fed announced new measures to stimulate the US economy and stabilize financial markets. Now the Fed intends to buy government bonds and securities issued by mortgage agencies if necessary in unlimited quantities. Over the past week, the Fed's balance sheet increased by $ 350 billion, to a record $ 4.7 trillion. According to CNBC, the Fed’s incentive measures are the most aggressive market intervention by the Fed since its inception.

After the Fed has approached the limit of its ability to support the economy, reducing its interest rates to almost zero and pouring billions of dollars into the financial system, investors are now waiting for no less strong action from the US government.

According to media reports, the US government is working on a large-scale package of incentive measures to help businesses and citizens. The amount of the package may exceed $ 1 trillion. However, last Sunday the US Senate did not reach an agreement on the rescue package, which includes assistance to companies and households.

Demand for gold and other protective assets will continue until the coronavirus epidemic declines, the global economy begins to recover, and the Fed does not think about tightening its monetary policy. And this is still very far away.

In the current situation, long positions are preferred. Above the short-term support levels of 1538.00 (EMA200 on the 1-hour chart), 1575.00 (EMA200 on the 4-hour chart), purchases look safe, and above the support level of 1496.00, the long-term positive dynamics of XAU / USD remains.

Support Levels: 1587.00, 1575.00, 1555.00, 1538.00, 1496.00, 1484.00, 1450.00

Resistance Levels: 1611.00, 1703.00, 1718.00

Trading Recommendations

Sell Stop 1550.00. Stop-Loss 1613.00. Take-Profit 1538.00, 1496.00, 1484.00, 1450.00

Buy "by the market". Stop-Loss 1550.00. Take-Profit 1611.00, 1703.00, 1718.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

24/03/2020

At the beginning of this month, having reached a new, more than 7-year high, near the mark of 1703.00, over the next 2 weeks the XAU / USD pair fell by 250 points (more than 17%), to the 1452.00 mark. Investors were forced to sell their gold reserves, hedging stock market transactions and covering margin stake requirements.

However, the growth of gold quotes seems to have resumed. Having bounced from the strong support levels of 1496.00 (ЕМА200 on the daily chart), 1484.00 (Fibonacci level 50% of the correction to the wave of decline since September 2011 and the mark of 1920.00), the XAU / USD has increased by 6.5% since the beginning of the week, today reaching an intraday maximum near the mark of 1611.00.

The aggressive stimulating actions of the Fed and the weakening of the dollar against this background contribute to the growth of gold quotes.

On Monday, the Fed announced new measures to stimulate the US economy and stabilize financial markets. Now the Fed intends to buy government bonds and securities issued by mortgage agencies if necessary in unlimited quantities. Over the past week, the Fed's balance sheet increased by $ 350 billion, to a record $ 4.7 trillion. According to CNBC, the Fed’s incentive measures are the most aggressive market intervention by the Fed since its inception.

After the Fed has approached the limit of its ability to support the economy, reducing its interest rates to almost zero and pouring billions of dollars into the financial system, investors are now waiting for no less strong action from the US government.

According to media reports, the US government is working on a large-scale package of incentive measures to help businesses and citizens. The amount of the package may exceed $ 1 trillion. However, last Sunday the US Senate did not reach an agreement on the rescue package, which includes assistance to companies and households.

Demand for gold and other protective assets will continue until the coronavirus epidemic declines, the global economy begins to recover, and the Fed does not think about tightening its monetary policy. And this is still very far away.

In the current situation, long positions are preferred. Above the short-term support levels of 1538.00 (EMA200 on the 1-hour chart), 1575.00 (EMA200 on the 4-hour chart), purchases look safe, and above the support level of 1496.00, the long-term positive dynamics of XAU / USD remains.

Support Levels: 1587.00, 1575.00, 1555.00, 1538.00, 1496.00, 1484.00, 1450.00

Resistance Levels: 1611.00, 1703.00, 1718.00

Trading Recommendations

Sell Stop 1550.00. Stop-Loss 1613.00. Take-Profit 1538.00, 1496.00, 1484.00, 1450.00

Buy "by the market". Stop-Loss 1550.00. Take-Profit 1611.00, 1703.00, 1718.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com