Tifia FX

TifiaFx Representative

- Messages

- 30

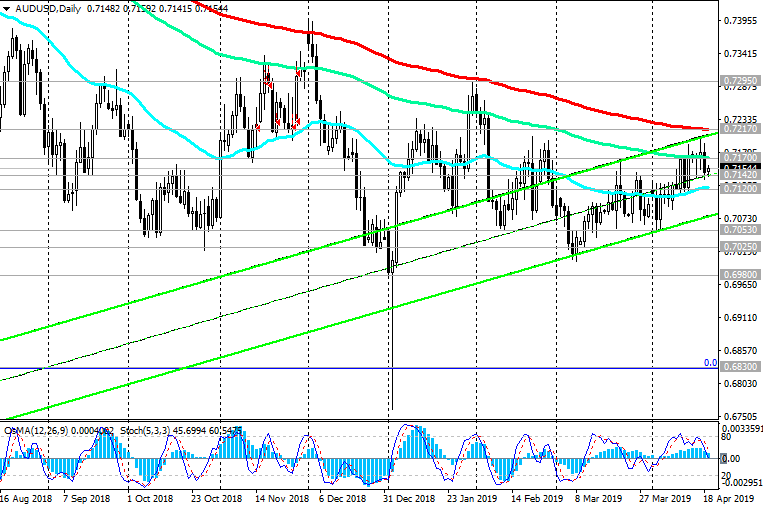

AUD/USD: Support and Resistance Levels

19/04/2019

The US dollar strengthened sharply last Thursday. The strengthening of the dollar was triggered by the fall of the euro on weak macro statistics, which came from the Eurozone at the beginning of the European session on Thursday. In the afternoon, the dollar continued to strengthen on positive statistics from the US.

The AUD / USD pair dropped on Thursday by 0.44% to 0.7148. Financial market participants fear that European problems may spread to other regions, weakening demand for commodities.

Nevertheless, the indicators OsMA and Stochastic on the 1-hour, 4-hour charts turned to long positions. The resumption of corrective growth can direct the pair AUD / USD to resistance levels of 0.7170, 0.7217. However, growth above the level of 0.7217 is unlikely.

Below resistance levels 0.7170 (ЕМА144), 0.7217 (ЕМА200 on the daily chart) short positions are preferable.

In the event of a breakdown of the support level of 0.7142, AUD / USD will move to the support level of 0.7127 (ЕМА200 on the 4-hour chart, ЕМА50 on the daily chart).

Break of this level will increase the risk of a return to the global bearish trend. In this case, AUD / USD will go towards the support levels of 0.7025, 0.6980, 0.6910 (lows of September 2015), 0.6830 (lows of 2016).

Support Levels: 0.7142, 0.7120, 0.7100, 0.7053, 0.7025, 0.6980

Resistance Levels: 0.7170, 0.7200, 0.7217, 0.7295

Trading recommendations

Sell in the market. Stop Loss 0.7230. Take-Profit 0.7120, 0.7100, 0.7053, 0.7025, 0.6980

Buy Stop 0.7230. Stop Loss 0.7160. Take-Profit 0.7295

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

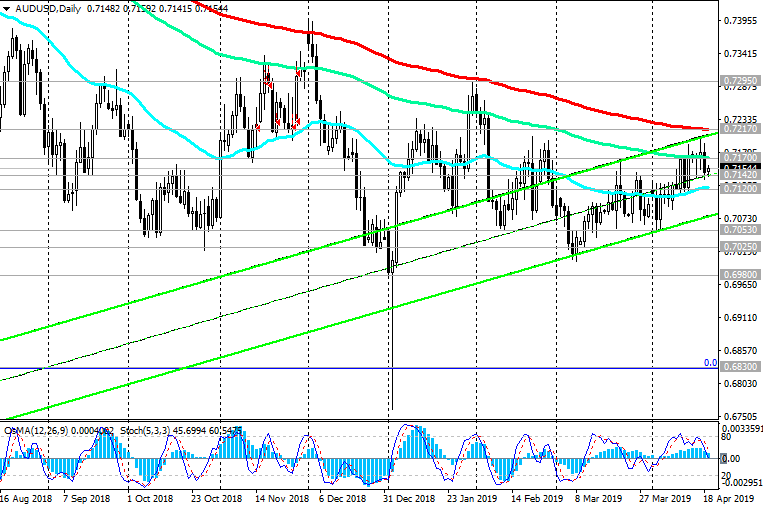

19/04/2019

The US dollar strengthened sharply last Thursday. The strengthening of the dollar was triggered by the fall of the euro on weak macro statistics, which came from the Eurozone at the beginning of the European session on Thursday. In the afternoon, the dollar continued to strengthen on positive statistics from the US.

The AUD / USD pair dropped on Thursday by 0.44% to 0.7148. Financial market participants fear that European problems may spread to other regions, weakening demand for commodities.

Nevertheless, the indicators OsMA and Stochastic on the 1-hour, 4-hour charts turned to long positions. The resumption of corrective growth can direct the pair AUD / USD to resistance levels of 0.7170, 0.7217. However, growth above the level of 0.7217 is unlikely.

Below resistance levels 0.7170 (ЕМА144), 0.7217 (ЕМА200 on the daily chart) short positions are preferable.

In the event of a breakdown of the support level of 0.7142, AUD / USD will move to the support level of 0.7127 (ЕМА200 on the 4-hour chart, ЕМА50 on the daily chart).

Break of this level will increase the risk of a return to the global bearish trend. In this case, AUD / USD will go towards the support levels of 0.7025, 0.6980, 0.6910 (lows of September 2015), 0.6830 (lows of 2016).

Support Levels: 0.7142, 0.7120, 0.7100, 0.7053, 0.7025, 0.6980

Resistance Levels: 0.7170, 0.7200, 0.7217, 0.7295

Trading recommendations

Sell in the market. Stop Loss 0.7230. Take-Profit 0.7120, 0.7100, 0.7053, 0.7025, 0.6980

Buy Stop 0.7230. Stop Loss 0.7160. Take-Profit 0.7295

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com